Answered step by step

Verified Expert Solution

Question

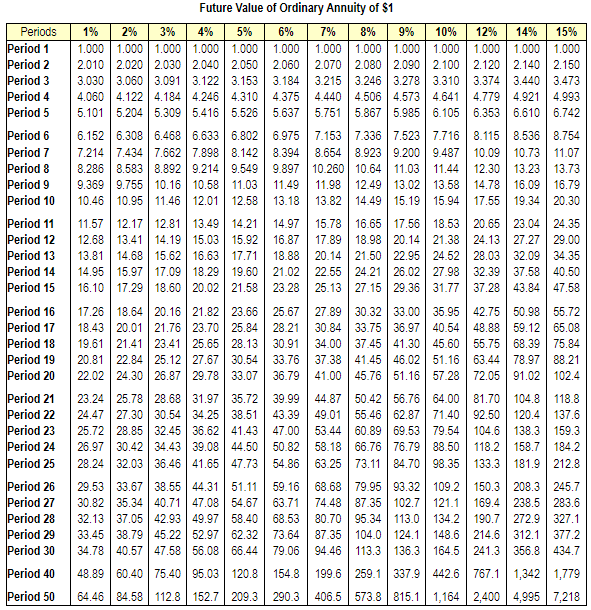

1 Approved Answer

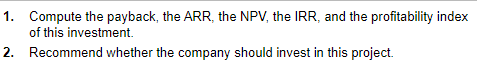

Can you please provide a step-by-step solution? Thanks! Water Country is considering purchasing a water park in Atlanta, Georgia, for $1,850,000. The new facility will

Can you please provide a step-by-step solution? Thanks!

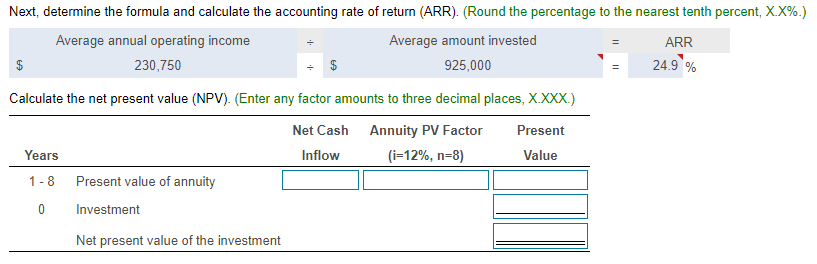

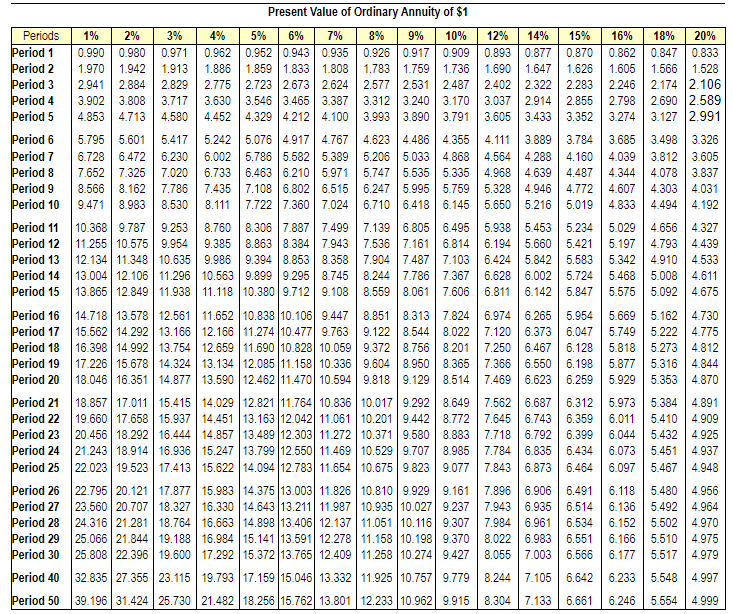

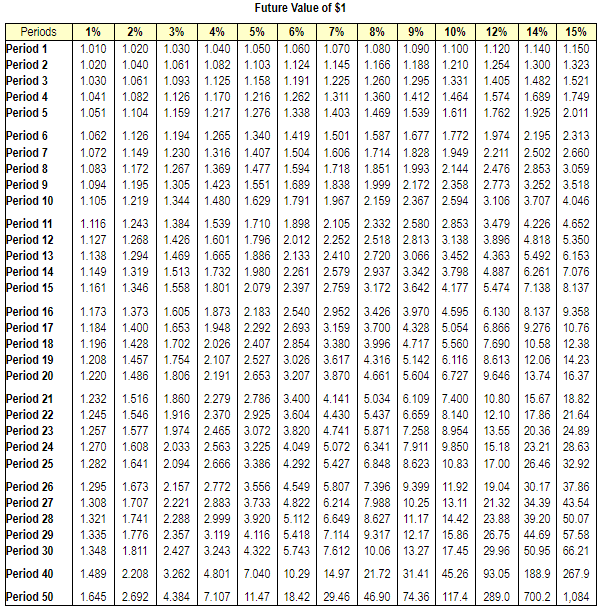

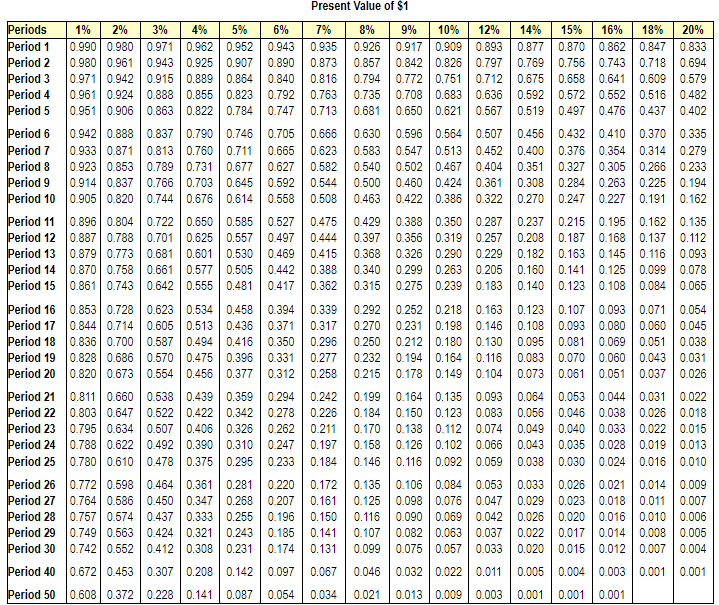

Water Country is considering purchasing a water park in Atlanta, Georgia, for $1,850,000. The new facility will generate annual net cash inflows of $462,000 for eight years. Engineers estimate that the facility will remain useful for eight years and have no residual value. The company uses straight-line depreciation, and its stockholders demand an annual return of 12% on investments of this nature.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started