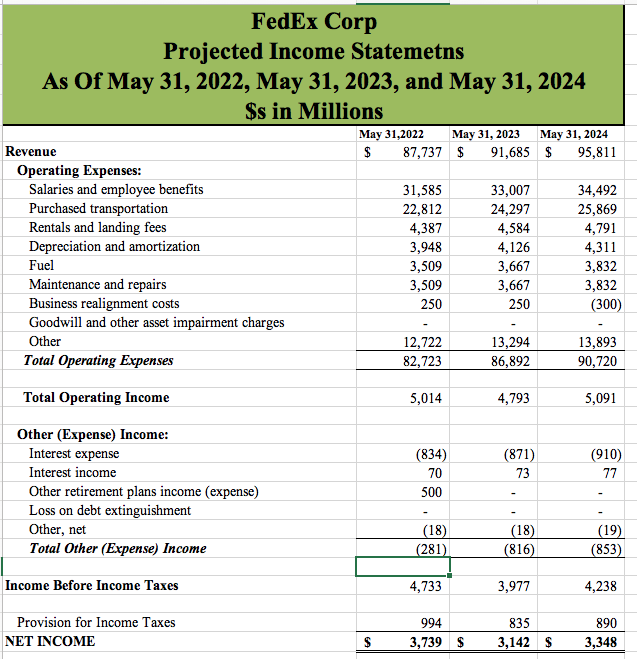

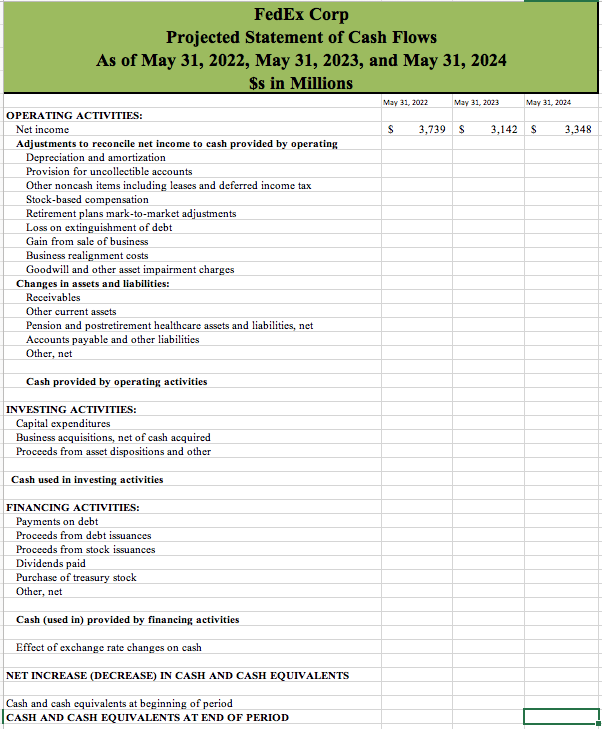

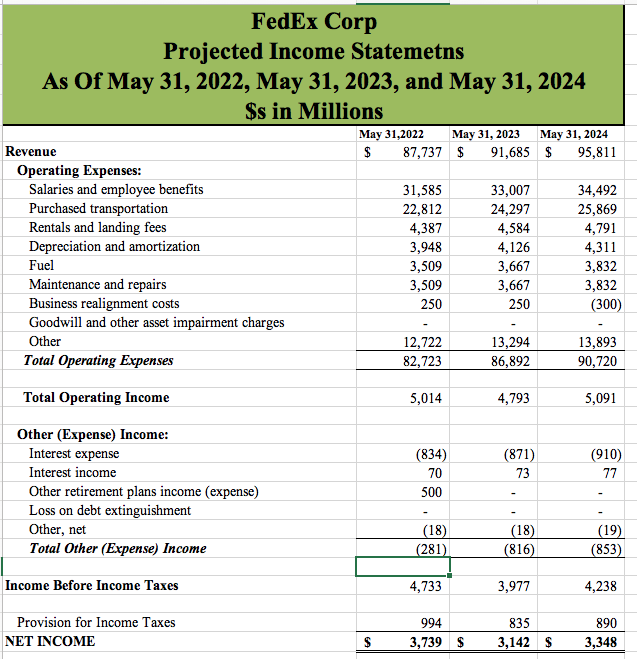

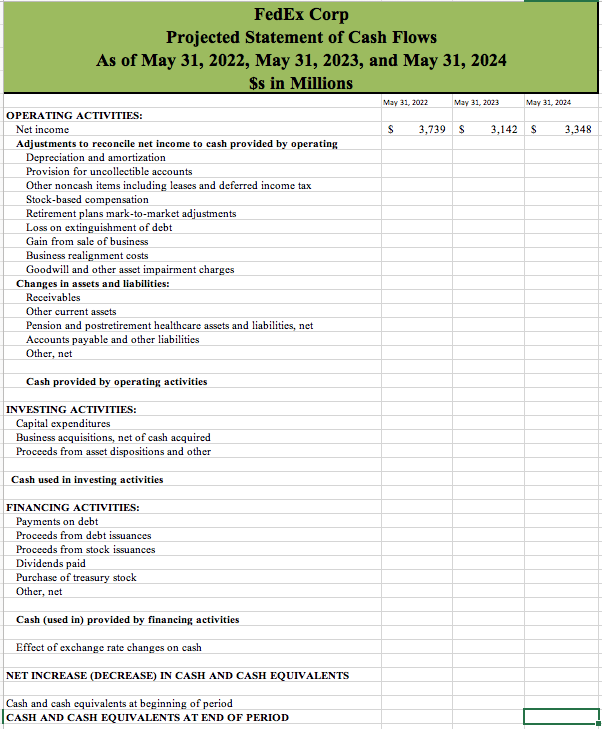

Can you please fill in and create this projected statement of Cashflows derived from the projected balance sheets and income statements that I have provided? I need the line items on this cashflow statement filled in with information derived from the balance sheets and income statements. The line items included and information used to project these statements come from FedEx's 10K report on the SEC website. Thank you!

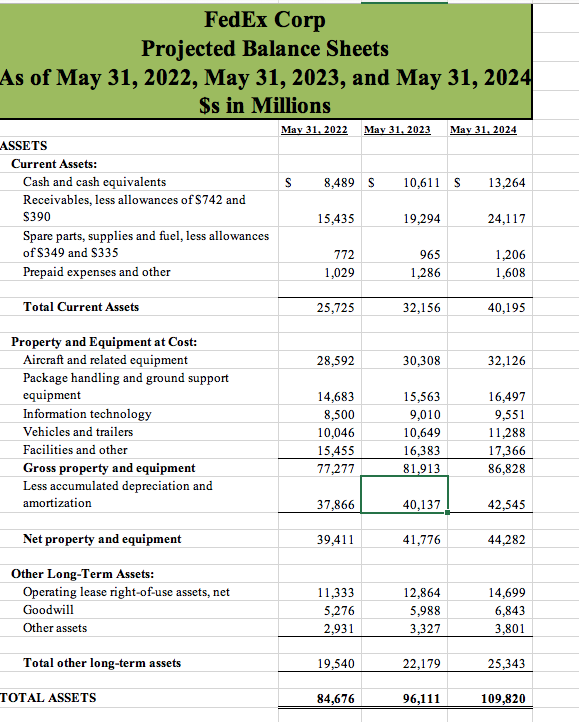

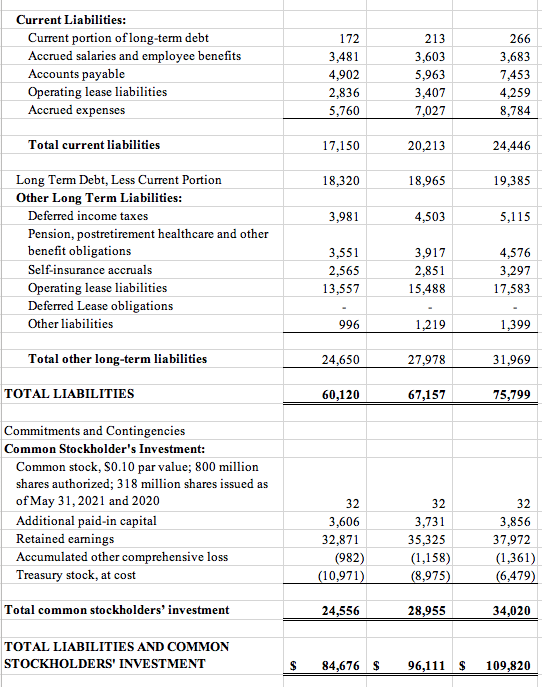

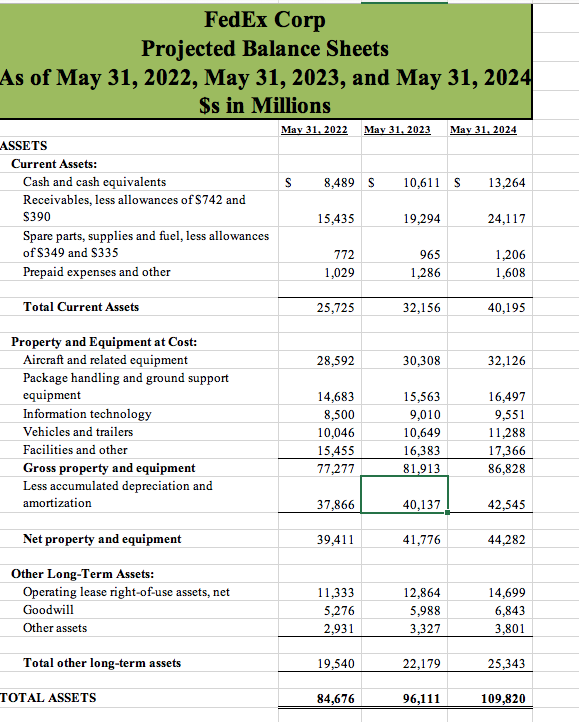

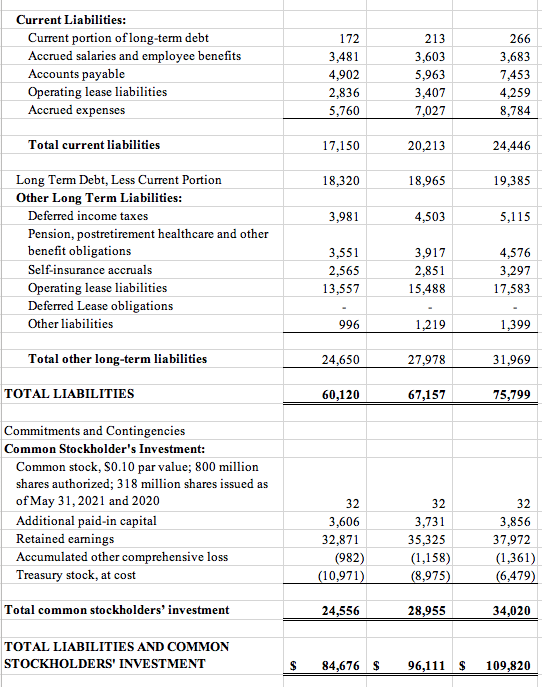

FedEx Corp Projected Income Statemetns As Of May 31, 2022, May 31, 2023, and May 31, 2024 Ss in Millions May 31,2022 May 31, 2023 May 31, 2024 $ 87,737 $ 91,685 $ 95,811 Revenue Operating Expenses: Salaries and employee benefits Purchased transportation Rentals and landing fees Depreciation and amortization Fuel Maintenance and repairs Business realignment costs Goodwill and other asset impairment charges Other Total Operating Expenses 31,585 22,812 4,387 3,948 3,509 3,509 250 33,007 24,297 4,584 4,126 3,667 3,667 250 34,492 25,869 4,791 4,311 3,832 3,832 (300) 12,722 82,723 13,294 86,892 13,893 90,720 Total Operating Income 5,014 4,793 5,091 (834) 70 500 (871) 73 Other (Expense) Income: Interest expense Interest income Other retirement plans income (expense) Loss on debt extinguishment Other, net Total Other (Expense) Income (910) 77 (18) (281) (18) (816) (19) (853) Income Before Income Taxes 4,733 3,977 4,238 Provision for Income Taxes NET INCOME 994 3,739 $ 835 3,142 $ 890 3,348 $ FedEx Corp Projected Balance Sheets As of May 31, 2022, May 31, 2023, and May 31, 2024 Ss in Millions May 31, 2022 May 31, 2023 May 31, 2024 S 8,489 S 10,611 S 13,264 ASSETS Current Assets: Cash and cash equivalents Receivables, less allowances of $742 and $390 Spare parts, supplies and fuel, less allowances of $349 and $335 Prepaid expenses and other 15,435 19,294 24,117 772 1,029 965 1,286 1,206 1,608 Total Current Assets 25,725 32,156 40,195 28,592 30,308 32,126 Property and Equipment at Cost: Aircraft and related equipment Package handling and ground support equipment Information technology Vehicles and trailers Facilities and other Gross property and equipment Less accumulated depreciation and amortization 14,683 8,500 10,046 15,455 77,277 15,563 9,010 10,649 16,383 81,913 16,497 9,551 11,288 17,366 86,828 37,866 40,137 42,545 Net property and equipment 39,411 41,776 44,282 Other Long-Term Assets: Operating lease right-of-use assets, net Goodwill Other assets 11,333 5,276 2,931 12,864 5,988 3,327 14,699 6,843 3,801 Total other long-term assets 19,540 22,179 25,343 TOTAL ASSETS 84,676 96,111 109,820 Current Liabilities: Current portion of long-term debt Accrued salaries and employee benefits Accounts payable Operating lease liabilities Accrued expenses 172 3,481 4,902 2,836 5,760 213 3,603 5,963 3,407 7,027 266 3,683 7,453 4,259 8,784 Total current liabilities 17,150 20,213 24,446 18,320 18,965 19,385 3,981 4,503 5,115 Long Term Debt, Less Current Portion Other Long Term Liabilities: Deferred income taxes Pension, postretirement healthcare and other benefit obligations Self-insurance accruals Operating lease liabilities Deferred Lease obligations Other liabilities 3,551 2,565 13,557 3,917 2,851 15,488 4,576 3,297 17,583 996 1,219 1,399 Total other long-term liabilities 24,650 27,978 31,969 TOTAL LIABILITIES 60,120 67,157 75,799 Commitments and Contingencies Common Stockholder's Investment: Common stock, S0.10 par value; 800 million shares authorized; 318 million shares issued as of May 31, 2021 and 2020 Additional paid-in capital Retained earnings Accumulated other comprehensive loss Treasury stock, at cost 32 3,606 32,871 (982) (10,971) 32 3,731 35,325 (1,158) (8,975) 32 3,856 37,972 (1,361) (6,479) Total common stockholders' investment 24,556 28,955 34,020 TOTAL LIABILITIES AND COMMON STOCKHOLDERS' INVESTMENT $ 84,676 $ 96,111 $ 109,820 FedEx Corp Projected Statement of Cash Flows As of May 31, 2022, May 31, 2023, and May 31, 2024 $s in Millions May 31, 2022 May 31, 2023 May 31, 2024 $ 3,739 S 3,142 s 3,348 OPERATING ACTIVITIES: Net income Adjustments to reconcile net income to cash provided by operating Depreciation and amortization Provision for uncollectible accounts Other noncash items including leases and deferred income tax Stock-based compensation Retirement plans mark-to-market adjustments Loss on extinguishment of debt Gain from sale of business Business realignment costs Goodwill and other asset impairment charges Changes in assets and liabilities: Receivables Other current assets Pension and postretirement healthcare assets and liabilities, net Accounts payable and other liabilities Other, net Cash provided by operating activities INVESTING ACTIVITIES: Capital expenditures Business acquisitions, net of cash acquired Proceeds from asset dispositions and other Cash used in investing activities FINANCING ACTIVITIES: Payments on debt Proceeds from debt issuances Proceeds from stock issuances Dividends paid Purchase of treasury stock Other, net Cash (used in) provided by financing activities Effect of exchange rate changes on cash NET INCREASE (DECREASE) IN CASH AND CASH EQUIVALENTS Cash and cash equivalents at beginning of period CASH AND CASH EQUIVALENTS AT END OF PERIOD FedEx Corp Projected Income Statemetns As Of May 31, 2022, May 31, 2023, and May 31, 2024 Ss in Millions May 31,2022 May 31, 2023 May 31, 2024 $ 87,737 $ 91,685 $ 95,811 Revenue Operating Expenses: Salaries and employee benefits Purchased transportation Rentals and landing fees Depreciation and amortization Fuel Maintenance and repairs Business realignment costs Goodwill and other asset impairment charges Other Total Operating Expenses 31,585 22,812 4,387 3,948 3,509 3,509 250 33,007 24,297 4,584 4,126 3,667 3,667 250 34,492 25,869 4,791 4,311 3,832 3,832 (300) 12,722 82,723 13,294 86,892 13,893 90,720 Total Operating Income 5,014 4,793 5,091 (834) 70 500 (871) 73 Other (Expense) Income: Interest expense Interest income Other retirement plans income (expense) Loss on debt extinguishment Other, net Total Other (Expense) Income (910) 77 (18) (281) (18) (816) (19) (853) Income Before Income Taxes 4,733 3,977 4,238 Provision for Income Taxes NET INCOME 994 3,739 $ 835 3,142 $ 890 3,348 $ FedEx Corp Projected Balance Sheets As of May 31, 2022, May 31, 2023, and May 31, 2024 Ss in Millions May 31, 2022 May 31, 2023 May 31, 2024 S 8,489 S 10,611 S 13,264 ASSETS Current Assets: Cash and cash equivalents Receivables, less allowances of $742 and $390 Spare parts, supplies and fuel, less allowances of $349 and $335 Prepaid expenses and other 15,435 19,294 24,117 772 1,029 965 1,286 1,206 1,608 Total Current Assets 25,725 32,156 40,195 28,592 30,308 32,126 Property and Equipment at Cost: Aircraft and related equipment Package handling and ground support equipment Information technology Vehicles and trailers Facilities and other Gross property and equipment Less accumulated depreciation and amortization 14,683 8,500 10,046 15,455 77,277 15,563 9,010 10,649 16,383 81,913 16,497 9,551 11,288 17,366 86,828 37,866 40,137 42,545 Net property and equipment 39,411 41,776 44,282 Other Long-Term Assets: Operating lease right-of-use assets, net Goodwill Other assets 11,333 5,276 2,931 12,864 5,988 3,327 14,699 6,843 3,801 Total other long-term assets 19,540 22,179 25,343 TOTAL ASSETS 84,676 96,111 109,820 Current Liabilities: Current portion of long-term debt Accrued salaries and employee benefits Accounts payable Operating lease liabilities Accrued expenses 172 3,481 4,902 2,836 5,760 213 3,603 5,963 3,407 7,027 266 3,683 7,453 4,259 8,784 Total current liabilities 17,150 20,213 24,446 18,320 18,965 19,385 3,981 4,503 5,115 Long Term Debt, Less Current Portion Other Long Term Liabilities: Deferred income taxes Pension, postretirement healthcare and other benefit obligations Self-insurance accruals Operating lease liabilities Deferred Lease obligations Other liabilities 3,551 2,565 13,557 3,917 2,851 15,488 4,576 3,297 17,583 996 1,219 1,399 Total other long-term liabilities 24,650 27,978 31,969 TOTAL LIABILITIES 60,120 67,157 75,799 Commitments and Contingencies Common Stockholder's Investment: Common stock, S0.10 par value; 800 million shares authorized; 318 million shares issued as of May 31, 2021 and 2020 Additional paid-in capital Retained earnings Accumulated other comprehensive loss Treasury stock, at cost 32 3,606 32,871 (982) (10,971) 32 3,731 35,325 (1,158) (8,975) 32 3,856 37,972 (1,361) (6,479) Total common stockholders' investment 24,556 28,955 34,020 TOTAL LIABILITIES AND COMMON STOCKHOLDERS' INVESTMENT $ 84,676 $ 96,111 $ 109,820 FedEx Corp Projected Statement of Cash Flows As of May 31, 2022, May 31, 2023, and May 31, 2024 $s in Millions May 31, 2022 May 31, 2023 May 31, 2024 $ 3,739 S 3,142 s 3,348 OPERATING ACTIVITIES: Net income Adjustments to reconcile net income to cash provided by operating Depreciation and amortization Provision for uncollectible accounts Other noncash items including leases and deferred income tax Stock-based compensation Retirement plans mark-to-market adjustments Loss on extinguishment of debt Gain from sale of business Business realignment costs Goodwill and other asset impairment charges Changes in assets and liabilities: Receivables Other current assets Pension and postretirement healthcare assets and liabilities, net Accounts payable and other liabilities Other, net Cash provided by operating activities INVESTING ACTIVITIES: Capital expenditures Business acquisitions, net of cash acquired Proceeds from asset dispositions and other Cash used in investing activities FINANCING ACTIVITIES: Payments on debt Proceeds from debt issuances Proceeds from stock issuances Dividends paid Purchase of treasury stock Other, net Cash (used in) provided by financing activities Effect of exchange rate changes on cash NET INCREASE (DECREASE) IN CASH AND CASH EQUIVALENTS Cash and cash equivalents at beginning of period CASH AND CASH EQUIVALENTS AT END OF PERIOD