Answered step by step

Verified Expert Solution

Question

1 Approved Answer

can you please help? I don't know if my answers are right Manny Music Company purchased for $175,000 a patent for a new sound system.

can you please help? I don't know if my answers are right

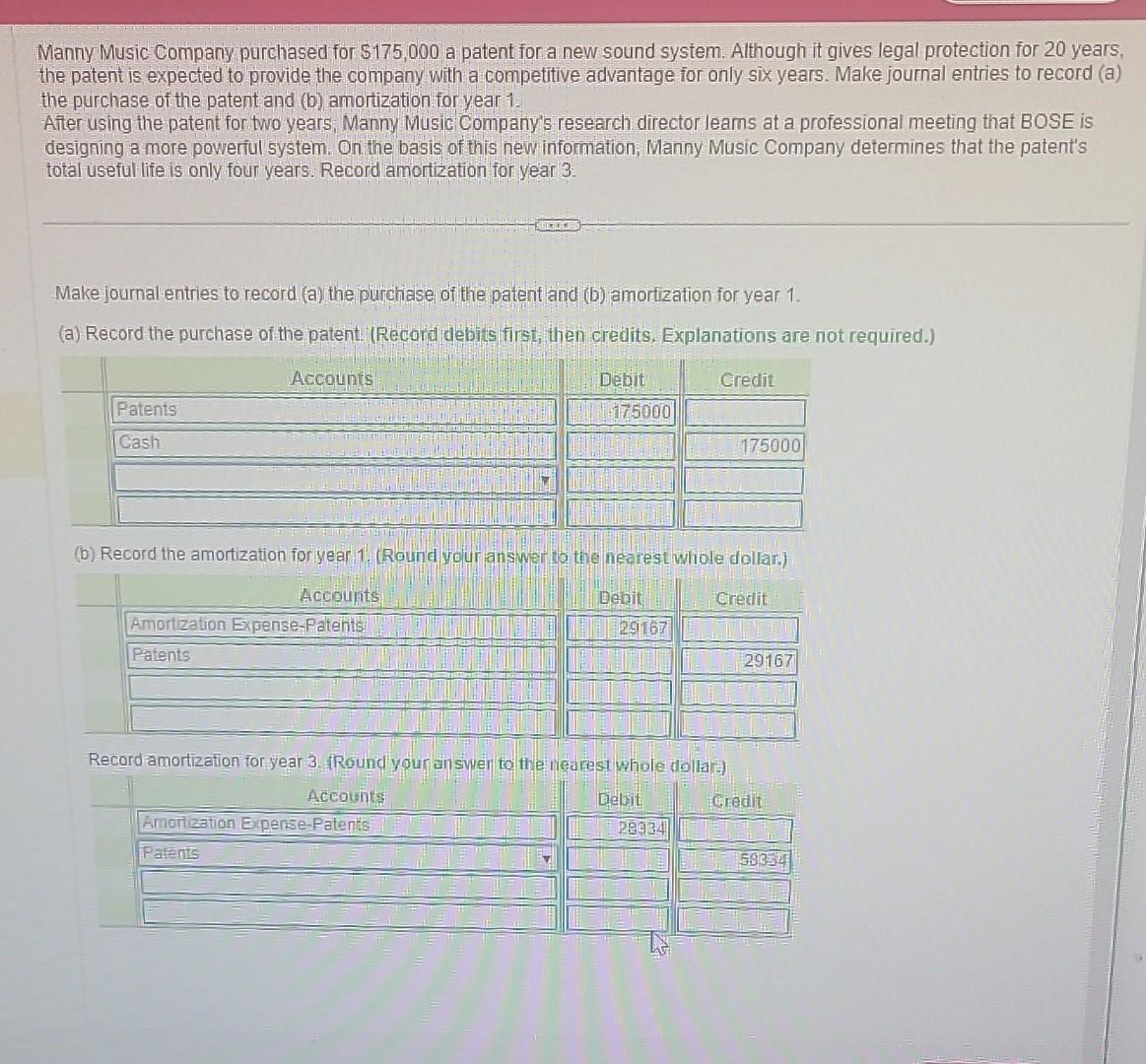

Manny Music Company purchased for $175,000 a patent for a new sound system. Although it gives legal protection for 20 years, the patent is expected to provide the company with a competitive advantage for only six years. Make journal entries to record (a) the purchase of the patent and (b) amortization for year 1. Aiter using the patent for two years; Manny Music Company's research director learns at a professional meeting that BOSE is designing a more poweriul system. On the basis of this new information, Manny Music Company determines that the patent's total useful life is only four years. Record amortization for year 3 . -Make journal entries to record (a) the purchase of the patent and (b) amorfization for year 1. (a) Record the purchase of the patent: (Record debits first, then credits. Explanations are not required.) (b) Record the amortization for year 1. (Round your answer to the nearest whole dollar.) Recordamortization for year 3 . (Round your an siver to the nearest whole dollari) Manny Music Company purchased for $175,000 a patent for a new sound system. Although it gives legal protection for 20 years, the patent is expected to provide the company with a competitive advantage for only six years. Make journal entries to record (a) the purchase of the patent and (b) amortization for year 1. Aiter using the patent for two years; Manny Music Company's research director learns at a professional meeting that BOSE is designing a more poweriul system. On the basis of this new information, Manny Music Company determines that the patent's total useful life is only four years. Record amortization for year 3 . -Make journal entries to record (a) the purchase of the patent and (b) amorfization for year 1. (a) Record the purchase of the patent: (Record debits first, then credits. Explanations are not required.) (b) Record the amortization for year 1. (Round your answer to the nearest whole dollar.) Recordamortization for year 3 . (Round your an siver to the nearest whole dollari)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started