Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Can you please show calculations Thank you Question 3 ABC Inc. is a division of a multinational company. ABC is interested in buying DEF Inc.,

Can you please show calculations

Thank you

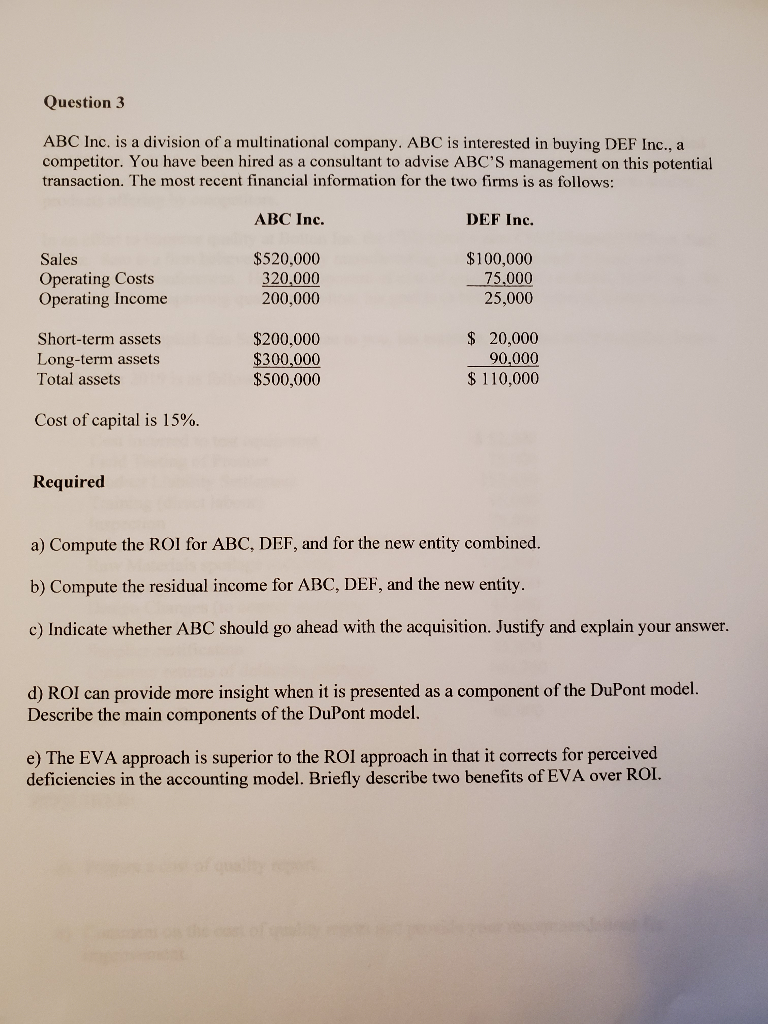

Question 3 ABC Inc. is a division of a multinational company. ABC is interested in buying DEF Inc., a competitor. You have been hired as a consultant to advise ABC'S management on this potential transaction. The most recent financial information for the two firms is as follows: ABC Inc. DEF Inc. Sales Operating Costs Operating Income $520.000 320,000 200,000 $100,000 75.000 25,000 Short-term assets Long-term assets Total assets $200,000 $300,000 $500,000 $ 20,000 90,000 $ 110,000 Cost of capital is 15%. Required a) Compute the ROI for ABC, DEF, and for the new entity combined. b) Compute the residual income for ABC, DEF, and the new entity. c) Indicate whether ABC should go ahead with the acquisition. Justify and explain your answer. d) ROI can provide more insight when it is presented as a component of the DuPont model. Describe the main components of the DuPont model. e) The EVA approach is superior to the ROI approach in that it corrects for perceived deficiencies in the accounting model. Briefly describe two benefits of EVA over ROIStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started