Answered step by step

Verified Expert Solution

Question

1 Approved Answer

can you please help me to answer this question O 2023 Marc Karpoctuer Prop 1 at Ms. Mist's husband received a severance package in 2021

can you please help me to answer this question

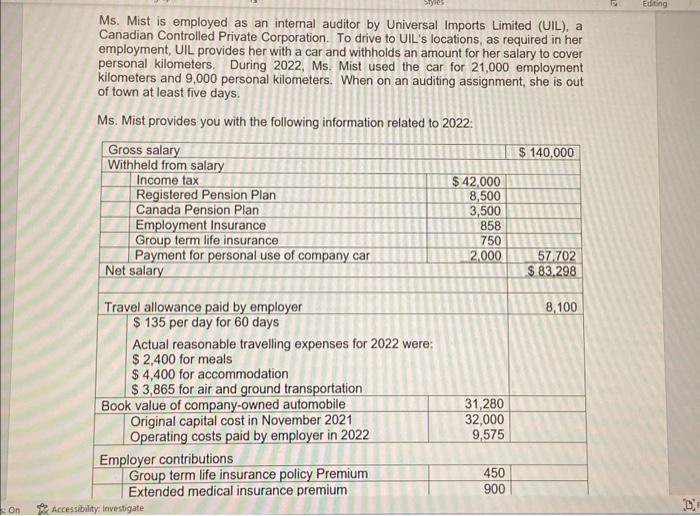

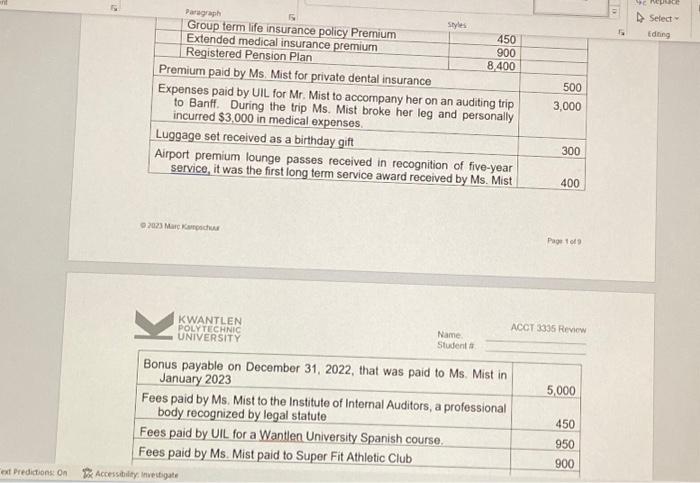

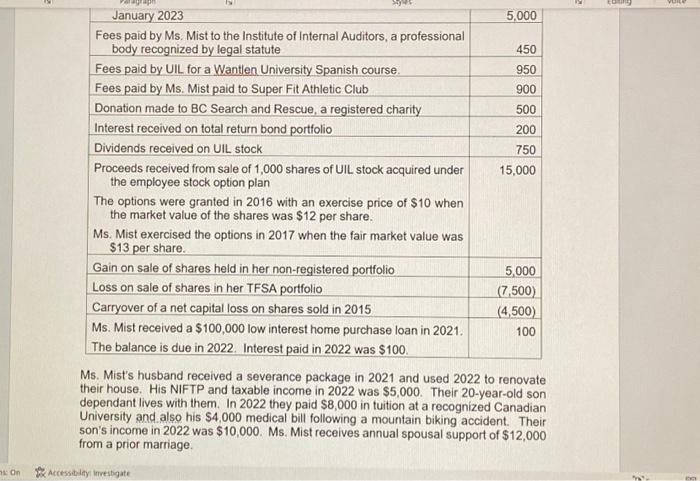

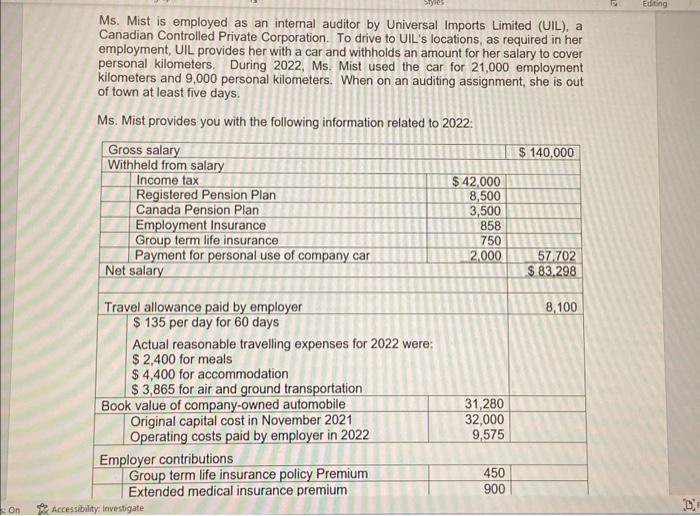

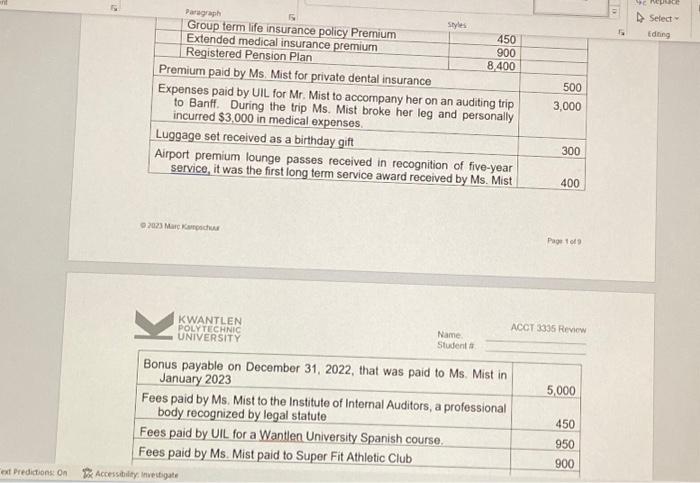

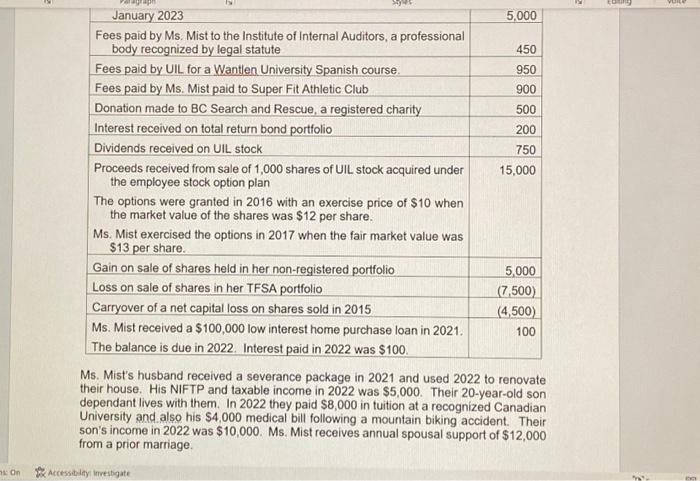

O 2023 Marc Karpoctuer Prop 1 at Ms. Mist's husband received a severance package in 2021 and used 2022 to renovate their house. His NIFTP and taxable income in 2022 was $5,000. Their 20 -year-old son dependant lives with them. In 2022 they paid $8,000 in tuition at a recognized Canadian University and also his $4,000 medical bill following a mountain biking accident. Their son's income in 2022 was $10,000. Ms. Mist receives annual spousal support of $12,000 from a prior marriage. Required: (A) Determine the federal tax payable for Ms. Mist in 2022. Clearly identify sources of income, net income for tax purposes, taxable income and federal tax in your calculation. Present all aspects of the required calculations. (B) Explain any tests applied in the determination of the appropriate tax treatment. (C) Explain any amounts excluded from your calculation of tax payable

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started