Answered step by step

Verified Expert Solution

Question

1 Approved Answer

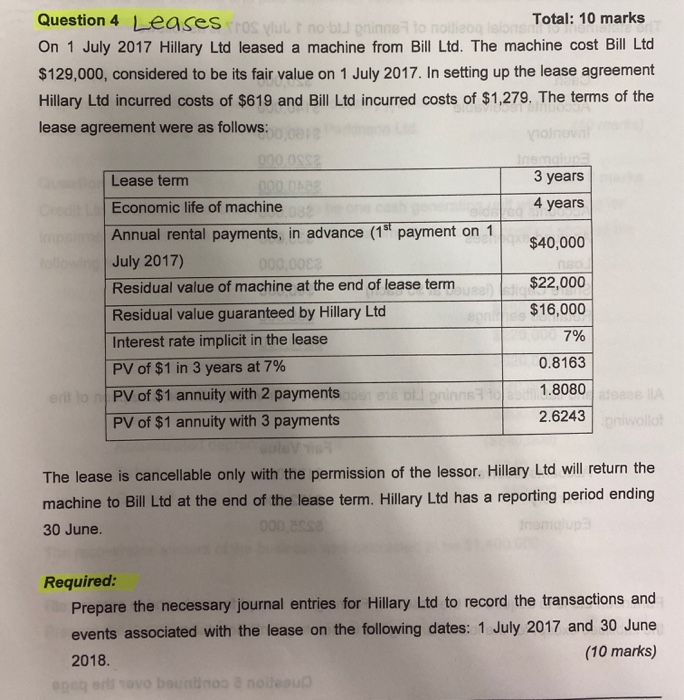

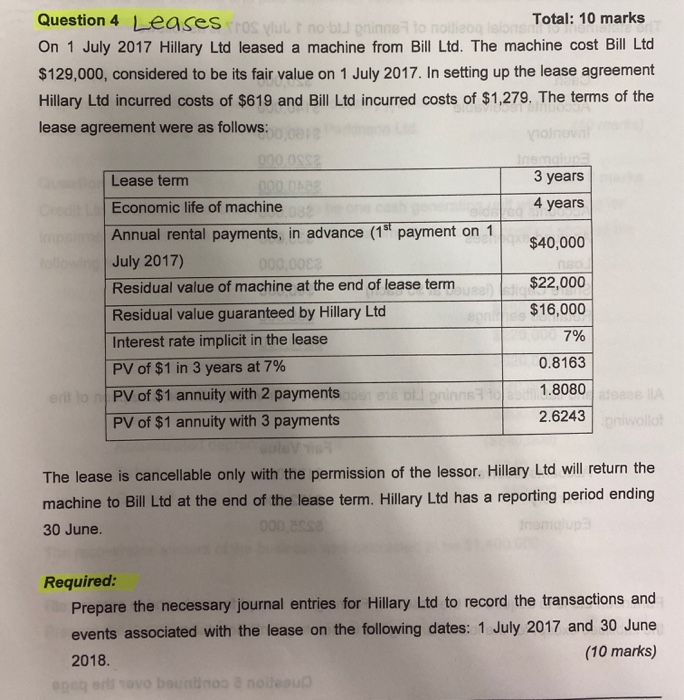

can you please help with this i also dont understand why it will be -$40000 3 years Question 4 Leases ros y bionin Total: 10

can you please help with this

3 years Question 4 Leases ros y bionin Total: 10 marks On 1 July 2017 Hillary Ltd leased a machine from Bill Ltd. The machine cost Bill Ltd $129,000, considered to be its fair value on 1 July 2017. In setting up the lease agreement Hillary Ltd incurred costs of $619 and Bill Ltd incurred costs of $1,279. The terms of the lease agreement were as follows: Vio 000 OSS Lease term 00001 Economic life of machine 4 years Annual rental payments, in advance (15 payment on 1 $40,000 July 2017) 000.000 Residual value of machine at the end of lease term $22,000 Residual value guaranteed by Hillary Ltd $16,000 Interest rate implicit in the lease 7% PV of $1 in 3 years at 7% 0.8163 to PV of $1 annuity with 2 payments 1.8080 PV of $1 annuity with 3 payments 2.6243nwolle The lease is cancellable only with the permission of the lessor. Hillary Ltd will return the machine to Bill Ltd at the end of the lease term. Hillary Ltd has a reporting period ending 30 June 000 SS nam up Required: Prepare the necessary journal entries for Hillary Ltd to record the transactions and events associated with the lease on the following dates: 1 July 2017 and 30 June 2018. (10 marks) ang er ovo bounting a noleu i also dont understand why it will be -$40000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started