Can you please solve P16-54?

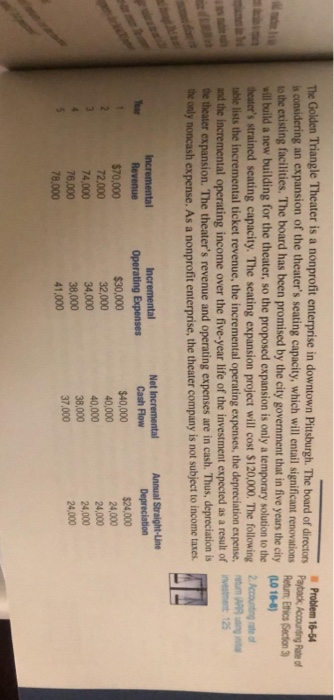

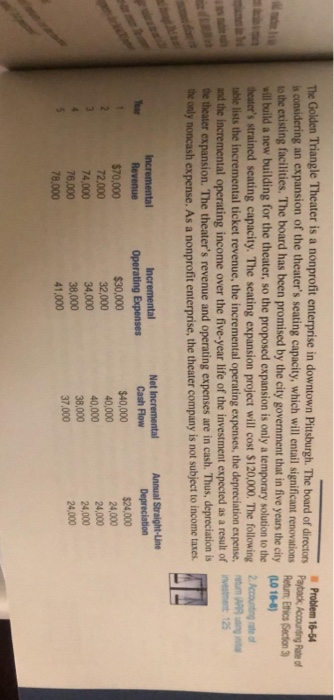

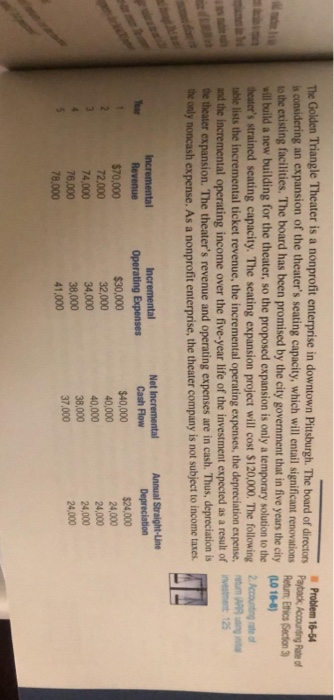

The Golden Triangle Theater is a nonprofit enterprise in downtown Pittsburgh. The board of directors partuk, Mecourting fun of Problem 16-54 is considering an expansion of the theater's seating capacity, which will entail significant renovations Retum, etics Section 3 to the existing facilities. The board has been promised by the city government that in five years the city (LO 16-8) will build a new building for the theater, so the proposed expansion is only a temporary solution to the theater's strained seating capacity. The seating expansion project will cost $120,000. The following 2. Accounting rate of table lists the incremental ticket revenue, the incremental operating expenses, the depreciation expense, rotum og and the incremental operating income over the five-year life of the investment expected as a result of investment 125 the theater expansion. The theater's revenue and operating expenses are in cash. Thus, depreciation is the only noncash expense. As a nonprofit enterprise, the theater company is not subject to income taxes. Incremental Revenue $70,000 72.000 74,000 76,000 78,000 Incremental Operating Expenses $30,000 32,000 34,000 38,000 41,000 Net Incremental Cash Flow $40,000 40,000 40,000 38,000 37.000 Annual Straight-Line Depreciation $24,000 24,000 24,000 24,000 24,000 728 Chapter 16 Capital Expenditure Decisions Required: 1. Compute the payback period for the proposed expansion of the theater's seating capacity. 2. Compute the project's accounting rate of return using the project's initial investment. 3. Compute the project's accounting rate of retum using the project's average investment. 4. Explain why many managerial accountants believe that discounted-cash-flow methods of evaluat- ing investment proposals are superior to the payback and accounting-rate-of-return methods. 5. Suppose the chairperson of the theater's board, who was formerly a managerial accountant, has calculated the seating expansion project's internal rate of return to be lower than the project's accounting rate of return. Moreover, the theater's cost of acquiring expansion capital is above the expansion project's internal rate of return but below its accounting rate of return. As a champion of the theater, and a strong proponent of the expansion, the board chairperson has decided to present only the project's accounting rate of return to the board for its approval of the project. Is this ethi- cal on the part of the board's chairperson? Explain. The Golden Triangle Theater is a nonprofit enterprise in downtown Pittsburgh. The board of directors partuk, Mecourting fun of Problem 16-54 is considering an expansion of the theater's seating capacity, which will entail significant renovations Retum, etics Section 3 to the existing facilities. The board has been promised by the city government that in five years the city (LO 16-8) will build a new building for the theater, so the proposed expansion is only a temporary solution to the theater's strained seating capacity. The seating expansion project will cost $120,000. The following 2. Accounting rate of table lists the incremental ticket revenue, the incremental operating expenses, the depreciation expense, rotum og and the incremental operating income over the five-year life of the investment expected as a result of investment 125 the theater expansion. The theater's revenue and operating expenses are in cash. Thus, depreciation is the only noncash expense. As a nonprofit enterprise, the theater company is not subject to income taxes. Incremental Revenue $70,000 72.000 74,000 76,000 78,000 Incremental Operating Expenses $30,000 32,000 34,000 38,000 41,000 Net Incremental Cash Flow $40,000 40,000 40,000 38,000 37.000 Annual Straight-Line Depreciation $24,000 24,000 24,000 24,000 24,000 728 Chapter 16 Capital Expenditure Decisions Required: 1. Compute the payback period for the proposed expansion of the theater's seating capacity. 2. Compute the project's accounting rate of return using the project's initial investment. 3. Compute the project's accounting rate of retum using the project's average investment. 4. Explain why many managerial accountants believe that discounted-cash-flow methods of evaluat- ing investment proposals are superior to the payback and accounting-rate-of-return methods. 5. Suppose the chairperson of the theater's board, who was formerly a managerial accountant, has calculated the seating expansion project's internal rate of return to be lower than the project's accounting rate of return. Moreover, the theater's cost of acquiring expansion capital is above the expansion project's internal rate of return but below its accounting rate of return. As a champion of the theater, and a strong proponent of the expansion, the board chairperson has decided to present only the project's accounting rate of return to the board for its approval of the project. Is this ethi- cal on the part of the board's chairperson? Explain