Answered step by step

Verified Expert Solution

Question

1 Approved Answer

can you please prepare a trial balance for the above transactions Adiustments The following adjustments have not yet been processed in order to prepare the

can you please prepare a trial balance for the above transactions

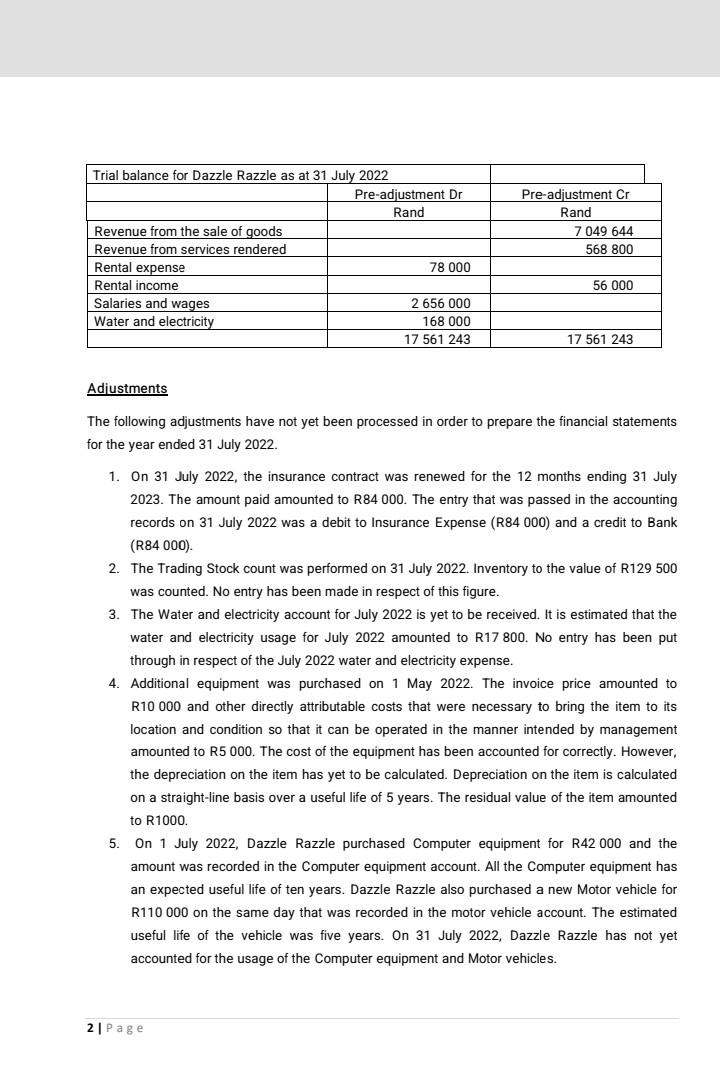

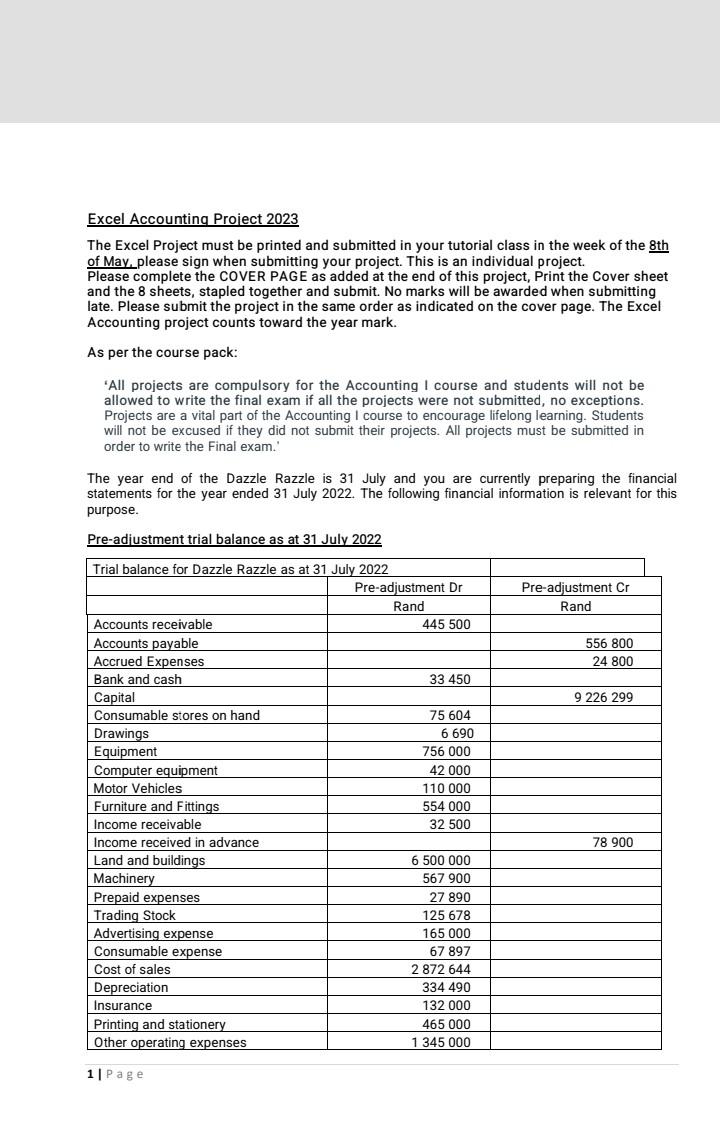

Adiustments The following adjustments have not yet been processed in order to prepare the financial statements for the year ended 31 July 2022. 1. On 31 July 2022 , the insurance contract was renewed for the 12 months ending 31 July 2023. The amount paid amounted to R84000. The entry that was passed in the accounting records on 31 July 2022 was a debit to Insurance Expense (R84 000) and a credit to Bank (R84 000). 2. The Trading Stock count was performed on 31 July 2022. Inventory to the value of R129 500 was counted. No entry has been made in respect of this figure. 3. The Water and electricity account for July 2022 is yet to be received. It is estimated that the water and electricity usage for July 2022 amounted to R17 800. No entry has been put through in respect of the July 2022 water and electricity expense. 4. Additional equipment was purchased on 1 May 2022. The invoice price amounted to R10 000 and other directly attributable costs that were necessary to bring the item to its location and condition so that it can be operated in the manner intended by management amounted to R5 000 . The cost of the equipment has been accounted for correctly. However, the depreciation on the item has yet to be calculated. Depreciation on the item is calculated on a straight-line basis over a useful life of 5 years. The residual value of the item amounted to R1000. 5. On 1 July 2022, Dazzle Razzle purchased Computer equipment for R42 000 and the amount was recorded in the Computer equipment account. All the Computer equipment has an expected useful life of ten years. Dazzle Razzle also purchased a new Motor vehicle for R110 000 on the same day that was recorded in the motor vehicle account. The estimated useful life of the vehicle was five years. On 31 July 2022, Dazzle Razzle has not yet accounted for the usage of the Computer equipment and Motor vehicles. Excel Accounting Project 2023 The Excel Project must be printed and submitted in your tutorial class in the week of the 8th of May, please sign when submitting your project. This is an individual project. Please complete the COVER PAGE as added at the end of this project, Print the Cover sheet and the 8 sheets, stapled together and submit. No marks will be awarded when submitting late. Please submit the project in the same order as indicated on the cover page. The Excel Accounting project counts toward the year mark. As per the course pack: 'All projects are compulsory for the Accounting I course and students will not be allowed to write the final exam if all the projects were not submitted, no exceptions. Projects are a vital part of the Accounting I course to encourage lifelong learning. Students will not be excused if they did not submit their projects. All projects must be submitted in order to write the Final exam.' The year end of the Dazzle Razzle is 31 July and you are currently preparing the financial statements for the year ended 31 July 2022. The following financial information is relevant for this purpose. Pre-adiustment trial balance as at 31 July 2022Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started