Answered step by step

Verified Expert Solution

Question

1 Approved Answer

can you please post a answer for this question Cbsy 2306 Accounting systems and advanced reporting applications. textbook- Learning Sage 50 Accounting 2020: A Modular

can you please post a answer for this question

Cbsy 2306 Accounting systems and advanced reporting applications.

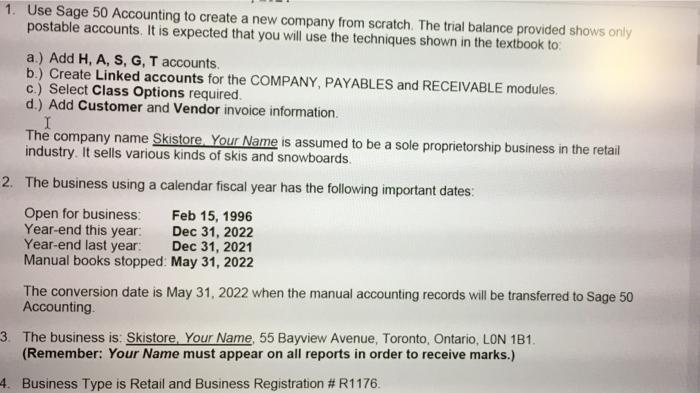

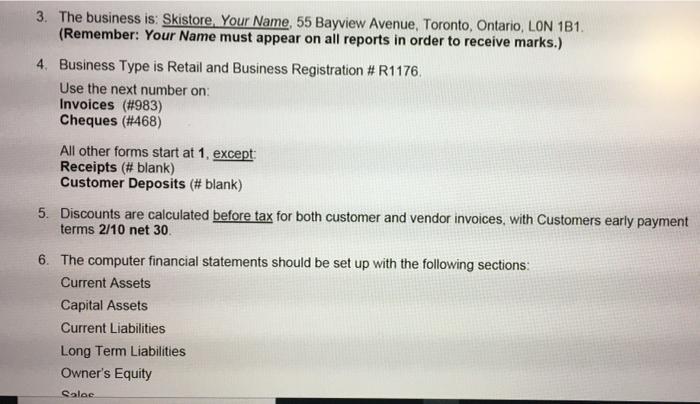

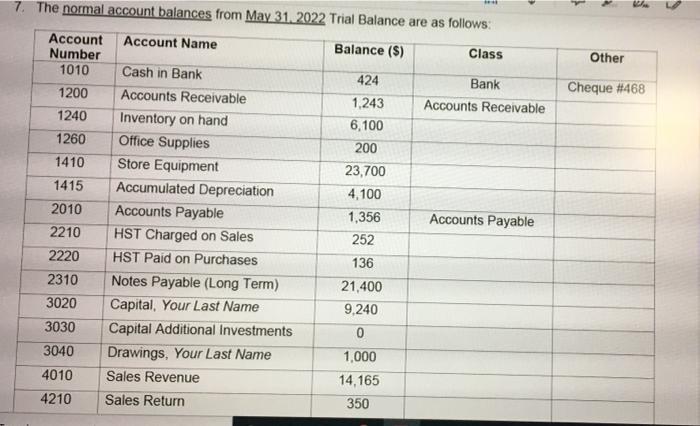

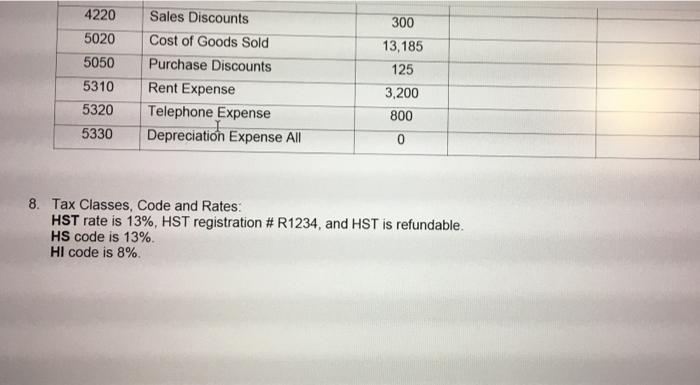

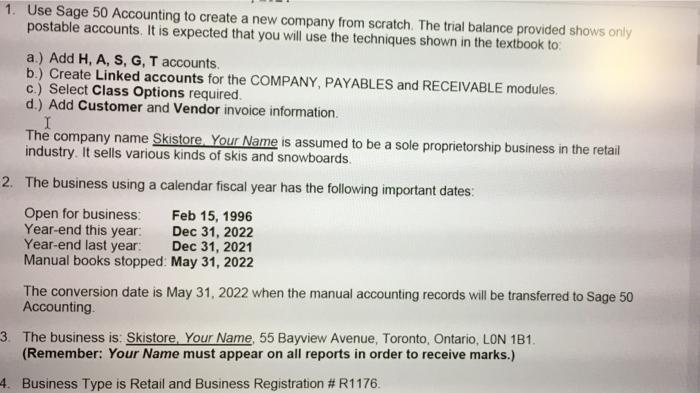

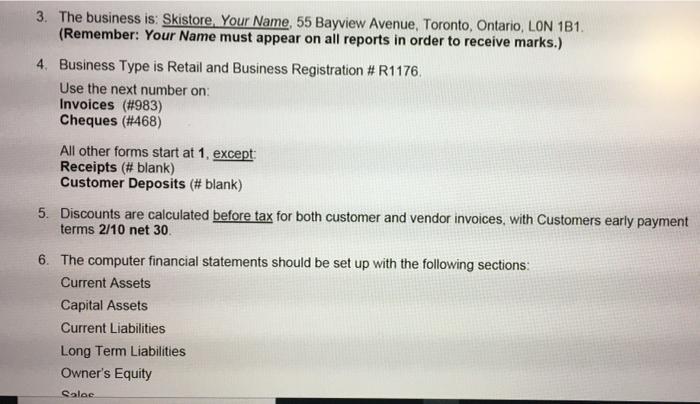

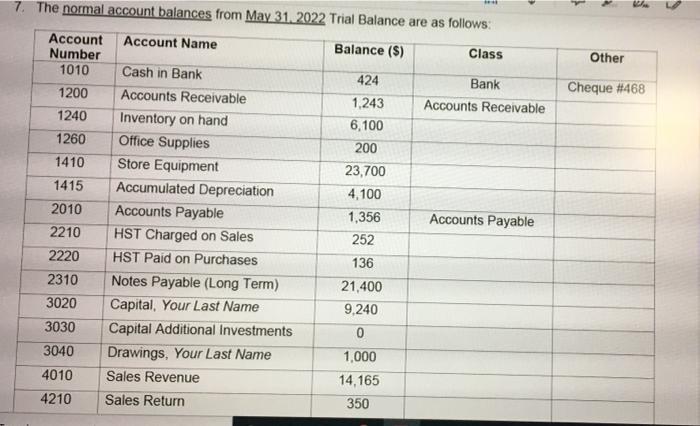

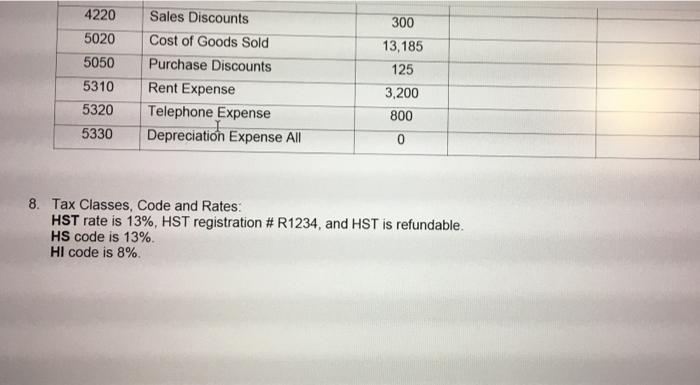

1. Use Sage 50 Accounting to create a new company from scratch. The trial balance provided shows only postable accounts. It is expected that you will use the techniques shown in the textbook to a.) Add H, A, S, GT accounts b.) Create Linked accounts for the COMPANY, PAYABLES and RECEIVABLE modules C.) Select Class Options required. d.) Add Customer and Vendor invoice information I The company name Skistore Your Name is assumed to be a sole proprietorship business in the retail industry. It sells various kinds of skis and snowboards. 2. The business using a calendar fiscal year has the following important dates: Open for business Feb 15, 1996 Year-end this year Dec 31, 2022 Year-end last year Dec 31, 2021 Manual books stopped: May 31, 2022 The conversion date is May 31, 2022 when the manual accounting records will be transferred to Sage 50 Accounting 3. The business is: Skistore, Your Name, 55 Bayview Avenue, Toronto, Ontario, LON 181. (Remember: Your Name must appear on all reports in order to receive marks.) 4. Business Type is Retail and Business Registration #R1176. 3. The business is: Skistore. Your Name, 55 Bayview Avenue, Toronto, Ontario, LON 181 (Remember: Your Name must appear on all reports in order to receive marks.) 4. Business Type is Retail and Business Registration #R1176. Use the next number on: Invoices (#983) Cheques (#468) All other forms start at 1. except Receipts (# blank) Customer Deposits (# blank) 5. Discounts are calculated before tax for both customer and vendor invoices, with Customers early payment terms 2/10 net 30 6. The computer financial statements should be set up with the following sections: Current Assets Capital Assets Current Liabilities Long Term Liabilities Owner's Equity Caloe 7. The normal account balances from May 31, 2022 Trial Balance are as follows: Account Name Balance (S) Class Other Account Number 1010 1200 Bank Accounts Receivable Cheque #468 1240 1260 1410 1415 2010 2210 Accounts Payable Cash in Bank Accounts Receivable Inventory on hand Office Supplies Store Equipment Accumulated Depreciation Accounts Payable HST Charged on Sales HST Paid on Purchases Notes Payable (Long Term) Capital, Your Last Name Capital Additional Investments Drawings, Your Last Name Sales Revenue Sales Return 424 1,243 6.100 200 23,700 4,100 1,356 252 136 21,400 9,240 0 1,000 14,165 350 2220 2310 3020 3030 3040 4010 4210 4220 5020 5050 5310 5320 5330 Sales Discounts Cost of Goods Sold Purchase Discounts Rent Expense Telephone Expense Depreciation Expense All 300 13,185 125 3,200 800 0 8. Tax Classes, Code and Rates: HST rate is 13%, HST registration # R1234, and HST is refundable. HS code is 13% Hl code is 8% 1. Use Sage 50 Accounting to create a new company from scratch. The trial balance provided shows only postable accounts. It is expected that you will use the techniques shown in the textbook to a.) Add H, A, S, GT accounts b.) Create Linked accounts for the COMPANY, PAYABLES and RECEIVABLE modules C.) Select Class Options required. d.) Add Customer and Vendor invoice information I The company name Skistore Your Name is assumed to be a sole proprietorship business in the retail industry. It sells various kinds of skis and snowboards. 2. The business using a calendar fiscal year has the following important dates: Open for business Feb 15, 1996 Year-end this year Dec 31, 2022 Year-end last year Dec 31, 2021 Manual books stopped: May 31, 2022 The conversion date is May 31, 2022 when the manual accounting records will be transferred to Sage 50 Accounting 3. The business is: Skistore, Your Name, 55 Bayview Avenue, Toronto, Ontario, LON 181. (Remember: Your Name must appear on all reports in order to receive marks.) 4. Business Type is Retail and Business Registration #R1176. 3. The business is: Skistore. Your Name, 55 Bayview Avenue, Toronto, Ontario, LON 181 (Remember: Your Name must appear on all reports in order to receive marks.) 4. Business Type is Retail and Business Registration #R1176. Use the next number on: Invoices (#983) Cheques (#468) All other forms start at 1. except Receipts (# blank) Customer Deposits (# blank) 5. Discounts are calculated before tax for both customer and vendor invoices, with Customers early payment terms 2/10 net 30 6. The computer financial statements should be set up with the following sections: Current Assets Capital Assets Current Liabilities Long Term Liabilities Owner's Equity Caloe 7. The normal account balances from May 31, 2022 Trial Balance are as follows: Account Name Balance (S) Class Other Account Number 1010 1200 Bank Accounts Receivable Cheque #468 1240 1260 1410 1415 2010 2210 Accounts Payable Cash in Bank Accounts Receivable Inventory on hand Office Supplies Store Equipment Accumulated Depreciation Accounts Payable HST Charged on Sales HST Paid on Purchases Notes Payable (Long Term) Capital, Your Last Name Capital Additional Investments Drawings, Your Last Name Sales Revenue Sales Return 424 1,243 6.100 200 23,700 4,100 1,356 252 136 21,400 9,240 0 1,000 14,165 350 2220 2310 3020 3030 3040 4010 4210 4220 5020 5050 5310 5320 5330 Sales Discounts Cost of Goods Sold Purchase Discounts Rent Expense Telephone Expense Depreciation Expense All 300 13,185 125 3,200 800 0 8. Tax Classes, Code and Rates: HST rate is 13%, HST registration # R1234, and HST is refundable. HS code is 13% Hl code is 8% textbook- Learning Sage 50 Accounting 2020: A Modular Approach,21st Editionby Freedman(Nelson)

ISBN-10:0176925228

ISBN-13:9780176925222

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started