Answered step by step

Verified Expert Solution

Question

1 Approved Answer

can you please help me with these B. What will be the price of a 3% coupon, $1,000 face value bond 15 years from today

can you please help me with these

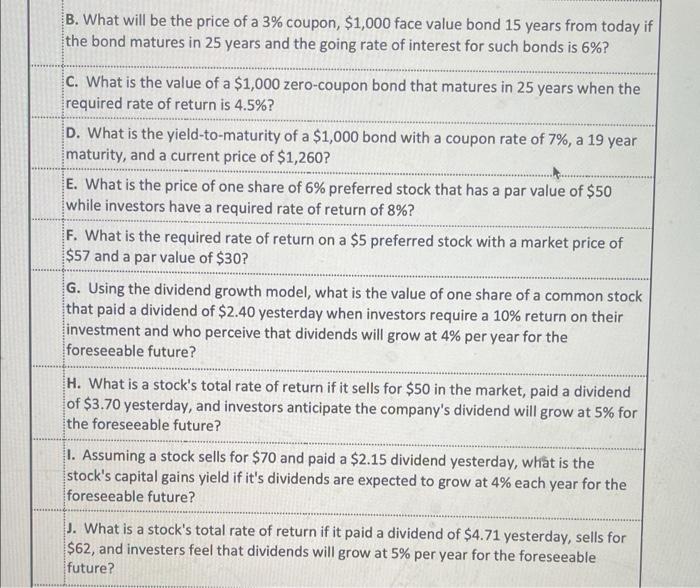

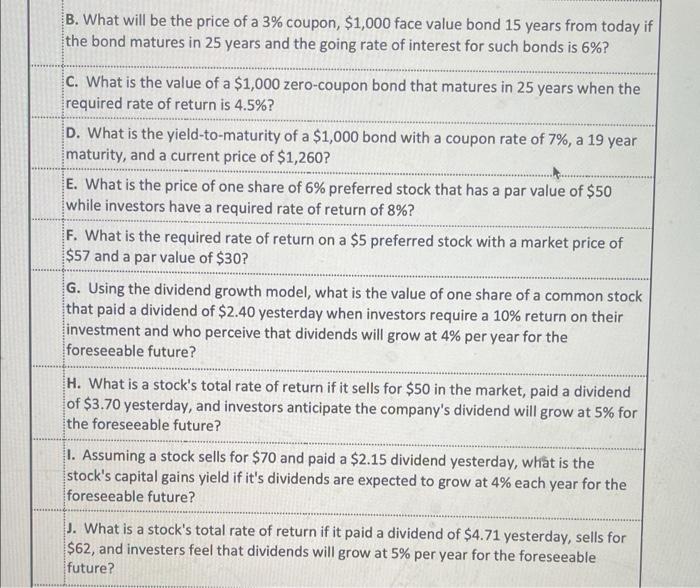

B. What will be the price of a 3% coupon, $1,000 face value bond 15 years from today if the bond matures in 25 years and the going rate of interest for such bonds is 6% ? C. What is the value of a $1,000 zero-coupon bond that matures in 25 years when the required rate of return is 4.5% ? D. What is the yield-to-maturity of a $1,000 bond with a coupon rate of 7%, a 19 year maturity, and a current price of $1,260 ? E. What is the price of one share of 6% preferred stock that has a par value of $50 while investors have a required rate of return of 8% ? F. What is the required rate of return on a $5 preferred stock with a market price of $57 and a par value of $30 ? G. Using the dividend growth model, what is the value of one share of a common stock that paid a dividend of $2.40 yesterday when investors require a 10% return on their investment and who perceive that dividends will grow at 4% per year for the foreseeable future? H. What is a stock's total rate of return if it sells for $50 in the market, paid a dividend of $3.70 yesterday, and investors anticipate the company's dividend will grow at 5% for the foreseeable future? I. Assuming a stock sells for $70 and paid a $2.15 dividend yesterday, whtat is the stock's capital gains yield if it's dividends are expected to grow at 4% each year for the foreseeable future? J. What is a stock's total rate of return if it paid a dividend of $4.71 yesterday, sells for $62, and investers feel that dividends will grow at 5% per year for the foreseeable future

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started