Can you please show me HOW to solve these? Thank you...

Can you please show me HOW to solve these? Thank you...

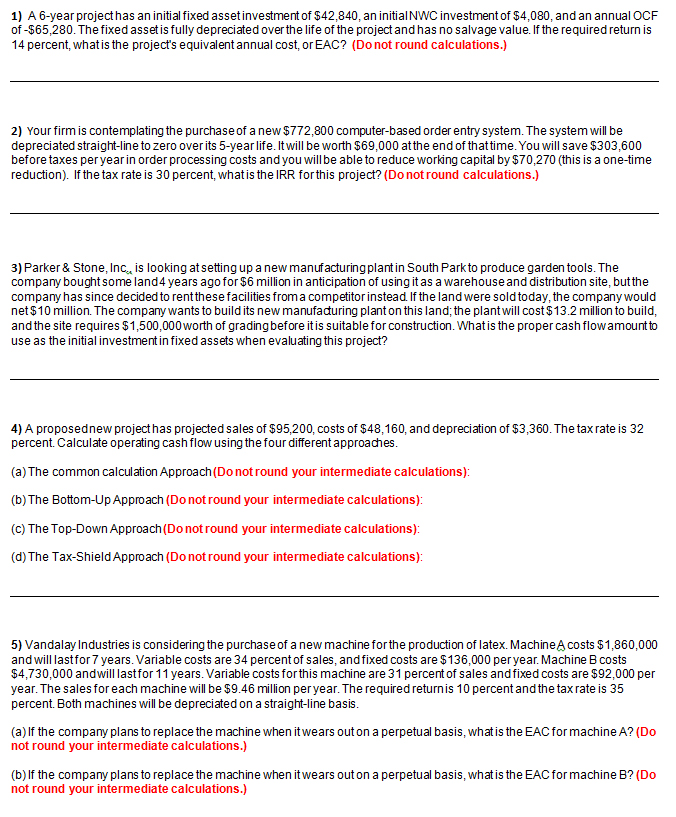

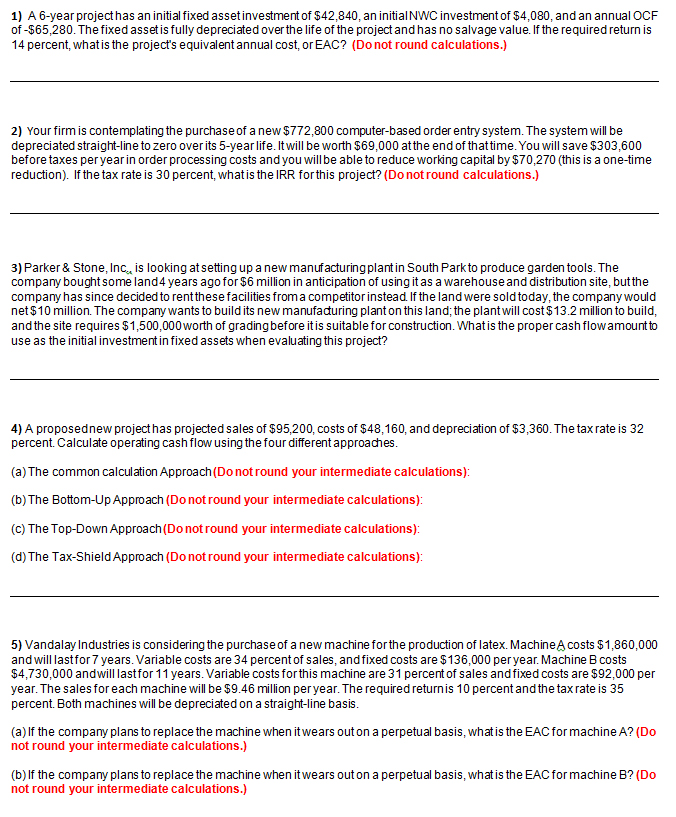

1) A 6-year project has aninitial fixed assetinvestment of $42,840, an initialNWC investment of $4,080, and an annual OCF of-$65,280. The fixed asset is fu depreciated over the life of the project and has no salvage value. If the required return is 14 percent, what is the project's equivalent annual cost, orEAC? (Do round calculations.) 2) Your firm is contemplating the purchase of a new $772,800 computer-based order entry system. The systemwill be depreciated straight-line to zero over its 5-year life. It be worth $69,000 at the end of that time You will save $303,600 before taxes per year in order processing costs and you be able to reduce working capital by $70,270 (this is a one-time reduction f the tax rate is 30 percent, what is the IRR for this project? (Do not round calculations.) to produce garden tools. The 3) Parker & Stone, In is at looking etting up a ne manufacturing plant in South Park company bought some land4 years ago for$6 million in anticipation of using it as a warehouse and distribution site, but the company has since decided to rent hese facilities from a competitor instead If the land were sold today, the company would net $10 m on. The company wants to build its ne manufacturing plant on this land the plant cost $13.2 m on to build and the site requires $1,500,000worth of gradingbefore it is suitable for construction. What is the proper cash amount to use as the initial investment infixed assets when evaluating this project? 4) A proposednew project has projectedsales of $95,200, costs of $48,160, and depreciation of $3,360. The tax rate is 32 percent. Calculate operating cashflow using the four different approaches (a) The common calculationApproach (Do not round your intermediate calculations) (b)The Bottom-Up Approach (Do not round your intermediate calculations) (c) The Top-Down Approach (Do not round your intermediate calculations) (d) The Tax-Shie d Approach (Do not round your intermediate calculations) 5) Vandalay Industries is considering the purchase of a new machine for the production of latex. Machine A costs $1,860,000 and astfor7 ariable costs are 34 percent of sales, and fixed costs are $136,000 peryear Machine B costs ears $4,730,000 andwi astfor 11 years ariable costs for his machine are 31 percent of sales an fixed costs are $92,000 per year. The sales for each machine will be $9.46 million per year. The required returnis 10 percent and the taxrate is 35 percent. Both machines will be depreciated on a straight-line basis (a) If the company plans to replace the machine when itwears out on a perpetual basis hat is the EACfor machine A? (Do nd your intermediate calculations.) (b) f the company plans to replace the machine when itwears out on a perpetual basis hat is the EAC for machine B? (Do not round your intermediate calculations.) 1) A 6-year project has aninitial fixed assetinvestment of $42,840, an initialNWC investment of $4,080, and an annual OCF of-$65,280. The fixed asset is fu depreciated over the life of the project and has no salvage value. If the required return is 14 percent, what is the project's equivalent annual cost, orEAC? (Do round calculations.) 2) Your firm is contemplating the purchase of a new $772,800 computer-based order entry system. The systemwill be depreciated straight-line to zero over its 5-year life. It be worth $69,000 at the end of that time You will save $303,600 before taxes per year in order processing costs and you be able to reduce working capital by $70,270 (this is a one-time reduction f the tax rate is 30 percent, what is the IRR for this project? (Do not round calculations.) to produce garden tools. The 3) Parker & Stone, In is at looking etting up a ne manufacturing plant in South Park company bought some land4 years ago for$6 million in anticipation of using it as a warehouse and distribution site, but the company has since decided to rent hese facilities from a competitor instead If the land were sold today, the company would net $10 m on. The company wants to build its ne manufacturing plant on this land the plant cost $13.2 m on to build and the site requires $1,500,000worth of gradingbefore it is suitable for construction. What is the proper cash amount to use as the initial investment infixed assets when evaluating this project? 4) A proposednew project has projectedsales of $95,200, costs of $48,160, and depreciation of $3,360. The tax rate is 32 percent. Calculate operating cashflow using the four different approaches (a) The common calculationApproach (Do not round your intermediate calculations) (b)The Bottom-Up Approach (Do not round your intermediate calculations) (c) The Top-Down Approach (Do not round your intermediate calculations) (d) The Tax-Shie d Approach (Do not round your intermediate calculations) 5) Vandalay Industries is considering the purchase of a new machine for the production of latex. Machine A costs $1,860,000 and astfor7 ariable costs are 34 percent of sales, and fixed costs are $136,000 peryear Machine B costs ears $4,730,000 andwi astfor 11 years ariable costs for his machine are 31 percent of sales an fixed costs are $92,000 per year. The sales for each machine will be $9.46 million per year. The required returnis 10 percent and the taxrate is 35 percent. Both machines will be depreciated on a straight-line basis (a) If the company plans to replace the machine when itwears out on a perpetual basis hat is the EACfor machine A? (Do nd your intermediate calculations.) (b) f the company plans to replace the machine when itwears out on a perpetual basis hat is the EAC for machine B? (Do not round your intermediate calculations.)

Can you please show me HOW to solve these? Thank you...

Can you please show me HOW to solve these? Thank you...