Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Can you please solve 16.5. Thank you Exercise 16.5 Employee benefits On 21 November, the weekly payroll register of Python Ltd showed gross wages and

Can you please solve 16.5. Thank you

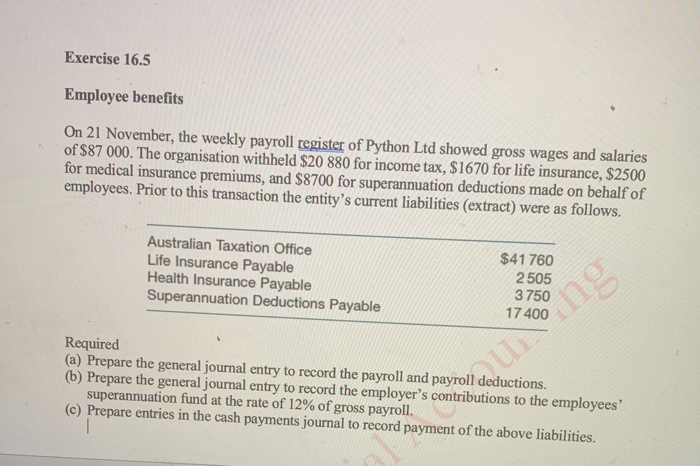

Exercise 16.5 Employee benefits On 21 November, the weekly payroll register of Python Ltd showed gross wages and salaries of $87 000. The organisation withheld $20 880 for income tax, $1670 for life insurance, $2500 for medical insurance premiums, and $8700 for superannuation deductions made on behalf of employees. Prior to this transaction the entity's current liabilities (extract) were as follows. Australian Taxation Office Life Insurance Payable Health Insurance Payable Superannuation Deductions Payable $41 760 2505 3750 Required (a) Prepare the general journal entry to record the payroll and payroll deductions. (b) Prepare the general journal entry to record the employer's contributions to the employees' superannuation fund at the rate of 12% of gross payroll. (c) Prepare entries in the cash payments journal to record payment of the above liabilities Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started