can you please solve exercise questions from exercise 1 till end.

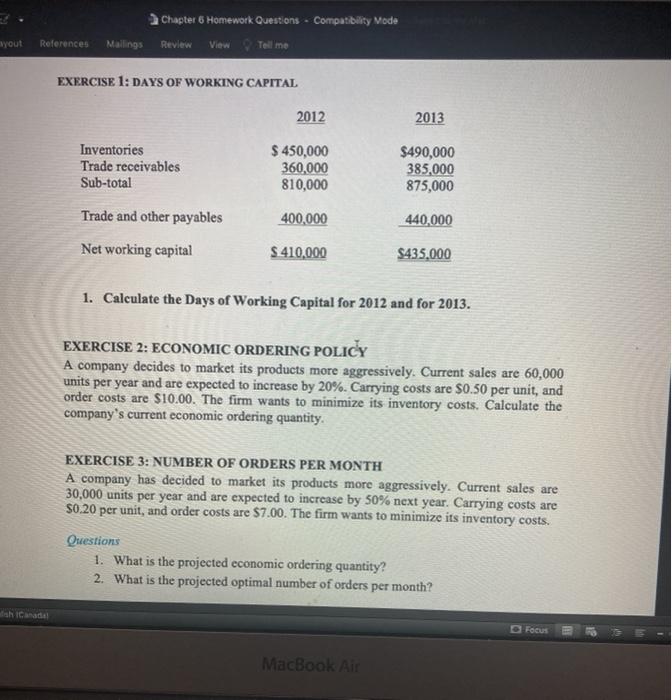

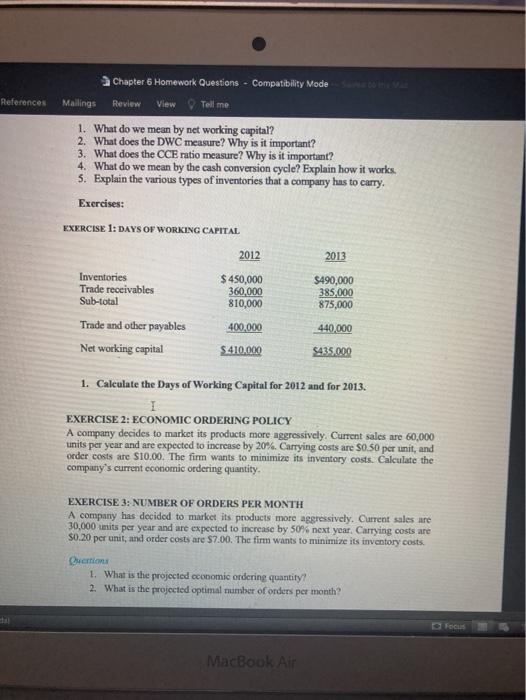

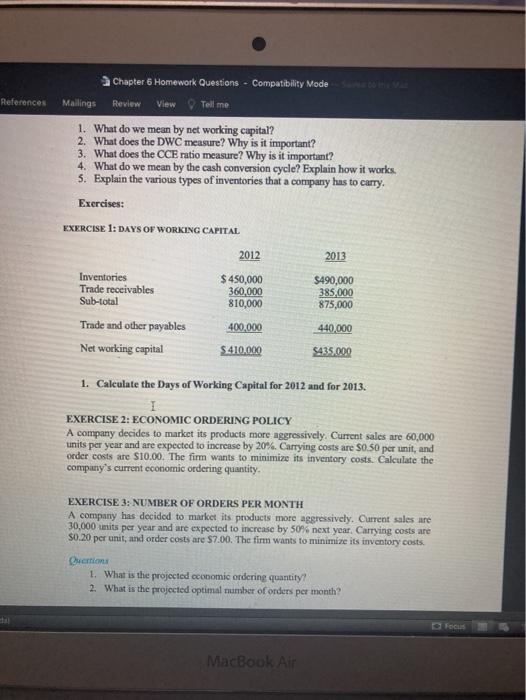

Chapter 6 Homework Questions - Compatibility Mode Review View Tell me ayout References Mallings EXERCISE 1: DAYS OF WORKING CAPITAL 2012 2013 Inventories Trade receivables Sub-total $ 450,000 360,000 810,000 $490,000 385,000 875,000 400,000 440,000 Trade and other payables Net working capital $ 410,000 $435,000 1. Calculate the Days of Working Capital for 2012 and for 2013. EXERCISE 2: ECONOMIC ORDERING POLICY A company decides to market its products more aggressively. Current sales are 60,000 units per year and are expected to increase by 20%. Carrying costs are $0.50 per unit, and order costs are $10.00. The firm wants to minimize its inventory costs. Calculate the company's current economic ordering quantity EXERCISE 3: NUMBER OF ORDERS PER MONTH A company has decided to market its products more aggressively. Current sales are 30,000 units per year and are expected to increase by 50% next year. Carrying costs are $0.20 per unit, and order costs are $7.00. The firm wants to minimize its inventory costs. Questions 1. What is the projected economic ordering quantity? 2. What is the projected optimal number of orders per month? D Focus MacBook Air Chapter 6 Homework Questions - Compatibility Mode References Mailings Review View Tell me 1. What do we mean by net working capital? 2. What does the DWC measure? Why is it important? 3. What does the CCE ratio measure? Why is it important? 4. What do we mean by the cash conversion cycle? Explain how it works. 5. Explain the various types of inventories that a company has to carry. Exercises: EXERCISE 1: DAYS OF WORKING CAPITAL 2012 2013 $ 450,000 360,000 810,000 $490,000 385,000 875,000 Inventories Trade receivables Sub-total Trade and other payables Net working capital 400,000 440,000 $ 410.000 S435.000 1. Calculate the Days of Working Capital for 2012 and for 2013. EXERCISE 2: ECONOMIC ORDERING POLICY A company decides to market its products more aggressively. Current sales are 60,000 units per year and are expected to increase by 20%. Carrying costs are $0.50 per unit, and order costs are $10.00. The firm wants to minimize its inventory costs. Calculate the company's current economic ordering quantity EXERCISE 3: NUMBER OF ORDERS PER MONTH A company has decided to market its products more aggressively. Current sales are 30,000 units per year and are expected to increase by 50% next year. Carrying costs are $0.20 per unit, and order costs are $7.00. The firm wants to minimize its inventory costs. Duction 1. What is the projected economic ordering quantity? 2. What is the projected optimal number of orders per month? Focus MacBook Air