Question

Can you please help to create balance sheet and income statement for all 3 options in excel? DeAngelos Foods Ltd. (DeAngelos) is a grocery

Can you please help to create balance sheet and income statement for all 3 options in excel?

DeAngelos Foods Ltd. (DeAngelos) is a grocery store company specializing in high-quality fresh produce, and gourmet foods. Currently, there are three locations in downtown Vancouver.

DeAngelos is a private company, with 100,000 common shares issued and outstanding to each of Brenda and Anthony DeAngelo (200,000 common shares total). The company follows accounting standards for private enterprises (ASPE) for accounting purposes. DeAngelos' first store opened 20 years ago, when Anthony arrived in Canada from Italy. Six years later, a second location was opened, followed by a third location.

All three stores have similar formats and layouts. All inventory items are sourced locally, where possible. Anthony and Brenda pride themselves on having developed stores where customers enjoy the shopping experience.

DeAngelos has recently decided to expand outside of the downtown core and plans to open one new store in July 2024 and another in June 2025. The new stores will be similar in format and size to the current locations.

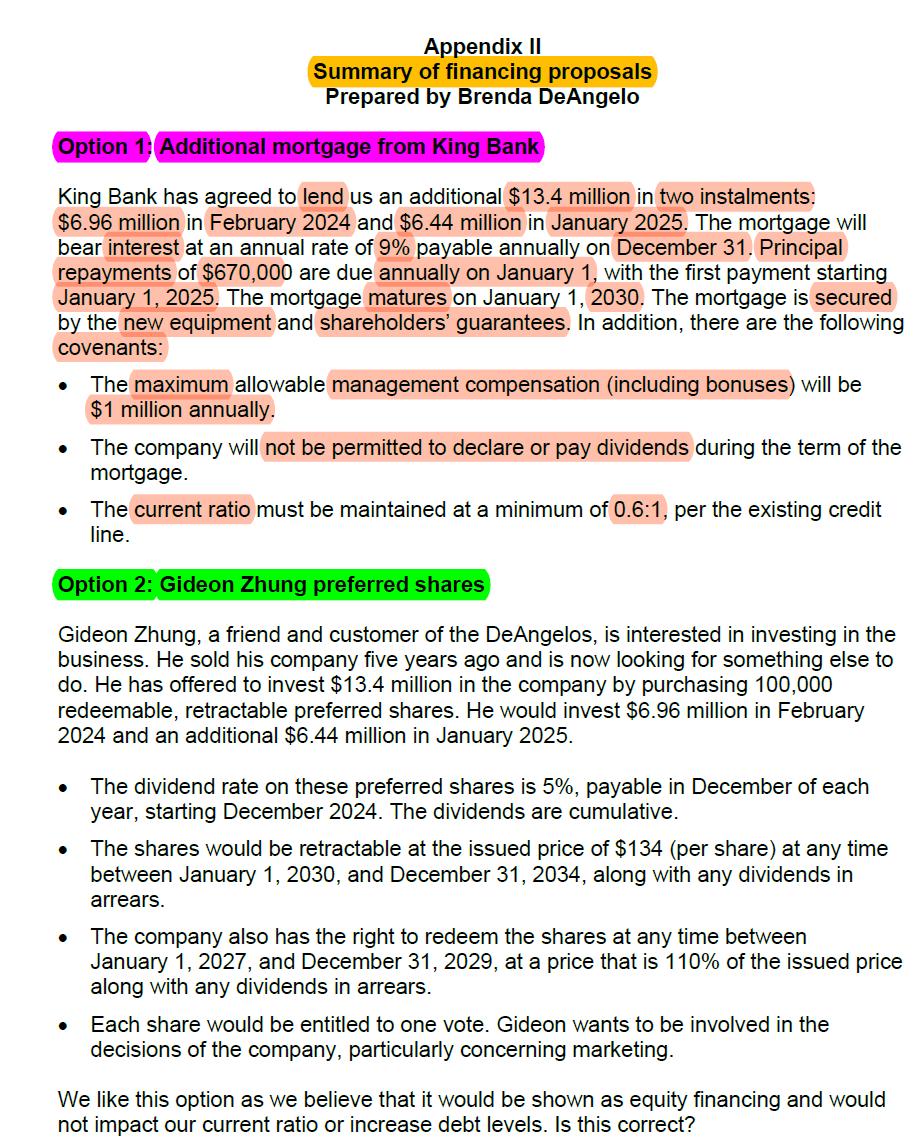

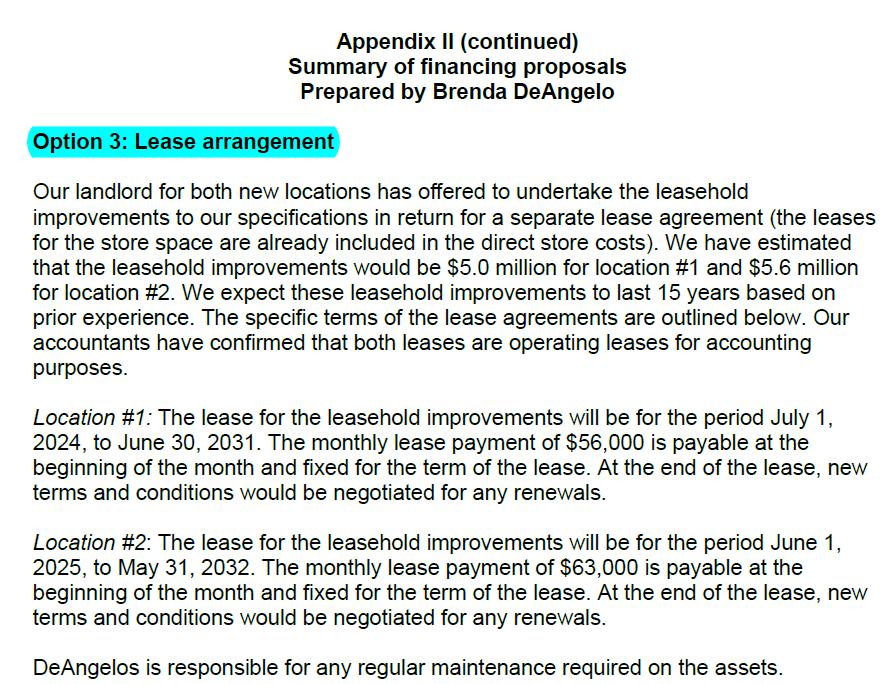

You, work as a consultant for Henderson and Mulik (HM), a regional financial consulting firm. Anthony recently contacted David Henderson, a partner at HM, for financing advice for the expansion. DeAngelos requires $13.4 million to finance leasehold improvements and new equipment purchases for the new locations. Inventory and store opening costs can be financed via the current line of credit and cash flow from operations.

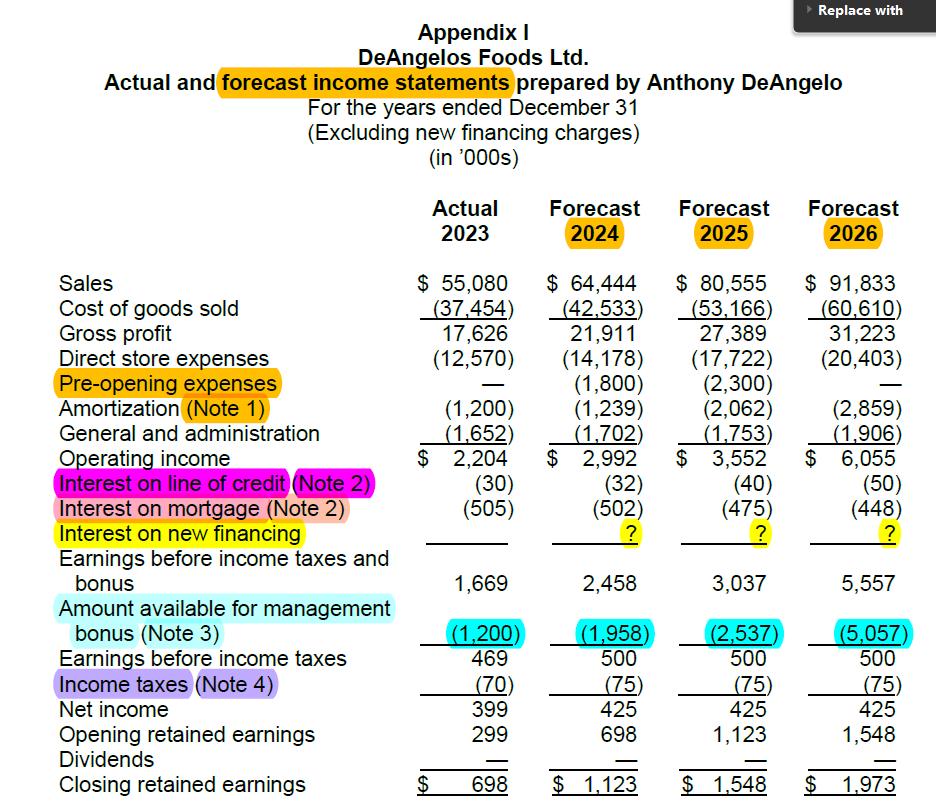

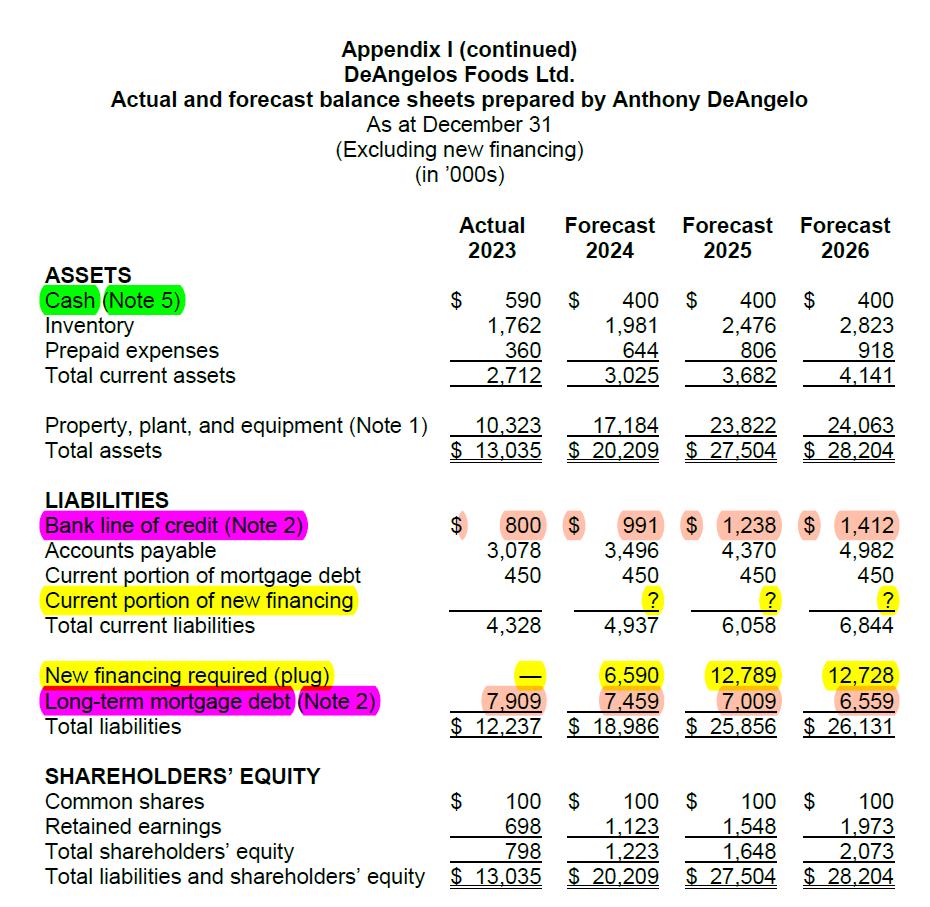

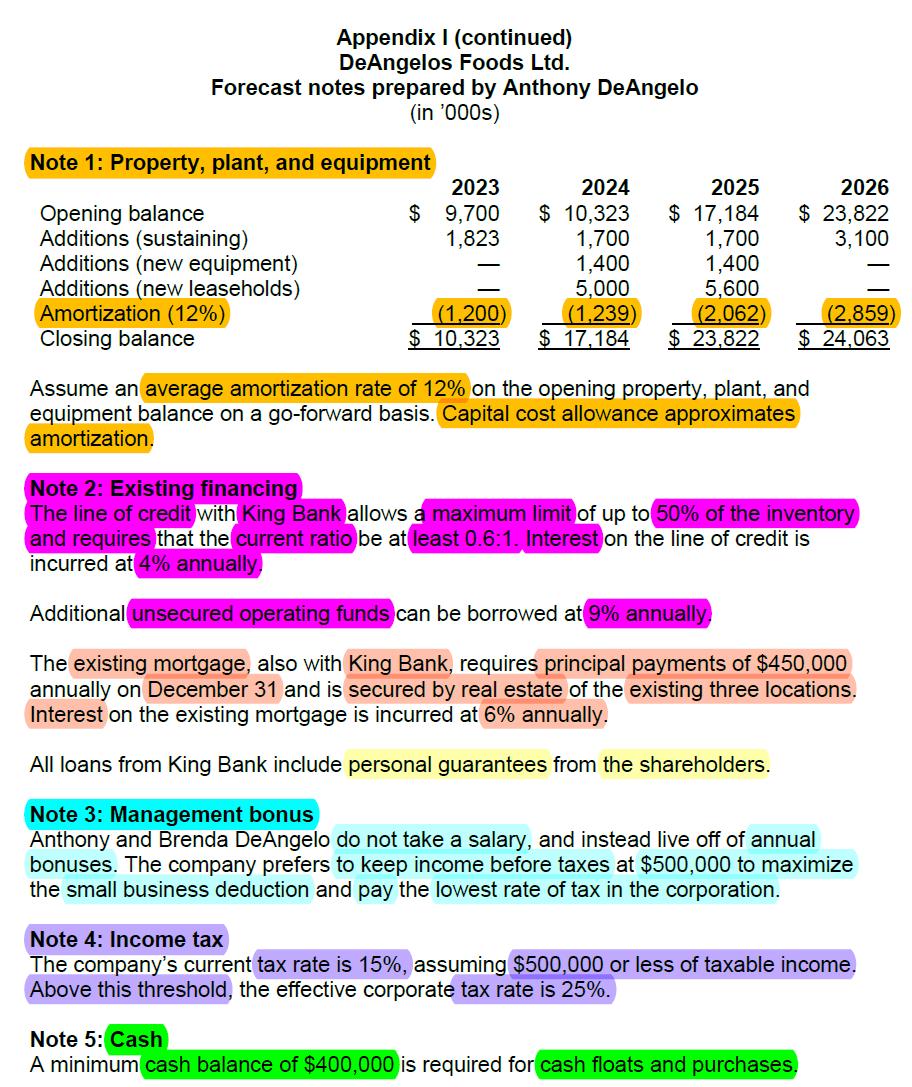

Anthony has provided David with a three-year operating projection including both the income statement and balance sheet (Appendix I). These projections include existing financing but do not include any new financing alternatives for the expansion.

It is now January 2024. David would like you to review the three new financing alternatives (Appendix II) and prepare an updated set of income statement and balance sheet projections for each alternative, using Anthony's operating projections as a base (Appendix I). David also suggests that you provide the DeAngelos with qualitative considerations and a final recommendation.

Replace with Appendix I DeAngelos Foods Ltd. Actual and forecast income statements prepared by Anthony DeAngelo For the years ended December 31 (Excluding new financing charges) (in '000s) Actual 2023 Forecast 2024 Forecast 2025 Forecast 2026 $ 80,555 $ 91,833 Sales Cost of goods sold Gross profit Direct store expenses Pre-opening expenses Amortization (Note 1) General and administration Operating income $ 55,080 (37,454) 17,626 (12,570) $ 64,444 (42,533) 21,911 (14,178) (53,166) 27,389 (17,722) (60,610) 31,223 (20,403) - (1,800) (2,300) - (1,200) (1,239) (2,062) (1,652) (1,702) (1,753) (2,859) (1,906) $ 2,204 $ 2,992 $ 3,552 $ 6,055 Interest on line of credit (Note 2) (30) (32) (40) (50) Interest on mortgage (Note 2) (505) (502) (475) (448) Interest on new financing ? ? ? Earnings before income taxes and bonus 1,669 2,458 3,037 5,557 Amount available for management bonus (Note 3) (1,200) (1,958) (2,537) (5,057) Earnings before income taxes 469 500 500 500 Income taxes (Note 4) (70) (75) (75) (75) Net income 399 425 425 425 Opening retained earnings Dividends 299 698 1,123 1,548 - Closing retained earnings LEAT $ 698 $ 1,123 $ 1,548 $ 1,973

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started