Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Can you please help me answer this question in an Excel spreadsheet? After reviewing Park Ridge Homecare's balance sheet and statement of cash flows, what

Can you please help me answer this question in an Excel spreadsheet?

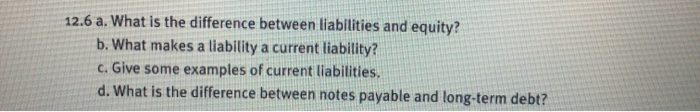

After reviewing Park Ridge Homecare's balance sheet and statement of cash flows, what has Lori (and you) learned about Park Ridge's financial ability to start a second location? The business has nearly $350,000 in cash and securities investments. Of course, some cash must be held to meet day-to-day operating expenses and as a reserve, and some of the securities investments are restricted and hence could not be used to fund a new loca- tion. Still, some portion of the $350,000 could likely be used to help open a second facility. According to the balance sheet, Park Ridge currently has $27,000 in inventories and $126,000 in gross fixed assets (vehicles and equipment), for a total gross investment of $153,000. Assuming that a start-up location would require about the same amount (or perhaps less initially) of these assets, it appears that the proposed business could be par- tially or wholly funded from Park Ridge's current securities investments. Finally, the statement of cash flows indicates that Park Ridge has generated $137,000 of operating cash flow over the last two years of operations. This means that a new location, if it achieves the same level of success as the existing business, would quickly generate a positive operating cash flow and hence would be more or less self-sustaining in a short time. All in all, Lori's plan to use Park Ridge's resources to fund another location seems feasible. However, a complete financial statement analysis will yield the best possible pic- ture of Park Ridge's financial condition, and hence its ability to support the opening of a new business. We will perform that analysis in Chapter 13. 12.6 a. What is the difference between liabilities and equity? b. What makes a liability a current liability? c. Give some examples of current liabilities. d. What is the difference between notes payable and long-term debt

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started