Can you please help me with this?

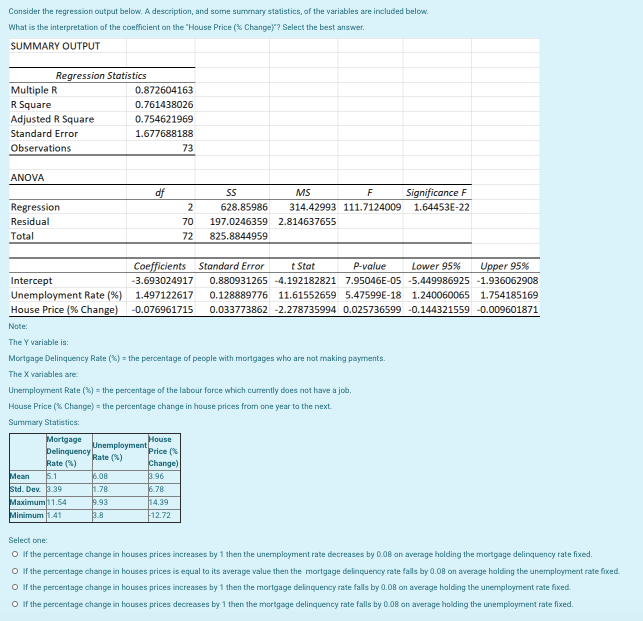

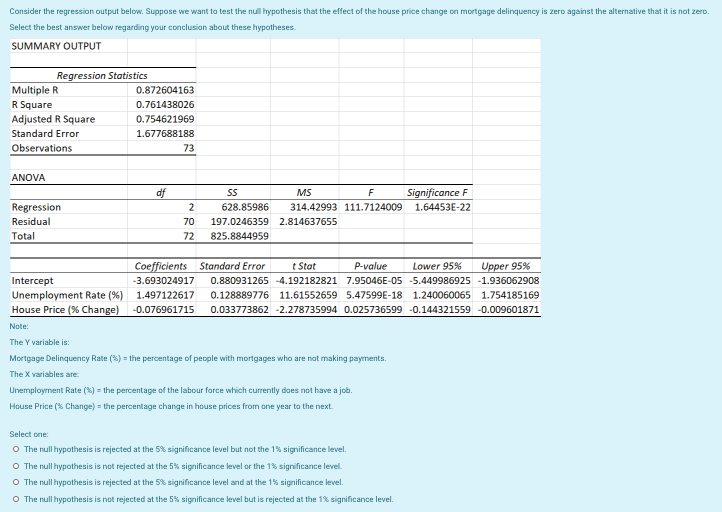

Consider the regression output below. A description, and some summary statistics, of the variables are included below. What is the interpretation of the coefficient on the "House Price (% Change)"? Select the best answer. SUMMARY OUTPUT Regression Statistics Multiple R 0.872604163 R Square 0.761438026 Adjusted R Square 0.754621969 Standard Error 1.677688188 Observations 73 ANOVA df 55 MS F Significance F Regression 2 628.85986 314.42993 111.7124009 1.64453E-22 Residual 70 197.0246359 2.814637655 Total 72 825.8844959 Coefficients Standard Error t Stat P-value Lower 95% Upper 95% Intercept 3.693024917 0.880931265 -4.192182821 7.95046E-05 -5.449986925 -1.936062908 Unemployment Rate (%) 1.497122617 0.128889776 11.61552659 5.47599E-18 1.240060065 1.754185169 House Price (% Change) -0.076961715 0.033773862 -2.278735994 0.025736599 -0.144321559 -0.009601871 Note: The Y variable is: Mortgage Delinquency Rate (%) = the percentage of people with mortgages who are not making payments. The X variables are Unemployment Rate (*) = the percentage of the labour force which currently does not have a job. House Price (% Change) = the percentage change in house prices from one year to the next Summary Statistics: Mortgage Unemployment House Delinquency Bate () Price (% Rate (% Change) Mean 5.1 2.96 Std. Dev. 3.39 1.78 6.78 Maximum 11.54 9.92 14.39 Minimum 1.41 -12.72 Select one: If the percentage change in houses prices increases by 1 then the unemployment rate decreases by 0.08 on average holding the mortgage delinquency rate fixed. If the percentage change in houses prices is equal to its average value then the mortgage delinquency rate falls by 0.08 on average holding the unemployment rate fixed. O If the percentage change in houses prices increases by 1 then the mortgage delinquency rate falls by 0.08 on average holding the unemployment rate fixed. If the percentage change in houses prices decreases by 1 then the mortgage delinquency rate falls by 0.08 on average holding the unemployment rate fixed.Consider the regression output below. Suppose we want to test the null hypothesis that the effect of the house price change on mortgage delinquency is zero against the alternative that it is not zero. Select the best answer below regarding your conclusion about these hypotheses. SUMMARY OUTPUT Regression Statistics Multiple R 0.872604163 R Square 0.761438026 Adjusted R Square 0.754621969 Standard Error 1.677688188 Observations 73 ANOVA df MS F Significance F Regression 2 628.85986 314.42993 111.7124009 1.64453E-22 Residual 70 197.0246359 2.814637655 Total 72 825.8844959 Coefficients Standard Error t Stat P-value Lower 95% Upper 95% Intercept -3.693024917 0.880931265 -4.192182821 7.95046E-05 -5.449986925 -1.936062908 Unemployment Rate (%) 1.497122617 0.128889776 11.61552659 5.47599E-18 1.240060065 1.754185169 House Price (% Change) -0.076961715 0.033773862 -2.278735994 0.025736599 -0.144321559 -0.009601871 Note: The Y variable is: Mortgage Delinquency Rate (%) = the percentage of people with mortgages who are not making payments. The X variables are Unemployment Rate (3) = the percentage of the labour force which currently does not have a job. House Price (% Change) = the percentage change in house prices from one year to the next. Select one: O The null hypothesis is rejected at the 5% significance level but not the 1% significance level. O The null hypothesis is not rejected at the 5% significance level or the 1% significance level O The null hypothesis is rejected at the 5%% significance level and at the 1% significance level. The null hypothesis is not rejected at the 5% significance level but is rejected at the 1% significance level