Can you please review the problems be. low and show your work to help explain how to work the problem

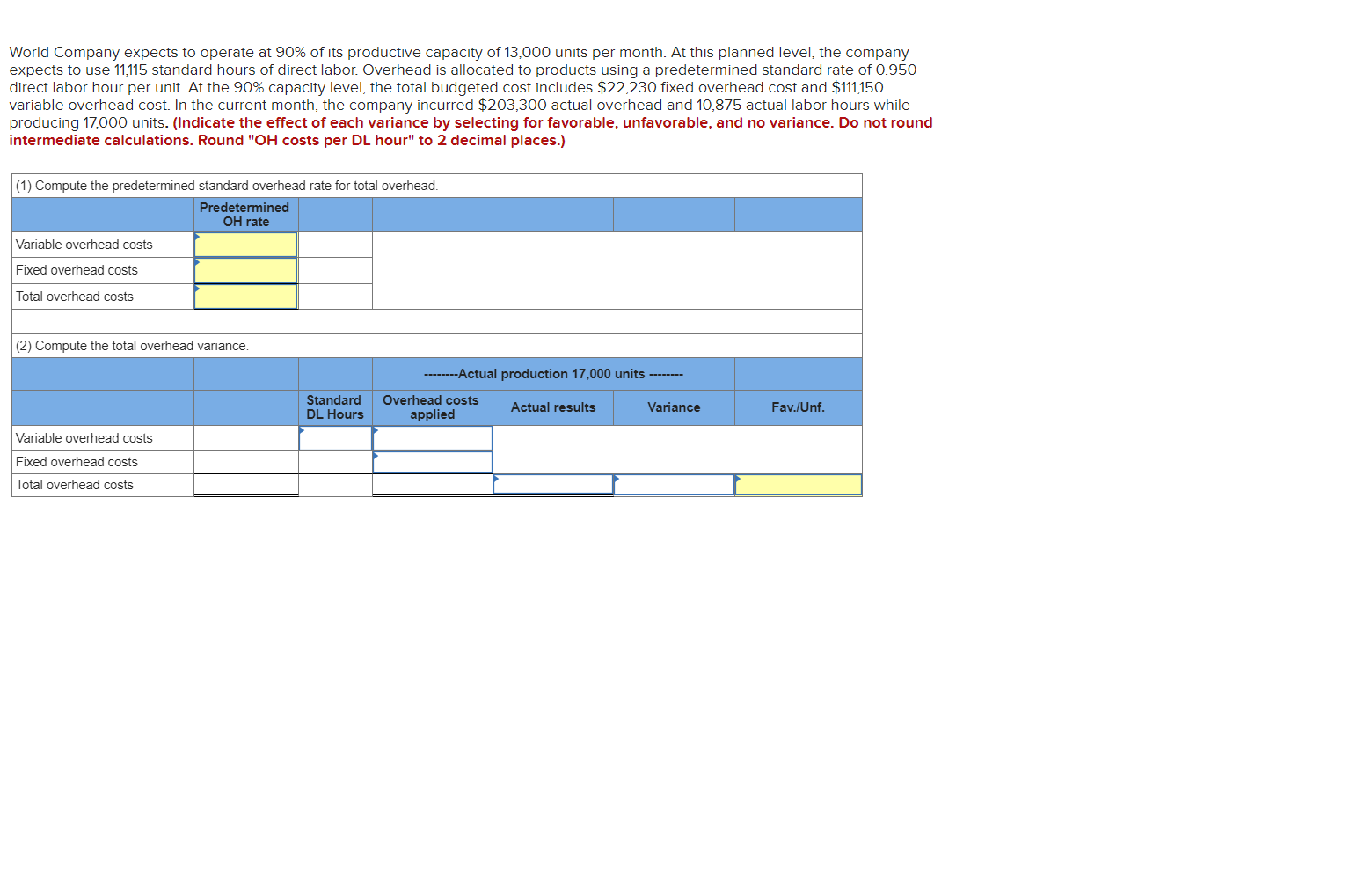

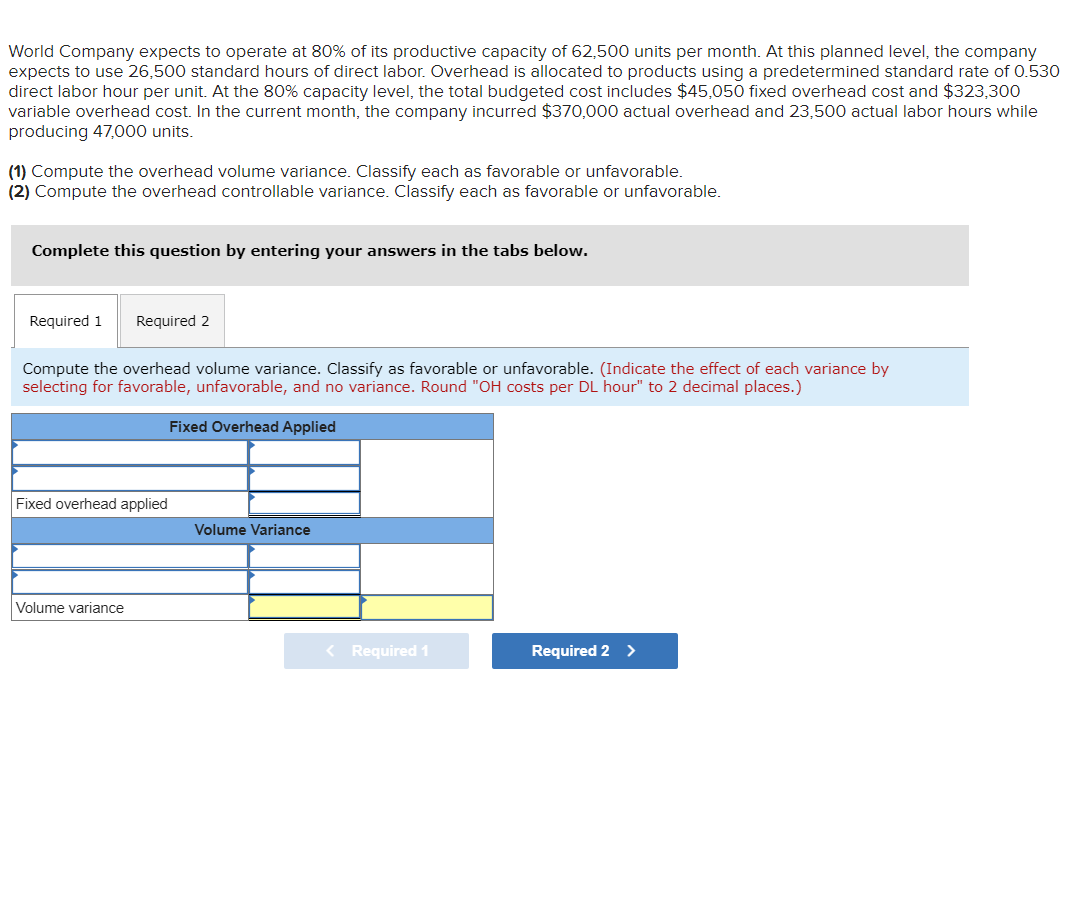

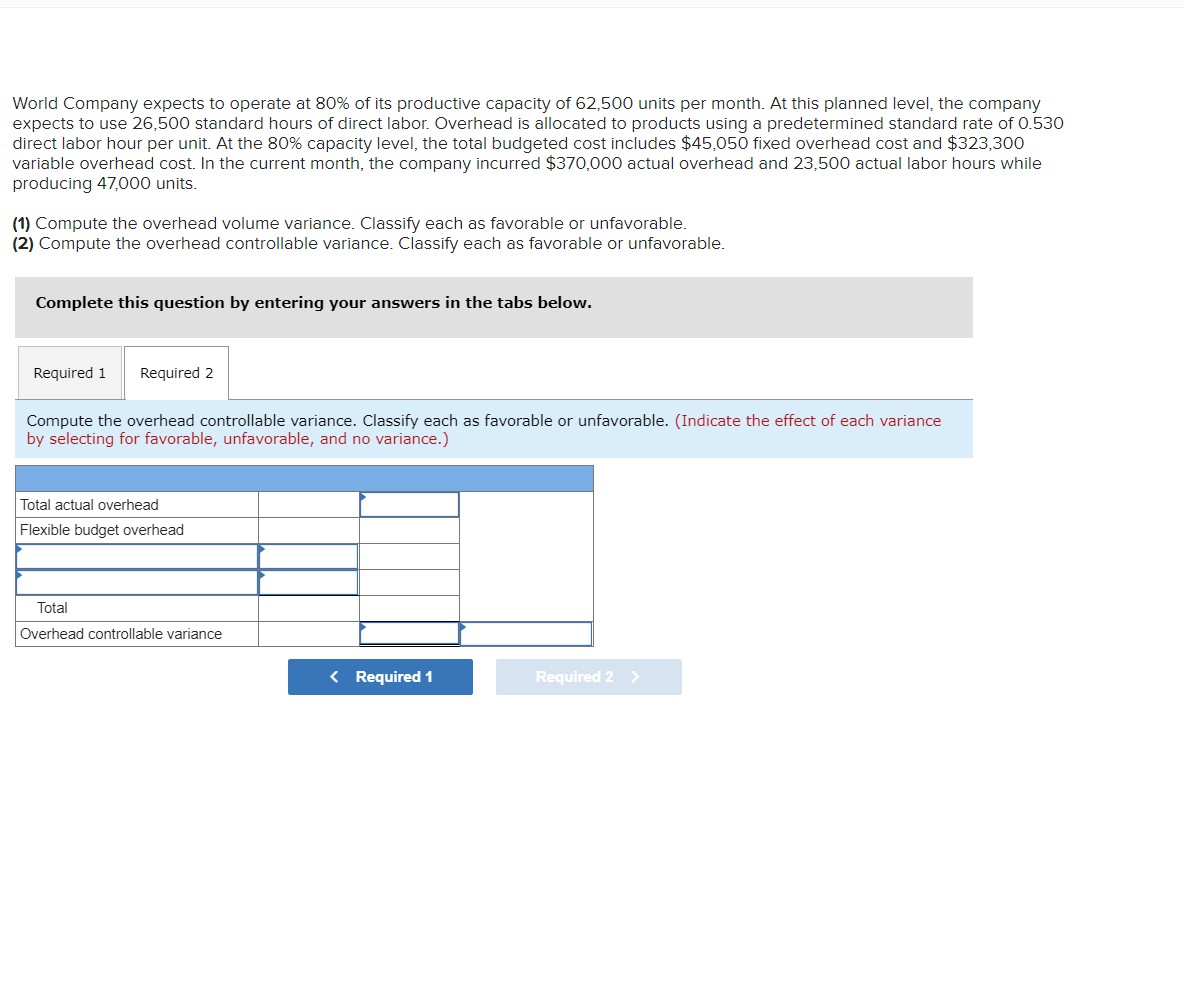

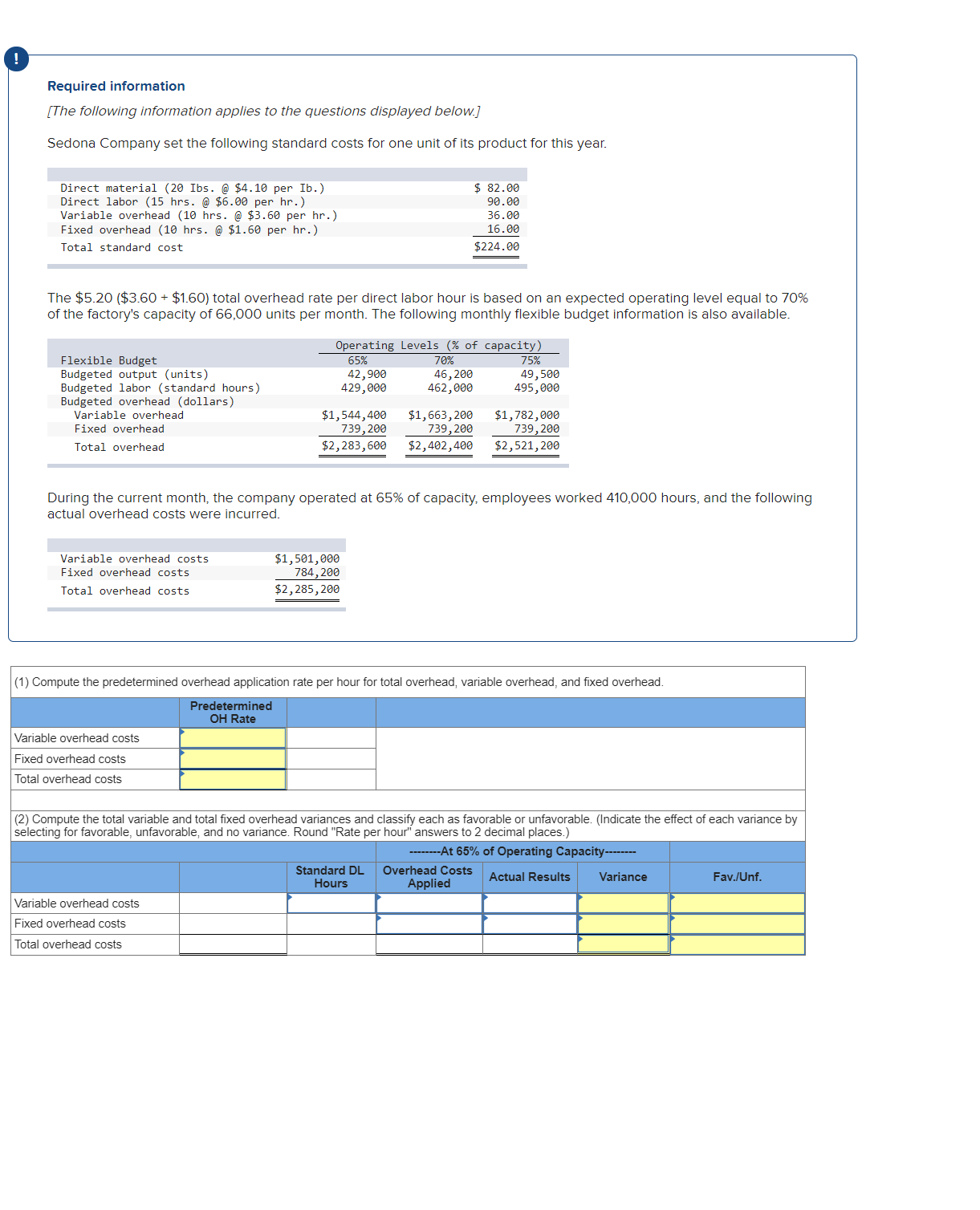

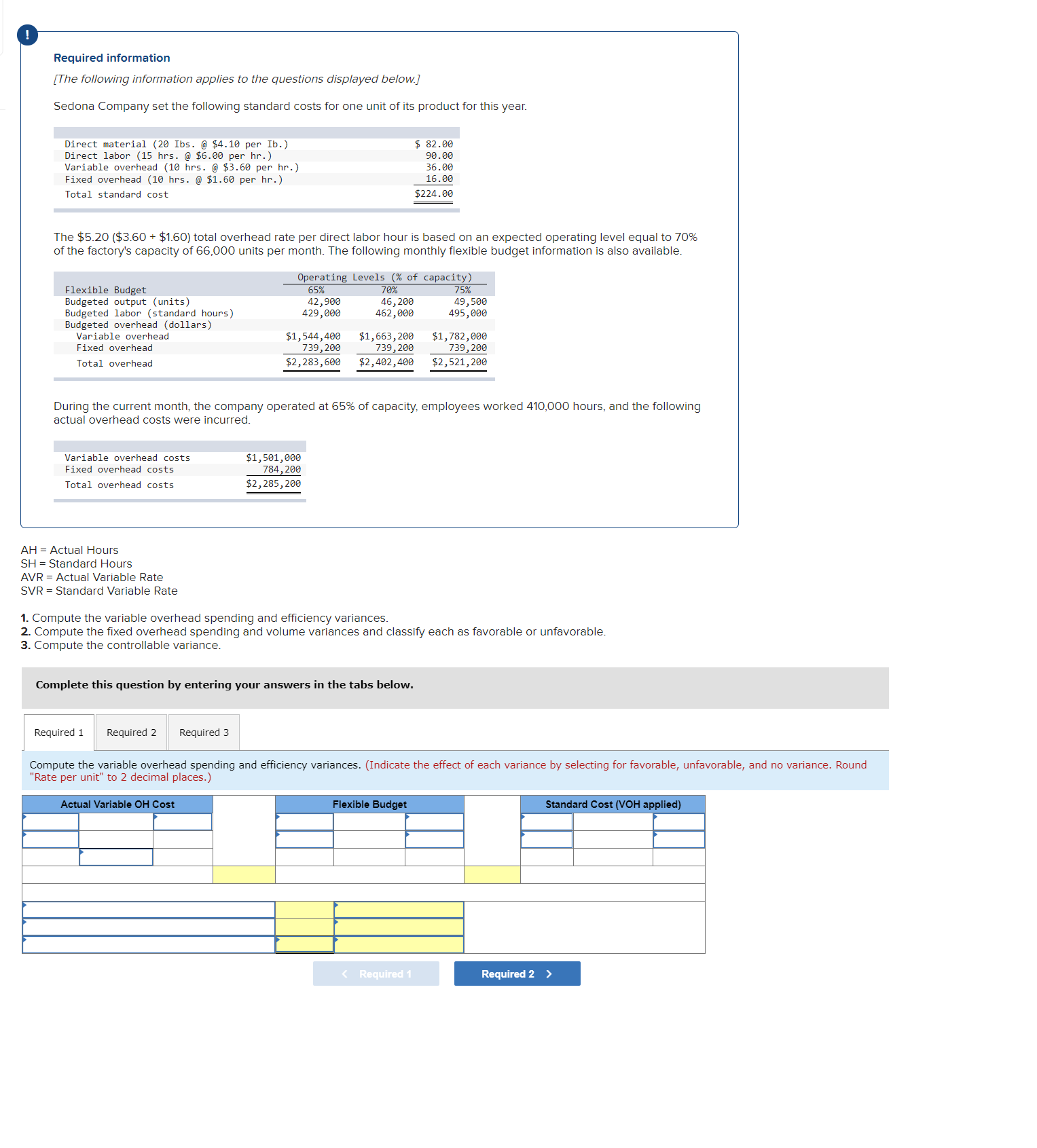

World Company expects to operate at 90% of its productive capacity of 13.000 units per month. At this planned level. the company expects to use 11,115 standard hours of direct labor. Overhead is allocated to products using a predetermined standard rate of 0950 direct labor hour per unit. At the 90% capacity level, the total budgeted cost includes $22,230 fixed overhead cost and $111,150 variable overhead cost. In the current month, the company incurred $203,300 actual overhead and 10,875 actual labor hours while aroducing 17.000 units. (Indicate the effect of each variance by selecting for favorable. unfavorable. and no variance. Do not round intermediate calculations. Round "0H costs per DL hour" to 2 decimal places.) (1 ) Compute the predetermined standard overhead rate for total overhead Variable nvelhmd costs Fixed overhead costs Total overhead costs (2}Compu1e the total DVEl'hid variance Variable overhead costs Fixed overhead costs Total overhead costs World Company expects to operate at 80% of its productive capacity of 62.500 units per month. At this planned level. the company expects to use 26,500 standard hours ofdirect labor Overhead is allocated to products using a predetermined standard rate of 0530 direct labor hour per unit, At the 80% capaCIty level, the total budgeted cost Includes $45,050 xed overhead cost and $323,300 variable overhead cost In the current month, the company incurred $370,000 actual overhead and 23.500 actual labor hours while producing 47,000 units. (1) Compute the overhead volume variance Classify each as favorable or unfavorable (2) Compute the overhead controllable variance, Cla55Ify each as favorable or unfavorable, Complete lis qu$un by entering your answers in the tabs below. Required 1 Required 2 Compute the overhead volume vananoe. Classify as favorable or unfavorable. (Indicate the effect of each variance by selecting for favorable, unfavorable, and no variance. Round "DH costs per DL hour" to 2 decimal planes.) Volume variance Required 2 > World Company expects to operate at 8096 of its productive capacity of 62.500 units per month. At this planned level. the company expects to use 26,500 standard hours ofdlrect labor. Overhead is allocated to products using a predetermined standard rate of 0530 direct labor hour per unit. At the 80% capacity level, the total budgeted cost includes $45,050 xed overhead cost and $323,300 variable overhead cost. In the current month, the company incurred $370,000 actual overhead and 23,500 actual labor hours while producing 47.000 units. (1) Compute the overhead volume variance. Classtfy each as favorable or unfavorable. (2) Compute the overhead controllable variance. Classify each as favorable or unfavorable. Complete this question by entering your answers in the tabs below. Mquired 1 Required 2 Compute the overhead controllable variance. Classify each as favorable or unfavorable. (Indicate the effect of each varianoe by selecting for favorable, unfavorable, and no variance.) Total actual overhead Flexible budget overhead E Total Overhead controllable variance l I Required 1 Required information [The following information applies to the questions displayed below] Sedona Company set the following standard costs for one unit of its product for this year. Direct material (23 Ihs. @ $4.19 per' Ib.) $ 82.36 Direct labor (15 hrs. @ $6.60 per hr.) 96.66 Variable overhead (16 hrs. @ $3.66 per hr.) 36.66 Fixed overhead (16 hrs. 6 $1.60 per hr.) 15.66 Total standard cost $224.33 The $520 ($3.60 + $'l.60) total overhead rate oer direct labor hour is based on an expected operating level equal to 70% of the factory's capacity of 66,000 units per month. The following monthly flexible budget Information is also available. Operating Levels (X of capacity) Flexible Budget 65% 70% 75% Budgeted output (units) 42,960 46,266 49,566 Budgeted labor (standard hours) 429,666 452,339 495,666 Budgeted overhead (dollars) Variable overhead $1,544,466 $1,653,266 $1,782,666 Fixed Dver'head 739,299 739,2\"? 739,268 Total overhead $2,133,569 $2,432 4'39 $2,521,239 During the current month, the company operated at 65% of capacity employees worked 410,000 hours, and the followmg actual overhead costs were incurred. Variable overhead costs $1,561,666 Fixed overhead costs 7'84, 206 Total overhead costs $2,285,233 (l ) Compie the predetermined overhead applkzijon rate per hour for total overhmd, vanable overhead, and xed Welhid Variable overhead posts FlXEd overhead costs Total overhead coals (2) Compute the total variable and total xed overhead vananoee and classify each as favorable or unfavorable. (Indicate the eflect of each variance by selecting for favorable, unfavorable, and no variance Round "Rate per hour\" answers lo 2 decimal planes.) Variable overhead posts FlXEd overhead [20615 Total overhead costs Required information [The following Information applies to the questions displayed below ,7 Sedona Company set the following standard coats for one unit of its product for this year. Direct material (26 lbs. @ $4.16 per Ib.) E 32.66 Direct labor (15 hrs. @ $6.66 per hr.) 93.88 Variable overhead (16 hrs. @ $3.66 per hr.) 35.66 Fixed overhead (16 hrs. @ $1.66 per hr.) 16.66 Total standard cost $22 66 The $520 ($3.60 + $l 60) total overhead rate per direct labor hour is based on an expected operating level equal to 70% of the factory's capaCIty of 66,000 units per month. The followmg monthly flexible budget information is also available. Operating Levels (X of capacity) Flexible Budget 65% 76K 75K Budgeted output (units) 42,966 46,266 49,566 Budgeted labor (standard hours) 419,666 462,666 495,666 Budgeted overhead (dollars) Variable overhead $1,544,466 $1,663,266 $1,782,666 Fixed overhead 739,299 739,288 739,288 Total overhead $2,283,688 $2,482,488 $2,521,288 During the current month, the company operated at 65% of capacity, employees worked 410,000 hours, and the following actual overhead c05ts were Incurred. Variable overhead Costs $1,561,666 Fixed overhead costs 764,266 Total overhead costs $2 255 233 AH : Actual Hours SH = Standard Hours AVR = Actual Variable Rate SVR = Standard Variable Rate 1. Compute the variable overhead spending and elciency variances. 2. Compute the fixed overhead spending and volume variances and classify each as favorable or unfavorable. 3. Compute the controllable variance. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Compute the variable overhead spending and efciency variances. (Indicate the effect of each variance by selecting for favorable, unfavol'dble, and no variance. Round "Rate per unit" to 2 decimal places.) Required 2 >