can you please show the full excel and steps

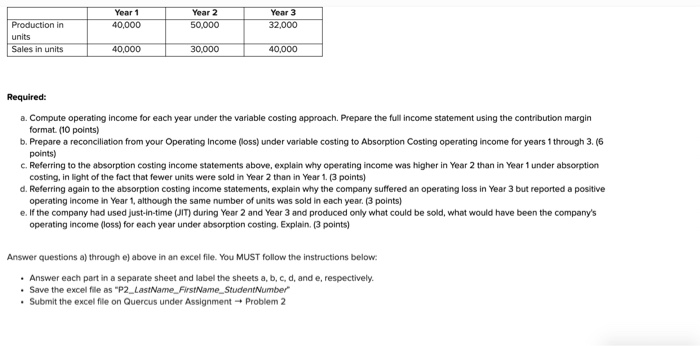

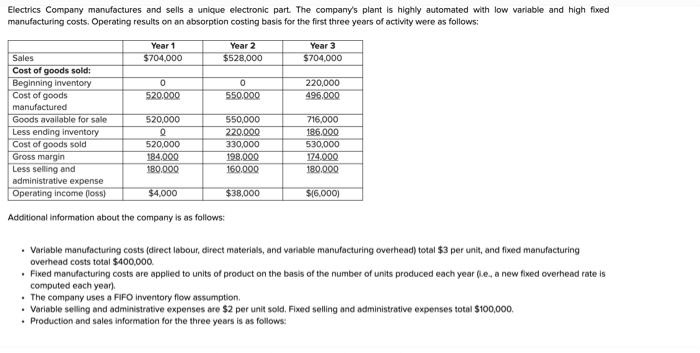

Electrics Company manufactures and sells a unique electronic part. The company's plant is highly automated with low variable and high fixed manufacturing costs. Operating results on an absorption costing basis for the first three years of activity were as follows: Year 1 $704.000 Year 2 $528,000 Year 3 $704,000 220,000 496.000 520.000 550.000 520,000 Sales Cost of goods sold: Beginning inventory Cost of goods manufactured Goods available for sale Less ending inventory Cost of goods sold Gross margin Less selling and administrative expense Operating income (oss) 520,000 184.000 180.000 550,000 220.000 330,000 198.000 160.000 716,000 186.000 530,000 174.000 180.000 $4.000 $38,000 ${6.000) Additional information about the company is as follows: Variable manufacturing costs (direct labour, direct materials, and variable manufacturing overhead) total $3 per unit, and fixed manufacturing overhead costs total $400,000 Fixed manufacturing costs are applied to units of product on the basis of the number of units produced each year (le, a new fixed overhead rate is computed each year). The company uses a FIFO inventory flow assumption, Variable selling and administrative expenses are $2 per unit sold. Fixed selling and administrative expenses total $100,000 Production and sales information for the three years is as follows: 1 Year 1 40,000 Year 2 50,000 Year 3 32,000 Production in units Sales in units 40,000 30,000 40,000 Required: a. Compute operating income for each year under the variable costing approach. Prepare the full income statement using the contribution margin format (10 points) b. Prepare a reconciliation from your Operating Income (loss) under variable costing to Absorption Costing operating income for years through 3.16 points) c. Referring to the absorption costing income statements above, explain why operating income was higher in Year 2 than in Year 1 under absorption costing, in light of the fact that fewer units were sold in Year 2 than in Year 1. (3 points) d. Referring again to the absorption costing income statements, explain why the company suffered an operating loss in Year 3 but reported a positive operating income in Year 1, although the same number of units was sold in each year. (3 points) e. If the company had used just-in-time (JIT) during Year 2 and Year 3 and produced only what could be sold, what would have been the company's operating income (loss) for each year under absorption costing. Explain. (3 points) Answer questions a) through e) above in an excel file. You MUST follow the instructions below: Answer each part in a separate sheet and label the sheets a, b, c, d, and e, respectively. Save the excel file as "P2_LastName_FirstName_Student Number Submit the excel file on Quercus under Assignment + Problem 2

can you please show the full excel and steps

can you please show the full excel and steps