Answered step by step

Verified Expert Solution

Question

1 Approved Answer

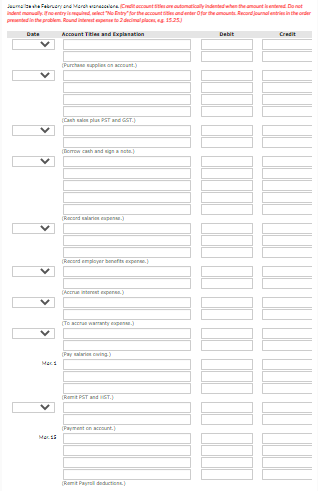

Can you please help me with this?: Cullumber Company had the following selected transactions. Feb. 2 Purchases supplies from Supplies R Us on account for

Can you please help me with this?:

Cullumber Company had the following selected transactions.

| Feb. 2 | Purchases supplies from Supplies R Us on account for $2,600. | |

| 10 | Cash register sales total $44,100, plus 5% GST and 8% PST. Ignore any cost of goods sold entry. | |

| 15 | Signs a $35,700, six-month, 6%-interest-bearing note payable to MidiBank and receives $35,700 in cash. | |

| 21 | The payroll for the previous two weeks consists of salaries of $51,000. All salaries are subject to CPP of $2,354, EI of $960, and income tax of $9,100. The salaries are paid on February 28. The employers payroll expense is also recorded. | |

| 28 | Accrues interest on the MidiBank note payable. | |

| 28 | Accrues the required warranty provision because some of the sales were made under warranty. Of the units sold under warranty, 360 are expected to become defective. Repair costs are estimated to be $40 per unit. | |

| 28 | Pays employees the salaries for the pay period ending February 21. | |

| Mar. 1 | Remits the sales taxes to the province and GST to the Receiver General for the February 10 sales. | |

| 2 | Makes the payment to Supplies R Us from the February purchase. | |

| 15 | Remits the payroll taxes owing from the February 21 payroll to the Receiver General. |

LIST OF ACCOUNTS:

- Accounts Payable

- Accounts Receivable

- Accumulated Amortization - Patents

- Accumulated Depreciation - Building

- Accumulated Depreciation - Equipment

- Admission Revenue

- Allowance for Doubtful Accounts

- Amortization Expense

- Bad Debt Expense

- Bank Indebtedness or Bank Loan Payable

- Cash

- Cost of Goods Sold

- CPP Payable

- Depreciation Expense

- Disabillity Insurance Payable

- Dividends Payable

- EI Payable

- Employee Benefits Expense

- Employee Benefits Payable

- Equipment

- GST Payable

- GST Recoverable

- Health Insurance Payable

- HST Payable

- HST Recoverable

- Income Tax Payable

- Interest Expense

- Interest Payable

- Interest Receivable

- Interest Revenue

- Land

- Life Insurance Payable

- Litigation Liability

- Merchandise Inventory

- Mortgage Payable

- Mortgage Payable - Current Portion

- No Entry

- Notes Payable

- Notes Receivable

- Operating Expenses

- Prepaid Expenses

- Prepaid Property Taxes

- Property Tax Expense

- Property Tax Payable

- PST Payable

- QST Payable

- Redemption Rewards Liability

- Repair Parts Inventory

- Revenue

- Revenue from Rewards Program

- Salaries Expense

- Salaries Payable

- Sales

- Sales Returns and Allowances

- Service Revenue

- Supplies

- Unearned Revenue

- Unearned Revenue-Loyalty Program

- Union Dues Payable

- United Way Contributions Payable

- Warranty Repair Inventory

- Vacation Pay Payable

- Warranty Expense

- Warranty Liability

- Workers' Compensation Payable

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started