Answered step by step

Verified Expert Solution

Question

1 Approved Answer

can you please show your work? Healthcare Finance 18.2 Net reven Cash expe Depreciati Earni Interest Earni Taxes (40 Net profit Asset requ c. Is

can you please show your work?

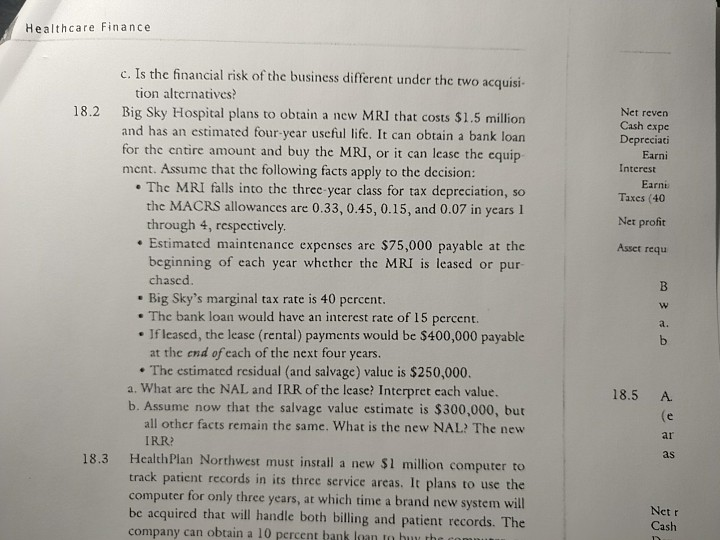

Healthcare Finance 18.2 Net reven Cash expe Depreciati Earni Interest Earni Taxes (40 Net profit Asset requ c. Is the financial risk of the business different under the two acquisi tion alternatives? Big Sky Hospital plans to obtain a new MRI that costs $1.5 million and has an estimated four-year useful life. It can obtain a bank loan for the entire amount and buy the MRI, or it can lease the equip ment. Assume that the following facts apply to the decision: The MRI falls into the three-year class for tax depreciation, so the MACRS allowances are 0.33, 0.45, 0.15, and 0.07 in years 1 through 4, respectively. Estimated maintenance expenses are $75,000 payable at the beginning of each year whether the MRI is leased or pur chased. Big Sky's marginal tax rate is 40 percent. The bank loan would have an interest rate of 15 percent. Ifleased, the lease (rental) payments would be $400,000 payable at the end of each of the next four years. The estimated residual (and salvage) value is $250,000. a. What are the NAL and IRR of the lease? Interpret cach value. b. Assume now that the salvage value estimate is $300,000, but all other facts remain the same. What is the new NAL? The new IRR Health Plan Northwest must install a new $1 million computer to track patient records in its three service areas. It plans to use the computer for only three years, at which time a brand new system will be acquired that will handle both billing and patient records. The company can obtain a 10 percent bank loan in hun the com 18.5 A 18.3 Netr CashStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started