Answered step by step

Verified Expert Solution

Question

1 Approved Answer

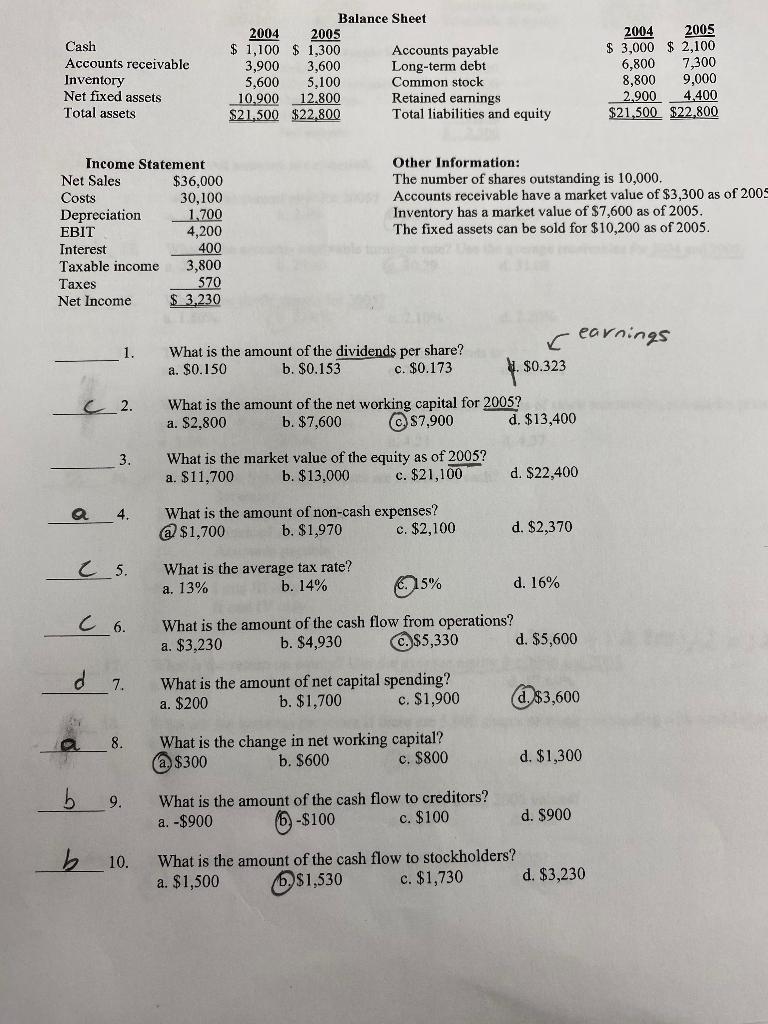

Can you please show work for Unanswered questions. Other Information: The number of shares outstanding is 10,000 . Accounts receivable have a market value of

Can you please show work for Unanswered questions.

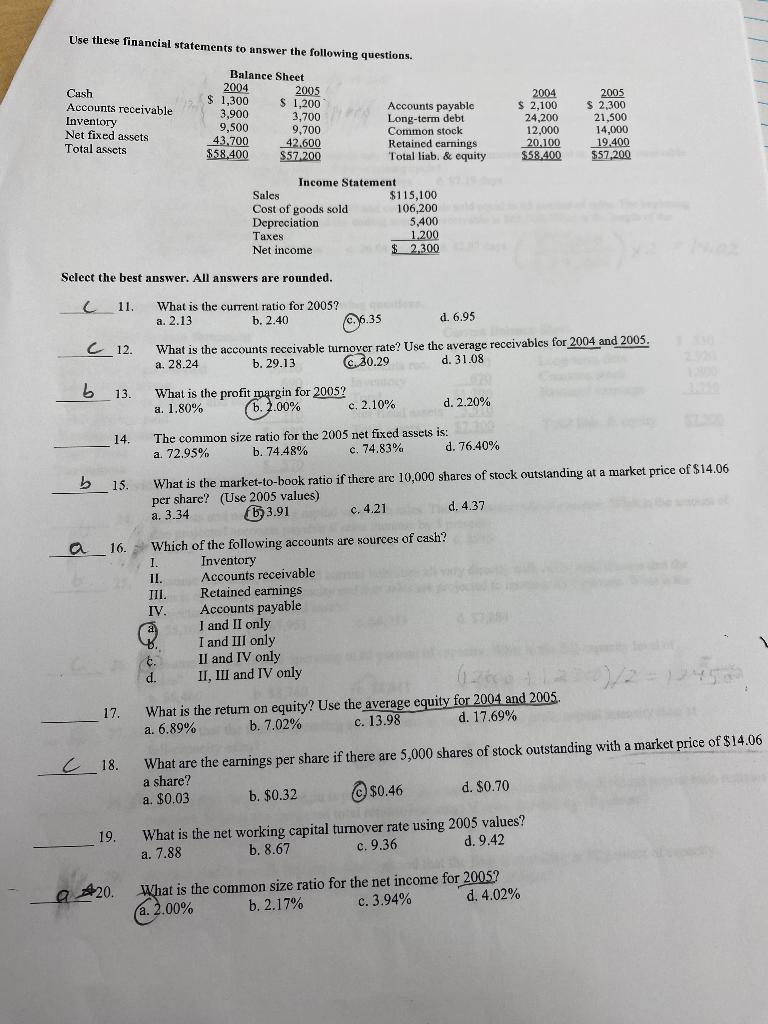

Other Information: The number of shares outstanding is 10,000 . Accounts receivable have a market value of $3,300 as of 200 s Inventory has a market value of $7,600 as of 2005 . The fixed assets can be sold for $10,200 as of 2005 . 1. What is the amount of the dividends per share? earnings a. $0.150 b. $0.153 c. $0.173 4. $0.323 2. What is the amount of the net working capital for 2005 ? a. $2,800 b. $7,600 (c.) $7,900 d. $13,400 3. What is the market value of the equity as of 2005 ? a. $11,700 b. $13,000 c. $21,100 d. $22,400 a 4. What is the amount of non-cash expenses? (a) $1,700 b. $1,970 c. $2,100 d. $2,370 2. What is the average tax rate? a. 13% b. 14% (.) 15% d. 16% 6. What is the amount of the cash flow from operations? a. $3,230 b. $4,930 (c. $5,330 d. $5,600 7. What is the amount of net capital spending? a. $200 b. $1,700 c. $1,900 (d. $3,600 8. What is the change in net working capital? (a.) $300 b. $600 c. $800 d. $1,300 b 9. What is the amount of the cash flow to creditors? a. $900 (b. $100 c. $100 d. $900 10. What is the amount of the cash flow to stockholders? a. $1,500 b. $1,530 c. $1,730 d. $3,230 Use these financial statements to answer the following questions. Select the best answer. All answers are rounded. (. 11. What is the current ratio for 2005 ? a. 2.13 b. 2.40 c. 6.35 d. 6.95 12. What is the accounts reccivable turnover rate? Use the average receivables for 2004 and 2005 . a. 28.24 b. 29.13 (c. 30.29 d. 31.08 6 13. What is the profit margin for 2005 ? a. 1.80% b. 2.00% c. 2.10% d. 2.20% 14. The common size ratio for the 2005 net fixed assets is: a. 72.95% b. 74.48% c. 74.83% d. 76.40% b 15 . What is the market-to-book ratio if there arc 10,000 shares of stock outstanding at a market price of $14.06 per share? (Use 2005 values) a. 3.34 (b) 3.91 c. 4.21 d. 4.37 16. Which of the following accounts are sources of cash? 1. Inventory II. Accounts receivable III. Retained earnings IV. Accounts payable I and II only b. I and III only c. II and IV only d. II, III and IV only 17. What is the return on equity? Use the average equity for 2004 and 2005 . a. 6.89% b. 7.02% c. 13.98 d. 17.69% 18. What are the earnings per share if there are 5,000 shares of stock outstanding with a market price of $14.06 a share? a. $0.03 b. $0.32 c.) $0.46 d. $0.70 19. What is the net working capital turnover rate using 2005 values? a. 7.88 b. 8.67 c. 9.36 d. 9.42Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started