Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Can you please show me HOW to solve these? Thank you... 1) A 6 -year project has an initial fixed asset investment of $42,840, an

Can you please show me HOW to solve these? Thank you...

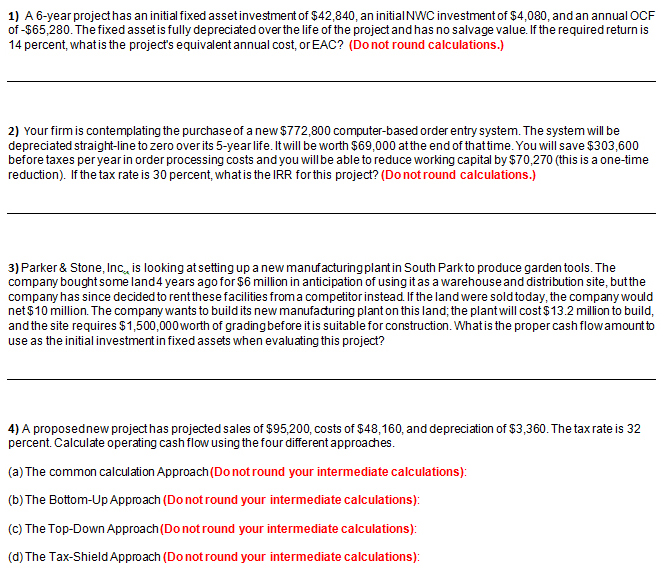

1) A 6 -year project has an initial fixed asset investment of $42,840, an initiaINWC investment of $4,080, and an annual OCF of -$65,280. The fixed assetis fully depreciated overthe life of the project and has no salvage value. If the required return is 14 percent, what is the projects equivalent annual cost, or EAC? (Do not round calculations.) 2) Your firm is contemplating the purchase of a new $772,800 computer -based order entry system. The system will be depreciated straight-line to zero over its 5 -year life. 'twill be worth $69,000 atthe end of thattime.You will save $303.600 before taxes peryear in order processing costs and you will be able to reduce working capital by$70,270 (this is a one-time reduction). If the tax rate is 30 percent, what is the IRR forthis project? (Do not round calculations.) 3) Parker & Stone, Inc? is looking at setting up a new manufacturing plant in South Parkto produce garden tools. The company bought some land4 years ago for $6 million in anticipation of using it as a warehouse and distribution site, butthe company has since decidedto rentthese facilities from a competitor instead. If the land were soldtoday,the companywould net $10 million. The companywants to build its new manufaduring plant on this land; the plantwill cost$13.2 million to build, andthe site requires $1,500,000worth of grading before itis suitable for construction. Whatis the proper cash flowamountto use as the initial investment infixed assets when evaluating this project? 4)A proposednew project has projected sales of $95,200, costs of $48,160, and depreciation of $3,360. The tax rate is 32 percent. Calculate operating cash flow using the four different approaches. (a)The common calculation Approach(Do not round your intermediate calculations): (b)The Bottom -Up Approach (Do not round your intermediate calculations): (c) The Top -Down Approach(Do not round your intermediate calculations): (d)The Tax -Shield Approach (Do not round your intermediate calculations): 1) A 6 -year project has an initial fixed asset investment of $42,840, an initiaINWC investment of $4,080, and an annual OCF of -$65,280. The fixed assetis fully depreciated overthe life of the project and has no salvage value. If the required return is 14 percent, what is the projects equivalent annual cost, or EAC? (Do not round calculations.) 2) Your firm is contemplating the purchase of a new $772,800 computer -based order entry system. The system will be depreciated straight-line to zero over its 5 -year life. 'twill be worth $69,000 atthe end of thattime.You will save $303.600 before taxes peryear in order processing costs and you will be able to reduce working capital by$70,270 (this is a one-time reduction). If the tax rate is 30 percent, what is the IRR forthis project? (Do not round calculations.) 3) Parker & Stone, Inc? is looking at setting up a new manufacturing plant in South Parkto produce garden tools. The company bought some land4 years ago for $6 million in anticipation of using it as a warehouse and distribution site, butthe company has since decidedto rentthese facilities from a competitor instead. If the land were soldtoday,the companywould net $10 million. The companywants to build its new manufaduring plant on this land; the plantwill cost$13.2 million to build, andthe site requires $1,500,000worth of grading before itis suitable for construction. Whatis the proper cash flowamountto use as the initial investment infixed assets when evaluating this project? 4)A proposednew project has projected sales of $95,200, costs of $48,160, and depreciation of $3,360. The tax rate is 32 percent. Calculate operating cash flow using the four different approaches. (a)The common calculation Approach(Do not round your intermediate calculations): (b)The Bottom -Up Approach (Do not round your intermediate calculations): (c) The Top -Down Approach(Do not round your intermediate calculations): (d)The Tax -Shield Approach (Do not round your intermediate calculations)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started