can you please help me??

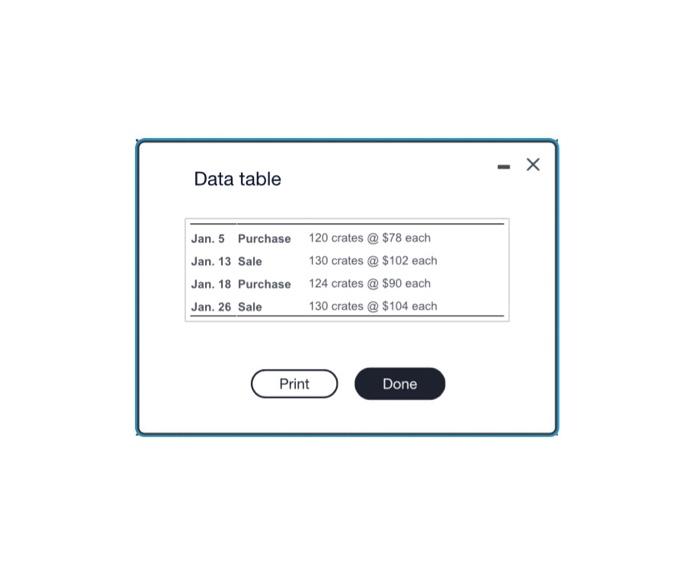

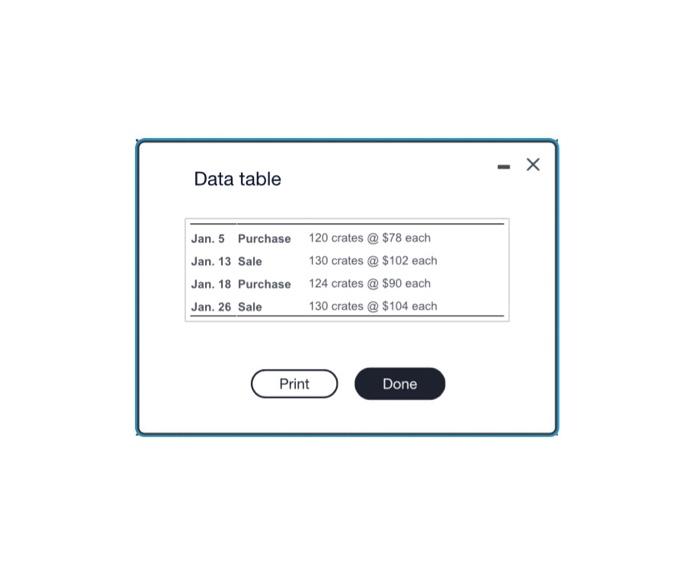

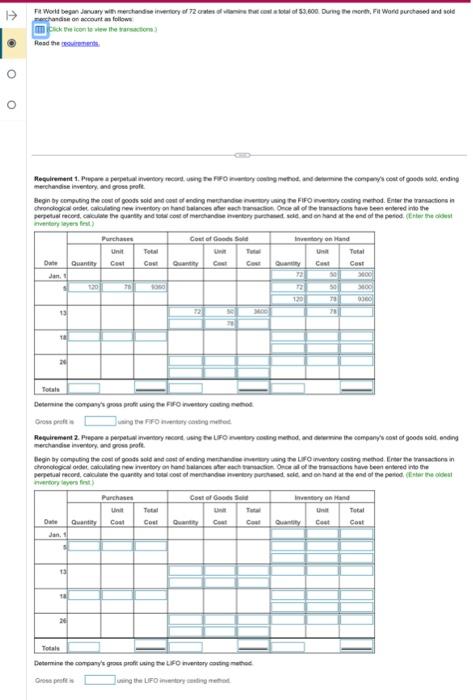

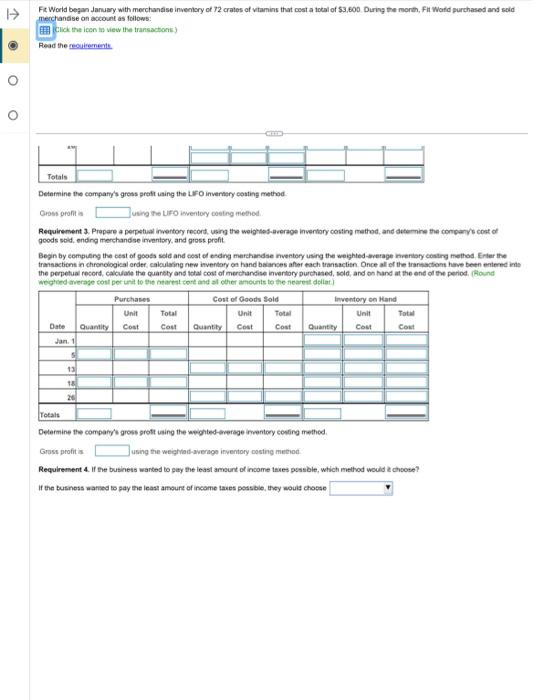

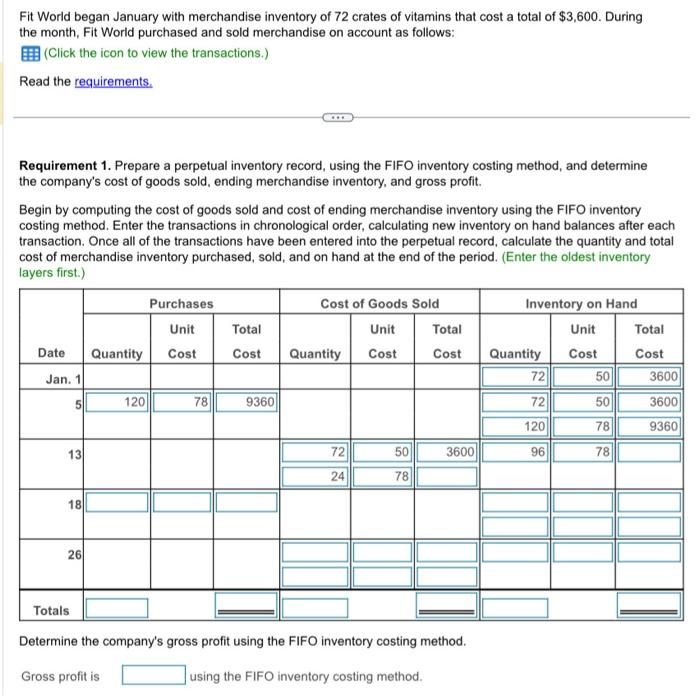

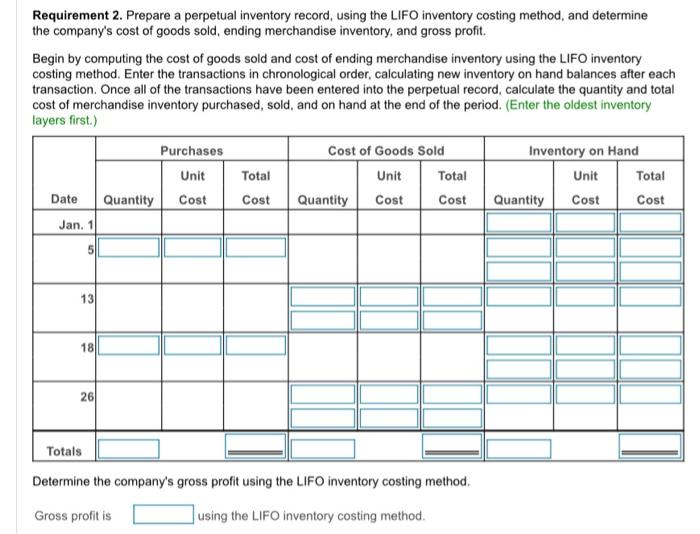

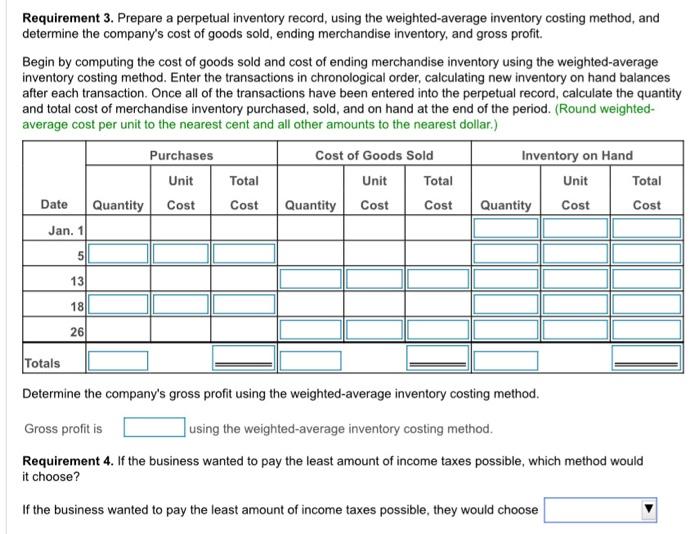

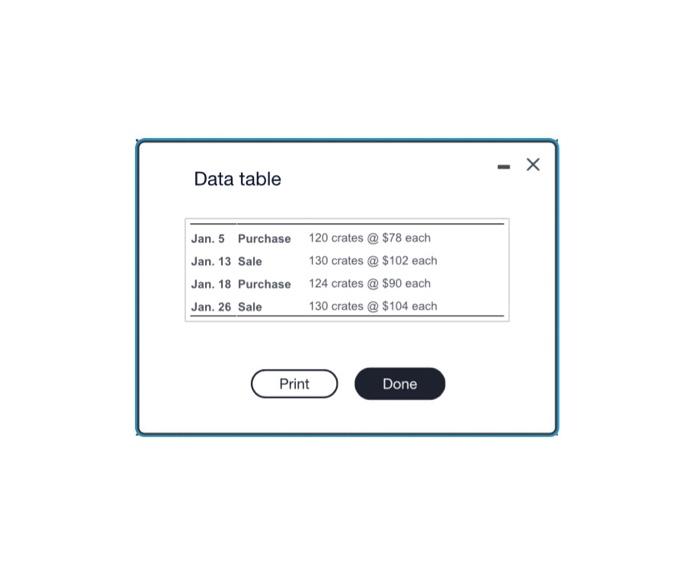

Data table mochandse or acceurt min follown Sick tie icon ie siew ite trarsaction 3 Fosd the recuenentent merchandise ieventery. and grose pruft. inetitary lepers firt? Detemine the eorgany's gase proft using the FJO inveitoy ceutivg nethot. Grest praft is ing Eie fifo makiary dastry mutted merthasdise inentury and goss proft. inertory inyers fint Detemine the catpany's gract preft vuing twe Ls d mentary abing mathet. Owsa preft is ining the LFO inteitery aitleg nefint. Fi, World began January with merchandise inventory of 72 crates of viamins that cest a total of $3,600 During the moreh, Fit World purchased and seld merhandise on account as foilows: Hlick the ipen in view the trarsastions.) Fiead the mesiremeats Detarmine the campary's gress predt vaing the Lis 0 invernery ceating mathod Cross gront ia Using the Lifo imentory cosing thethed. Requirement 3. Prapare a perpetiak inyentory record, usirg the weightestaverage inveriary costing method, and detornine the congarys cost of goods sbld, ending merchandse imentory, and gross preft Begin by eompueng the eest of gooss seld and cost of esding merchapdse mventory using the weighted-everage inreniofy cestrg methed. Fiter the tramsactient in chronciogical arder, caloulating new invendory oat hand betarses after pach transactitn. Once al of the iranisationt herve been entered iefs the pempetual rocerd, calculase the cuariby and total cost of merchandise inveribry purchased, sold, and on hand at the end of the period. fiound weighed averase cost per urit to the ntarest coct and at ether amounts to the nearest deliat. Determine the compary's gross groft ising the iwesited-merege impentory cosfing methed. Grast profit is using the weightad-average irventory posting method Requirement 4. If the butinest wanted bo gaty the least ambunt of income taves pessble, which meltiod would it choose? If the business watned to pay the ieast aindunt of income takes pessble, they would choese Data table Fit World began January with merchandise inventory of 72 crates of vitamins that cost a total of $3,600. During the month. Fit World purchased and sold merchandise on account as follows: (Click the icon to view the transactions.) Read the requirements. Requirement 1. Prepare a perpetual inventory record, using the FIFO inventory costing method, and determine the company's cost of goods sold, ending merchandise inventory, and gross profit. Begin by computing the cost of goods sold and cost of ending merchandise inventory using the FIFO inventory costing method. Enter the transactions in chronological order, calculating new inventory on hand balances after each transaction. Once all of the transactions have been entered into the perpetual record, calculate the quantity and total cost of merchandise inventory purchased, sold, and on hand at the end of the period. (Enter the oldest inventory layers first.) Determine the company's gross profit using the FIFO inventory costing method. Gross profit is using the FIFO inventory costing method. Requirement 2. Prepare a perpetual inventory record, using the LIFO inventory costing method, and determine the company's cost of goods sold, ending merchandise inventory, and gross profit. Begin by computing the cost of goods sold and cost of ending merchandise inventory using the LIFO inventory costing method. Enter the transactions in chronological order, calculating new inventory on hand balances after each transaction. Once all of the transactions have been entered into the perpetual record, calculate the quantity and total cost of merchandise inventory purchased, sold, and on hand at the end of the period. (Enter the oldest inventory layers first.) Determine the company's gross profit using the LIFO inventory costing method. Gross profit is using the LIFO inventory costing method. Requirement 3. Prepare a perpetual inventory record, using the weighted-average inventory costing method, and determine the company's cost of goods sold, ending merchandise inventory, and gross profit. Begin by computing the cost of goods sold and cost of ending merchandise inventory using the weighted-average inventory costing method. Enter the transactions in chronological order, calculating new inventory on hand balances after each transaction. Once all of the transactions have been entered into the perpetual record, calculate the quantity and total cost of merchandise inventory purchased, sold, and on hand at the end of the period. (Round weightedaverage cost per unit to the nearest cent and all other amounts to the nearest dollar.) Determine the company's gross profit using the weighted-average inventory costing method. Gross profit is using the weighted-average inventory costing method. Requirement 4. If the business wanted to pay the least amount of income taxes possible, which method would it choose? If the business wanted to pay the least amount of income taxes possible, they would choose