Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Can you please show step that leads to the answer The blowing financial statements of OZ Traders for the year ending 31 December 2007 forve

Can you please show step that leads to the answer

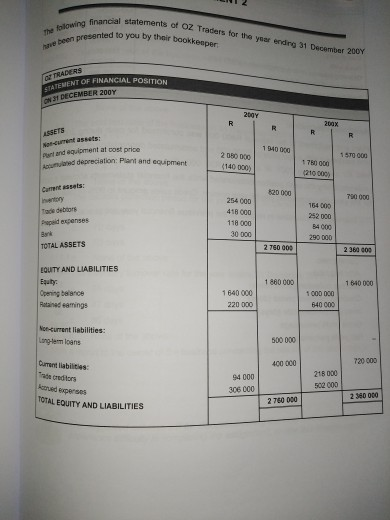

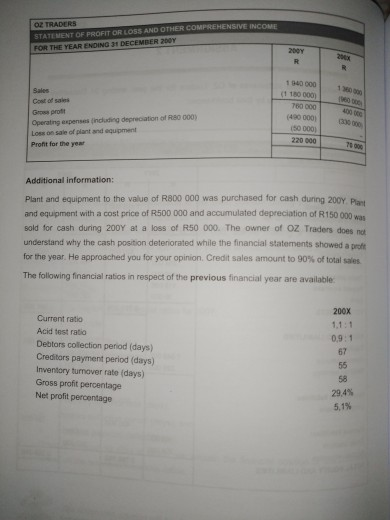

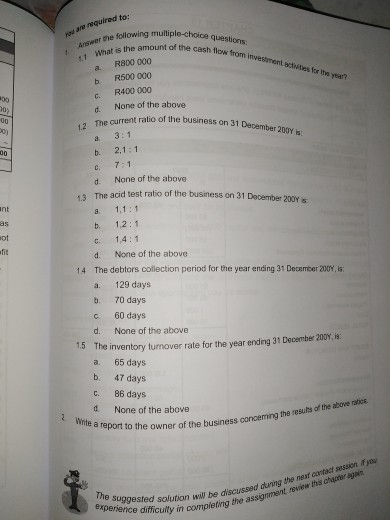

The blowing financial statements of OZ Traders for the year ending 31 December 2007 forve been presented to you by their bookkeeper STATEMENT OF FINANCIAL POSITION And depreciation: Plant and equipment OF TRADERS GN 1 DECEMBER 2008 2007 R 200X R R ASSETS Noncurrent assets: 1 340 00 Purtand equipment al cost price 150 000 1700 210000 780000 254000 418 000 118 000 30 000 Predeceses 154 000 252 000 34000 290 000 TOTAL ASSETS 2 700 000 2360 000 EQUITY AND LIABILITIES 1 880 000 1 640 000 Opening balance Retained earings 1 640 000 220 000 1 000 000 640 000 Noncurrent liabilities: Long term loans 500 000 400 000 720 000 de creditors Karud expenses 94 000 306 000 218 000 500.000 2 380 OBO TOTAL EQUITY AND LIABILITIES 2 750 000 OZ TRADERS STATEMENT OF PROFIT OR LOSS AND OTHER COMPREHENSIVE INCOME FOR THE YEAR ENDING 31 DECEMBER 2009 200Y R R Bales (+ 150 000 750 000 D G Grow profit Operating expenses including depreciation of R80 000) Loss on sale of plant and equipment Profit for the year 220 000 Additional information: Plant and equipment to the value of R800 000 was purchased for cash during 2007 Plani and equipment with a cost price of R500 000 and accumulated depreciation of R150 000 was sold for cash during 2008 at a loss of R50 000. The owner of OZ Traders does not understand why the cash position deteriorated while the financial statements showed a pro for the year. He approached you for your opinion. Credit sales amount to 90% of total sales The following financial ratios in respect of the previous financial year are available 200X Current ratio Acid test ratio Debtors collection period (days) Creditors payment period (days) Inventory turnover rate (days) Gross profit percentage Net profit percentage 0,91 67 55 58 29.4% 5,1% Answer the following multiple-choice questions 1 Wh is the amount of the show from investor The suggested solution will be discussed during the ear cara Onyou experience difficulty in completing the assignment or the charagan 12 The current ratio of the business on 31 December 2007 Winte a report to the owner of the business conceming me of the above as Oreguired to: b RODO 000 R500 000 R400 000 None of the above d yo) -00 30 10 b 3:1 2.1:1 7:1 d ant as ot b a. None of the above 13 The acid test ratio of the business on 31 December 2009 1.1:1 1.2:1 1,4:1 d. None of the above 14 The debtors collection period for the year ending 31 December 2007, 129 days b. 70 days C 60 days d. None of the above 15 The inventory tumover rate for the year ending 31 December 2009, in: a. 65 days b. 47 days 86 days d None of the above C. 2Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started