Answered step by step

Verified Expert Solution

Question

1 Approved Answer

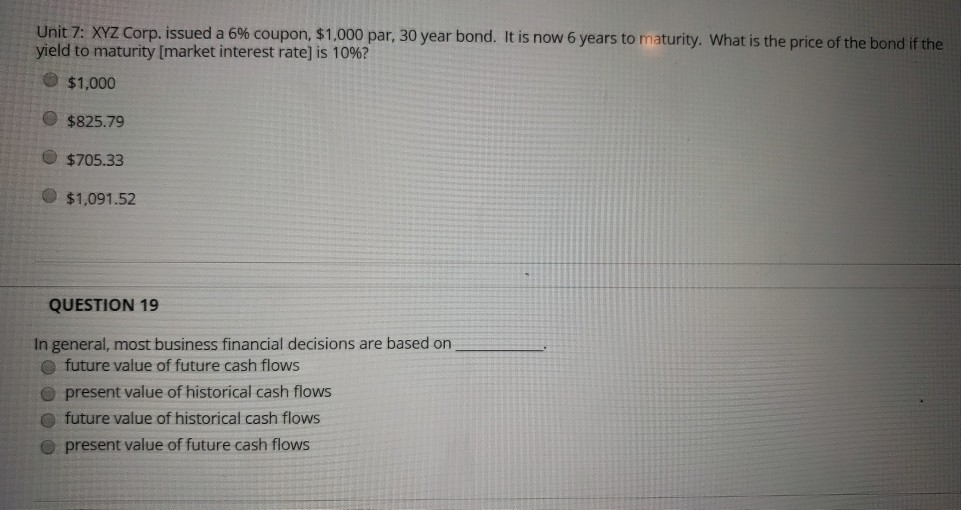

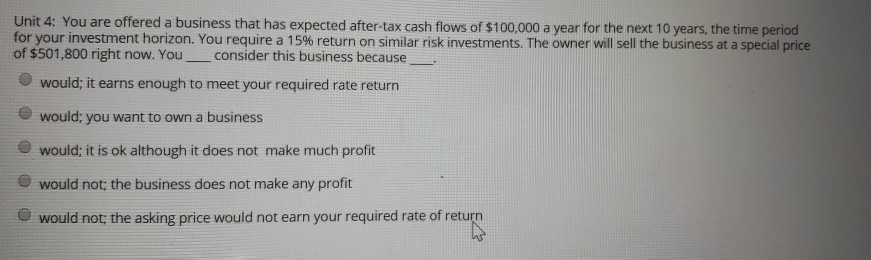

Can you please help me with the answers to these 3 questions? Thank you. :) Unit 7: XYZ Corp. issued a 6% coupon, $1,000 par,

Can you please help me with the answers to these 3 questions? Thank you. :)

Unit 7: XYZ Corp. issued a 6% coupon, $1,000 par, 30 year bond. It is now 6 years to m turity, what is the price of the bond if the yield to maturity [market interest rate) is 10%? $1,000 O $825.79 O $705.33 $1,091.52 QUESTION 19 In general, most business financial decisions are based on future value of future cash flows e present value of historical cash flows O future value of historical cash flows O present value of future cash flows Unit 4: You are offered a business that has expected after-tax cash flows of $100,000 a year for the next 10 years, the time period foryour investment horizon. You require a 15% return on similar risk Investments. The owner will sell the business at a specia price of $501,800 right now. You consider this business because would; it earns enough to meet your required rate return would: you want to own a business O would; it is ok although it does not make much profit would not; the business does not make any profit O would not, the asking price would not earn your required rate of return

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started