Answered step by step

Verified Expert Solution

Question

1 Approved Answer

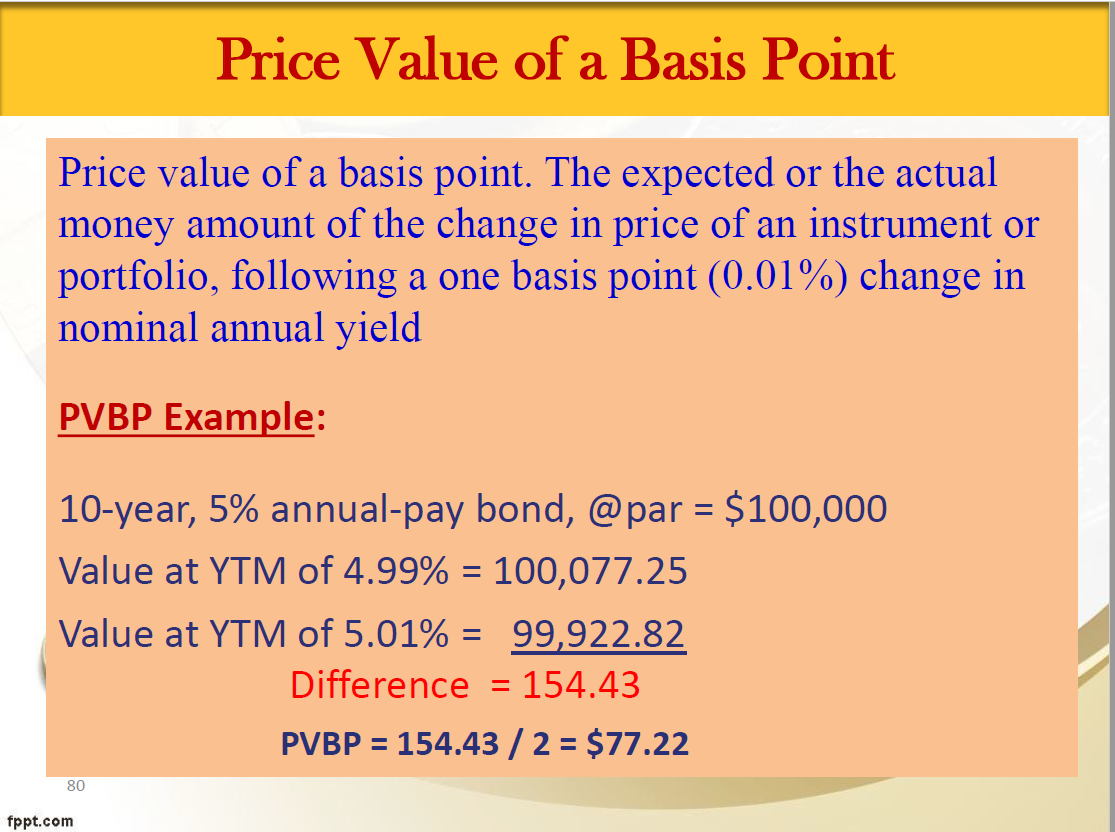

Can you please show me in steps how to solve this example with formula how we get the 154.43 ? and why divided by 2?

Can you please show me in steps how to solve this example with formula

Can you please show me in steps how to solve this example with formula

how we get the 154.43 ? and why divided by 2?

thank you

Price Value of a Basis Point Price value of a basis point. The expected or the actual money amount of the change in price of an instrument or portfolio, following a one basis point (0.01%) change in nominal annual yield PVBP Example: 10-year, 5% annual-pay bond, @par = $100,000 Value at YTM of 4.99% = 100,077.25 Value at YTM of 5.01% = 99,922.82 Difference = 154.43 PVBP = 154.43 / 2 = $77.22 80 fppt.comStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started