Can you please help me with this problem set? This is related to Industrial Organisation (Stackelberg model and Bertrand model

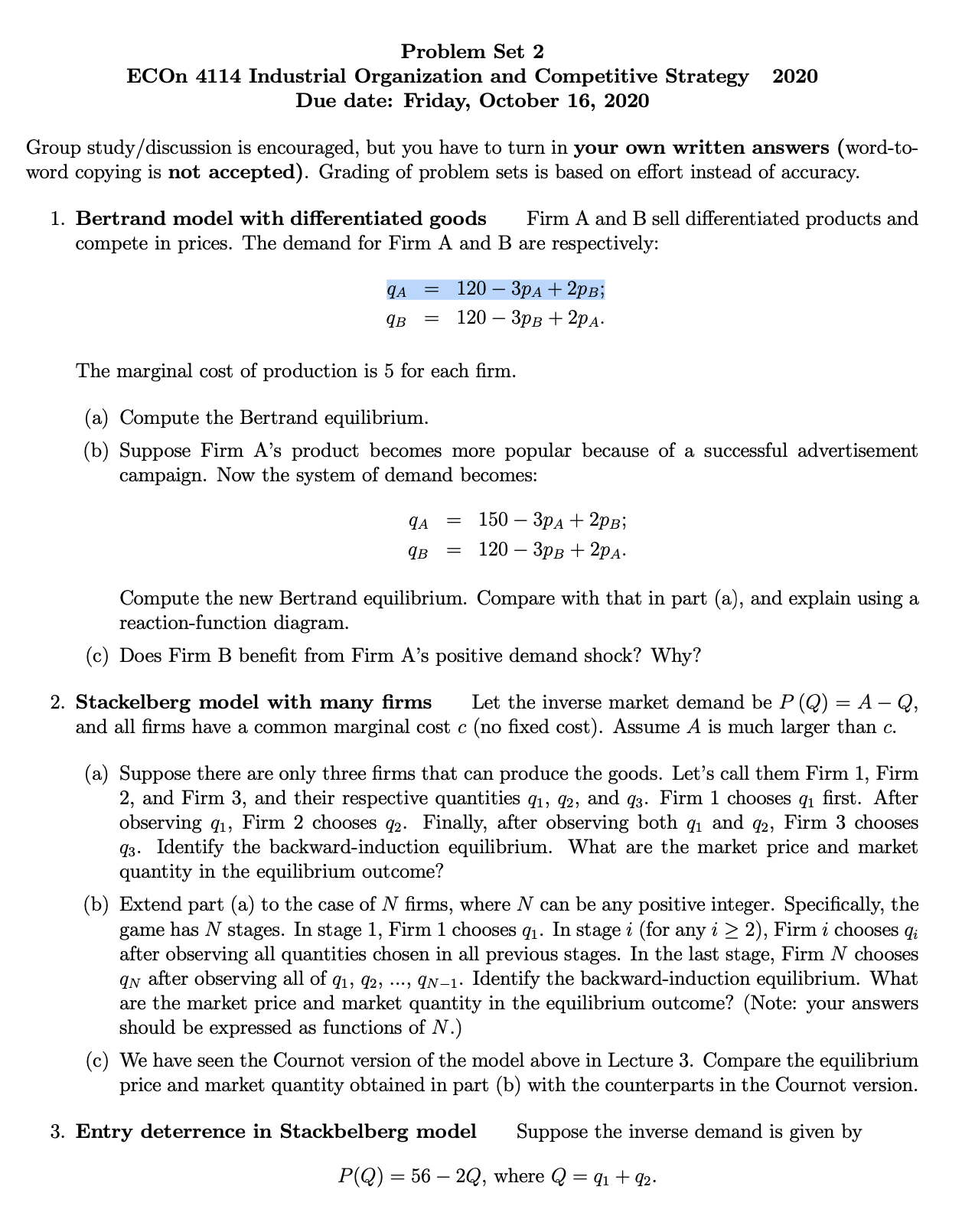

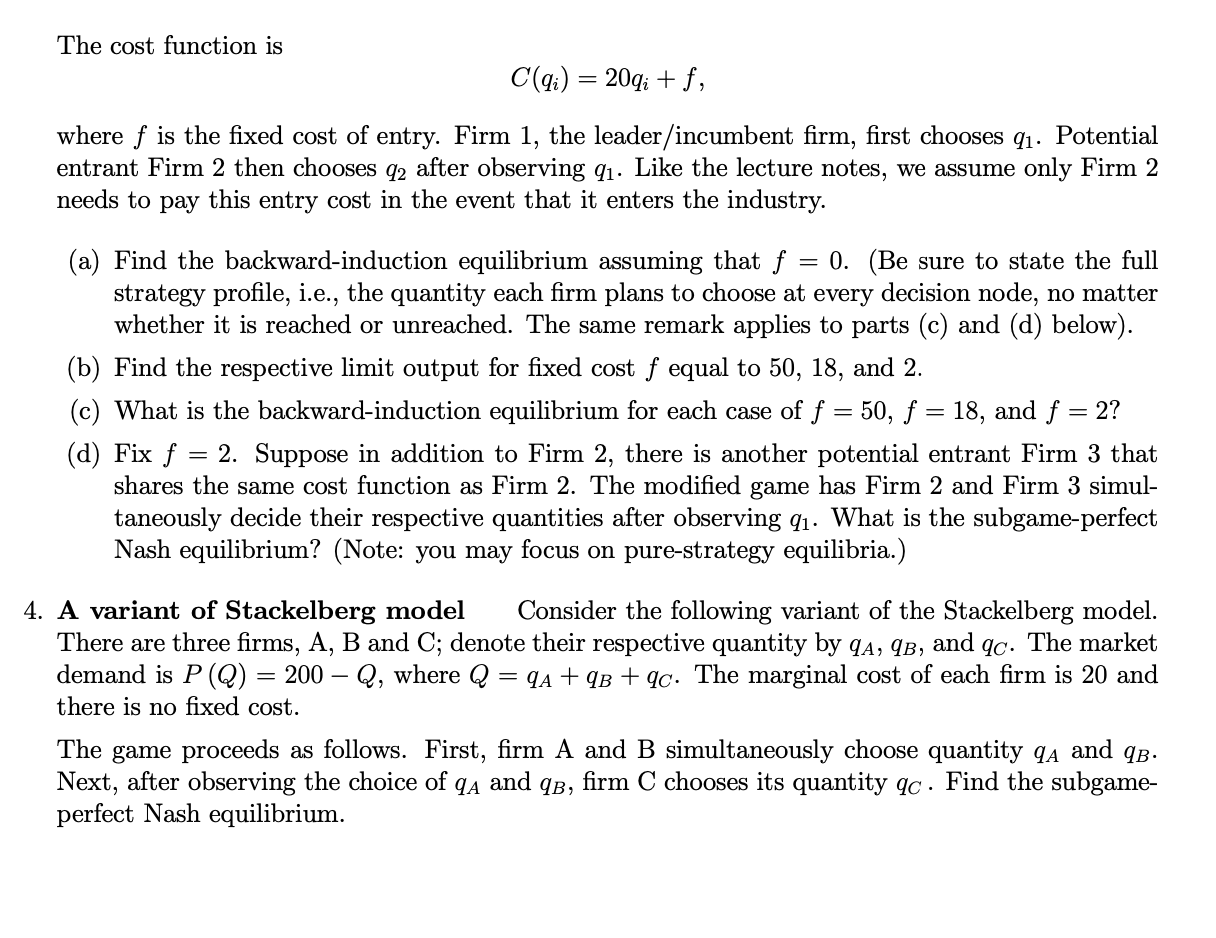

Problem Set 2 ECOn 4114 Industrial Organization and Competitive Strategy 2020 Due date: Friday, October 16, 2020 Group study / discussion is encouraged, but you have to turn in your own written answers (word-to- word copying is not accepted). Grading of problem sets is based on effort instead of accuracy. 1. Bertrand model with differentiated goods Firm A and B sell differentiated products and compete in prices. The demand for Firm A and B are respectively: A = 120 - 3pA + 2PB; 9B = 120 - 3pB + 2PA. The marginal cost of production is 5 for each firm. (a) Compute the Bertrand equilibrium. (b) Suppose Firm A's product becomes more popular because of a successful advertisement campaign. Now the system of demand becomes: qA = 150 - 3pA + 2PB; 9B = 120 - 3PB + 2PA. Compute the new Bertrand equilibrium. Compare with that in part (a), and explain using a reaction-function diagram. (c) Does Firm B benefit from Firm A's positive demand shock? Why? 2. Stackelberg model with many firms Let the inverse market demand be P (Q) = A - Q, and all firms have a common marginal cost c (no fixed cost). Assume A is much larger than c. (a) Suppose there are only three firms that can produce the goods. Let's call them Firm 1, Firm 2, and Firm 3, and their respective quantities q1, 92, and q3. Firm 1 chooses q1 first. After observing q1, Firm 2 chooses q2. Finally, after observing both q1 and 92, Firm 3 chooses 93. Identify the backward-induction equilibrium. What are the market price and market quantity in the equilibrium outcome? (b) Extend part (a) to the case of N firms, where N can be any positive integer. Specifically, the game has N stages. In stage 1, Firm 1 chooses q1. In stage i (for any i 2 2), Firm i chooses qi after observing all quantities chosen in all previous stages. In the last stage, Firm N chooses IN after observing all of q1, 92, ..., qN-1. Identify the backward-induction equilibrium. What are the market price and market quantity in the equilibrium outcome? (Note: your answers should be expressed as functions of N.) (c) We have seen the Cournot version of the model above in Lecture 3. Compare the equilibrium price and market quantity obtained in part (b) with the counterparts in the Cournot version. 3. Entry deterrence in Stackbelberg model Suppose the inverse demand is given by P(Q) = 56 - 2Q, where Q = q1 + 92.The cost function is 0011:): 209:: + f, where f is the xed cost of entry. Firm 1, the leader/incumbent rm, rst chooses ql. Potential entrant Firm 2 then chooses (12 after observing 9'1- Like the lecture notes, we assume only Firm 2 needs to pay this entry cost in the event that it enters the industry. (a) Find the backward-induction equilibrium assuming that f = 0. (Be sure to state the full strategy prole, i.e., the quantity each rm plans to choose at every decision node, no matter whether it is reached or unreached. The same remark applies to parts (c) and (d) below). (b) Find the respective limit output for xed cost f equal to 50, 18, and 2. (c) What is the backward-induction equilibrium for each case of f = 50, f = 18, and f = 2? (d) Fix f = 2. Suppose in addition to Firm 2, there is another potential entrant Firm 3 that shares the same cost function as Firm 2. The modied game has Firm 2 and Firm 3 simul taneously decide their respective quantities after observing Q1. What is the subgameperfect Nash equilibrium? (Note: you may focus on purestrateg equilibria.) . A variant of Stackelberg model Consider the following variant of the Stackelberg model. There are three rms, A, B and C; denote their respective quantity by 954, (13, and go. The market demand is P (Q) = 200 Q, where Q = 954 + qB + go. The marginal cost of each rm is 20 and there is no xed cost. The game proceeds as follows. First, rm A and B simultaneously choose quantity (1A and (15. Next, after observing the choice of qA and :33, rm C chooses its quantity qc. Find the subgame perfect Nash equilibrium