Answered step by step

Verified Expert Solution

Question

1 Approved Answer

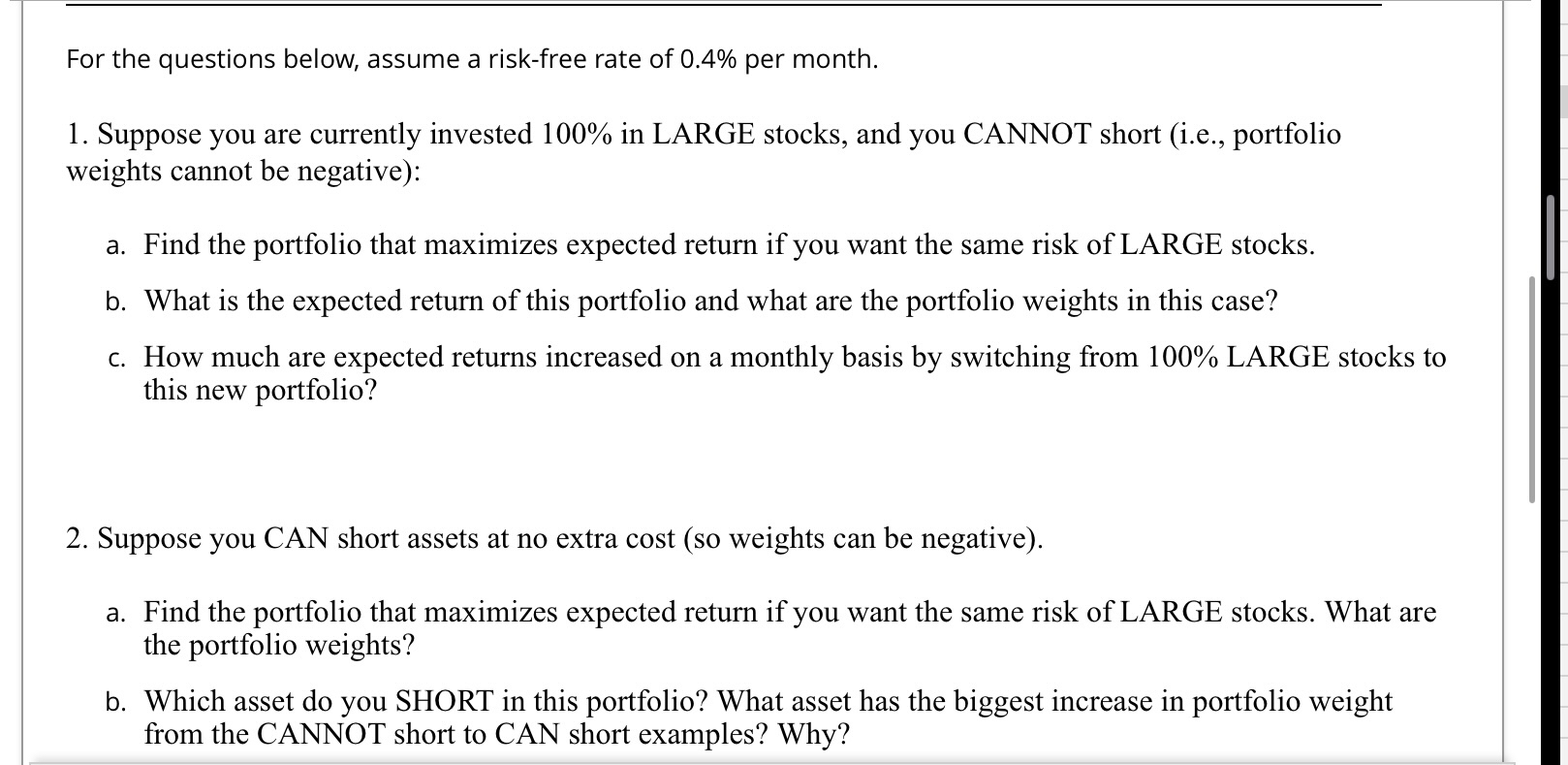

Can you please Provide excel sheet with formulas For the questions below, assume a risk - free rate of 0 . 4 % per month.

Can you please Provide excel sheet with formulas

For the questions below, assume a riskfree rate of per month.

Suppose you are currently invested in LARGE stocks, and you CANNOT short ie portfolio

weights cannot be negative:

a Find the portfolio that maximizes expected return if you want the same risk of LARGE stocks.

b What is the expected return of this portfolio and what are the portfolio weights in this case?

c How much are expected returns increased on a monthly basis by switching from LARGE stocks to

this new portfolio?

Suppose you CAN short assets at no extra cost so weights can be negative

a Find the portfolio that maximizes expected return if you want the same risk of LARGE stocks. What are

the portfolio weights?

b Which asset do you SHORT in this portfolio? What asset has the biggest increase in portfolio weight

from the CANNOT short to CAN short examples? Why?

Can you please provide excel sheet with formulas

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started