Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Can you please help me understand what I did wrong in my calculations? I seemed to have been correct in some areas and off in

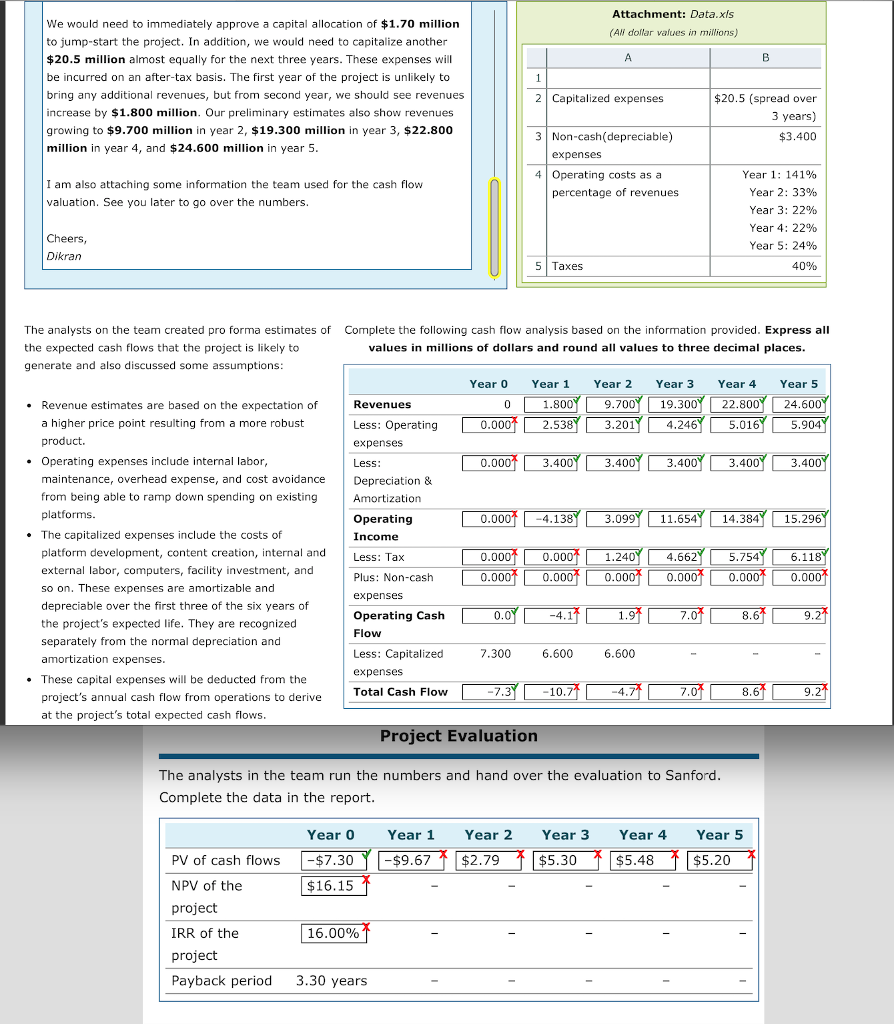

Can you please help me understand what I did wrong in my calculations? I seemed to have been correct in some areas and off in others. Yes, this is all one huge question I was given together, so I am going by the rule of only one question...you could not ask this any other way after all. Also note, the instructions in the first section require rounding to the nearest thousandth, but only to the nearest 100th on the cash flow below. Thanks in advance for your help!

Attachment: Data.xis We would need to immediately approve a capital allocation of $1.70 million to jump-start the project. In addition, we would need to capitalize another $20.5 million almost equally for the next three years. These expenses will be incurred on an after-tax basis. The first year of the project is unlikely to bring any additional revenues, but from second year, we should see revenues increase by $1.800 million. Our preliminary estimates also show revenues growing to $9.700 million in year 2, $19.300 million in year 3, $22.800 million in year 4, and $24.600 million in year 5 (Ali dolar values in milions) $20.5 (spread over 3 years) $3.400 2 Capitalized expenses 3 Non-cash (depreciable) expenses Year 1: 141% Year 2: 33% Year 3: 22% Year 4:22% Year 5:24% 40% 4 Operating costs as a I am also attaching some information the team used for the cash flow valuation. See you later to go over the numbers. percentage of revenues Cheers, Dikran axes The analysts on the team created pro forma estimates of the expected cash flows that the project is likely to generate and also discussed some assumptions Complete the following cash flow analysis based on the information provided. Express all values in millions of dollars and round all values to three decimal places. Year 0 Year 1 Year 2 Year 3 Year 4 Year 5 . Revenue estimates are based on the expectation of Revenues 9.70OY? 19.30OY | 22.800 | 24.600 a higher price point resulting from a more robust product. ?0.0 ?2.538 3.201??.246Y-.01GY 5.904? Less: Operating expenses .Operating expenses include internal labor, 0.000 3.400 3.400 maintenance, overhead expense, and cost avoidance Depreciation & from being able to ramp down spending on existing platforms. Y 3.09oYT1.654 14.384YT5.29GY Operating 0.000T4.138 . The capitalized expenses include the costs of Income - platform development, content creation, internal and ? 0.000 0.000 1.240 4562 5.754 Le 4.662 6.118 external labor, computers, facility investment, and so on. These expenses are amortizable and depreciable over the first three of the six years of the project's expected life. They are recognized separately from the normal depreciation and amortization expenses. 0.000 0.000 0.000 0.000 0.000 Plus: Non-cash expenses Operating Cash Flow Less: Capitalized expenses Total Cash Flow 7.300 . These capital expenses will be deducted from the project's annual cash flow from operations to derive at the project's total expected cash flows Project Evaluation The analysts in the team run the numbers and hand over the evaluation to Sanford Complete the data in the report Year 0 Year 1 Year 2 Year 3 Year 4 Year 5 9.67 $2.79$5.30$5.48$5.20 PV of cash flows$7.30 NPV of the IRR of the project Payback period 16.00% 3.30 years

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started