Answered step by step

Verified Expert Solution

Question

1 Approved Answer

can you please help me? thank you Q3: Hickory Corporation recorded sales revenue during the year of $300,000 of which $100,000 was on credit. The

can you please help me? thank you

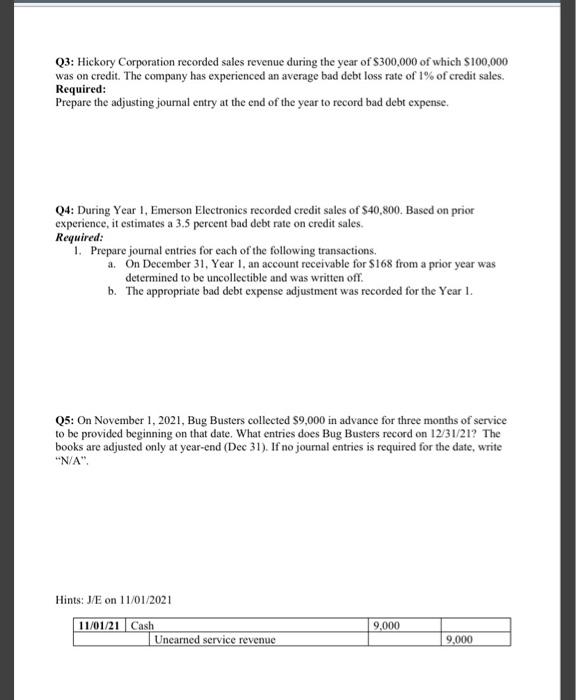

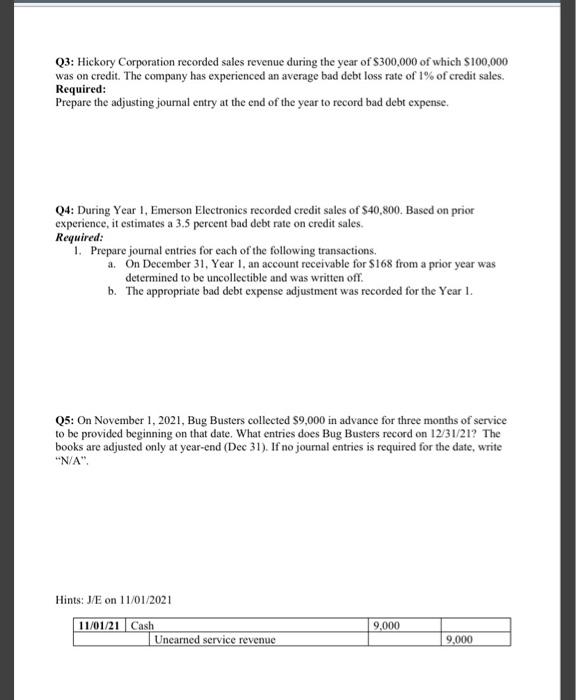

Q3: Hickory Corporation recorded sales revenue during the year of $300,000 of which $100,000 was on credit. The company has experienced an average bad debt loss rate of 1% of credit sales. *1 Required: Prepare the adjusting journal entry at the end of the year to record bad debt expense. Q4. During Year 1, Emerson Electronics recorded credit sales of $40,800. Based on prior experience, it estimates a 3.5 percent bad debt rate on credit sales. Required: 1. Prepare journal entries for each of the following transactions, a. On December 31, Year 1, an account receivable for $168 from a prior year was determined to be uncollectible and was written off. b. The appropriate bad debt expense adjustment was recorded for the Year I. Q5: On November 1, 2021, Bug Busters collected $9,000 in advance for three months of service to be provided beginning on that date. What entries does Bug Busters record on 12/31/21? The books are adjusted only at year-end (Dec 31). If no journal entries is required for the date, write "N/A". Hints: J/E on 11/01/2021 11/01/21 Cash Unearned service revenue 9,000 9,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started