Answered step by step

Verified Expert Solution

Question

1 Approved Answer

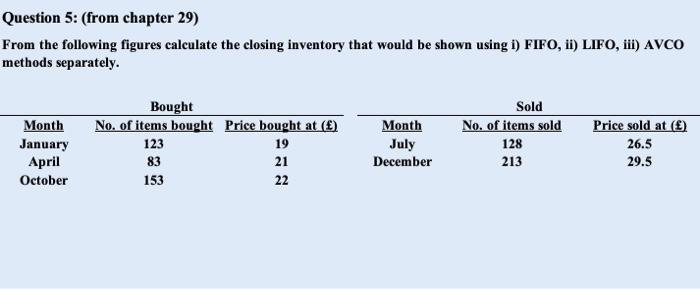

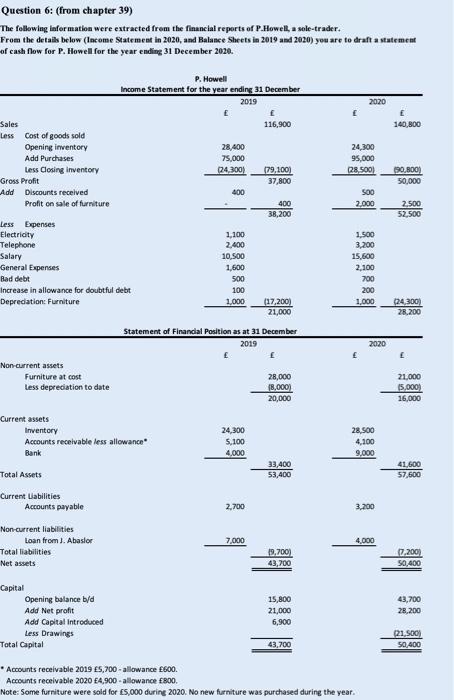

can you please solve this in excel? thank you Question 5: (from chapter 29) From the following figures calculate the closing inventory that would be

can you please solve this in excel?

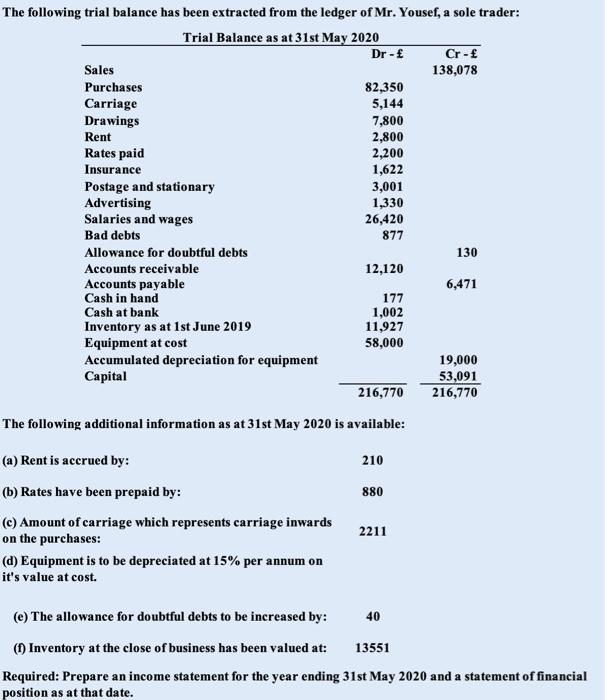

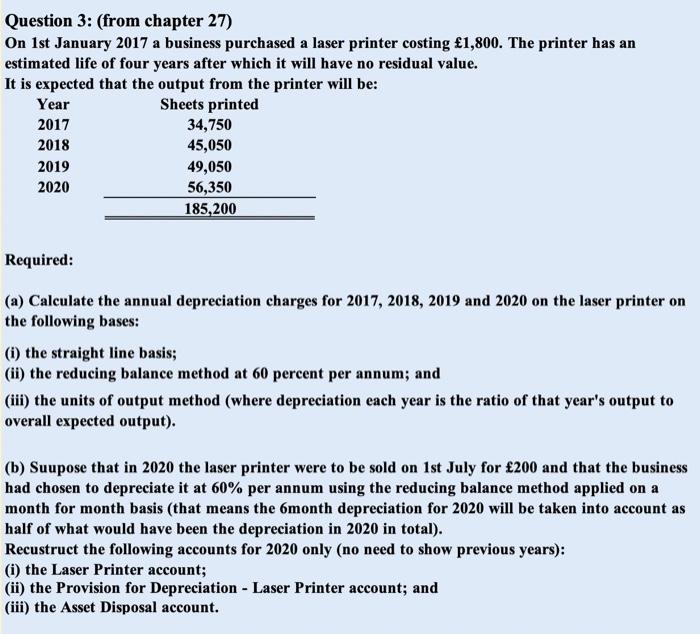

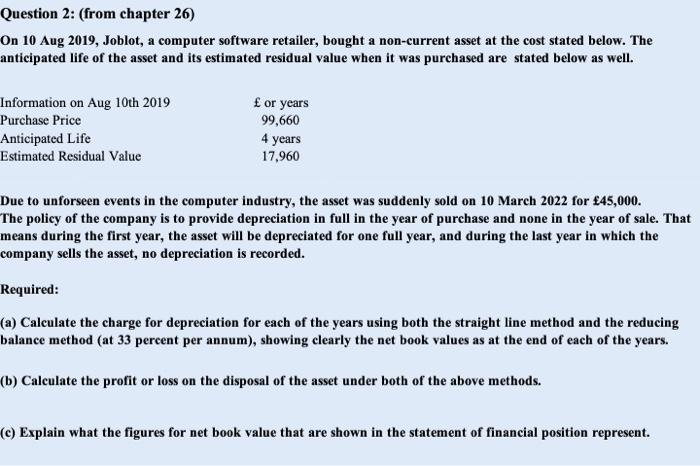

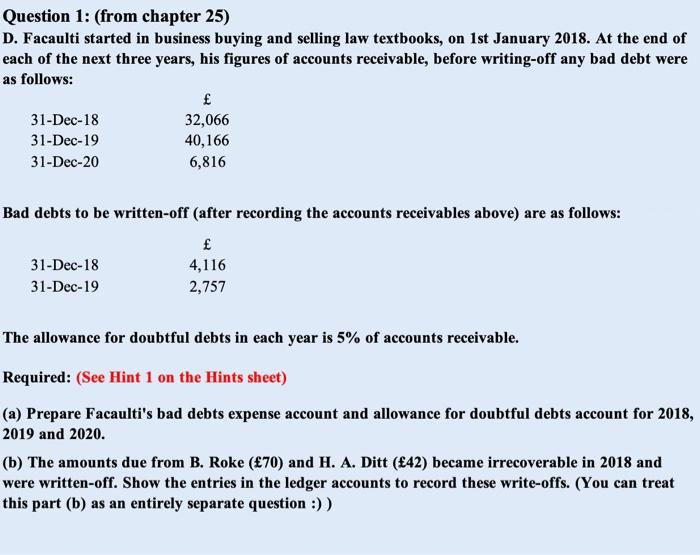

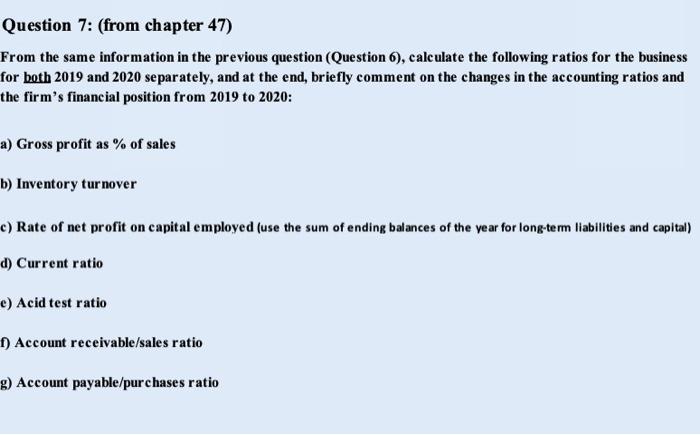

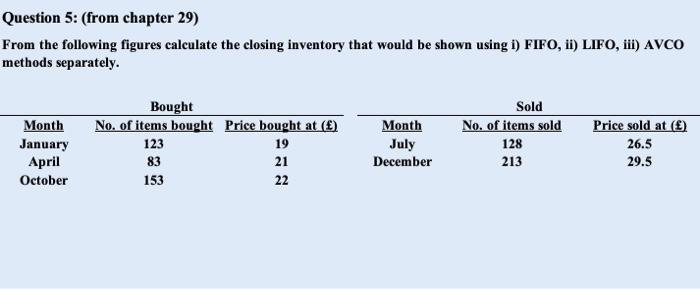

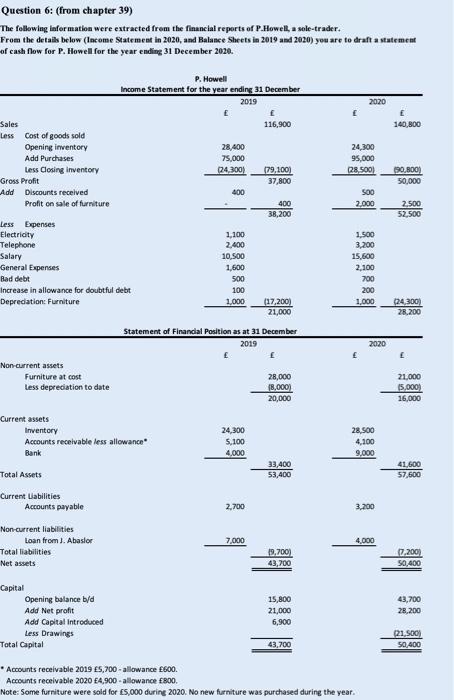

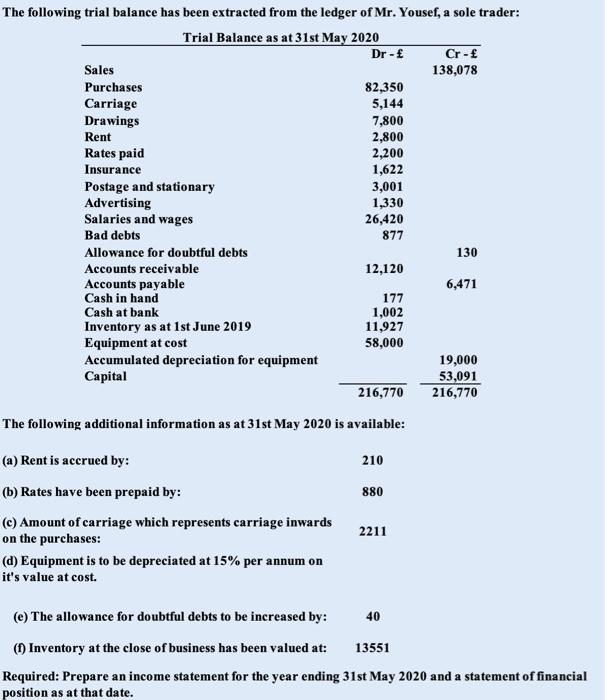

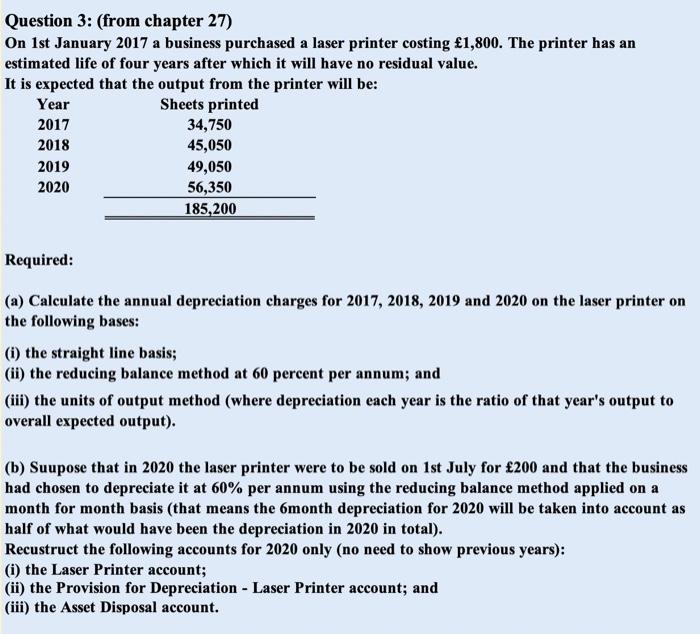

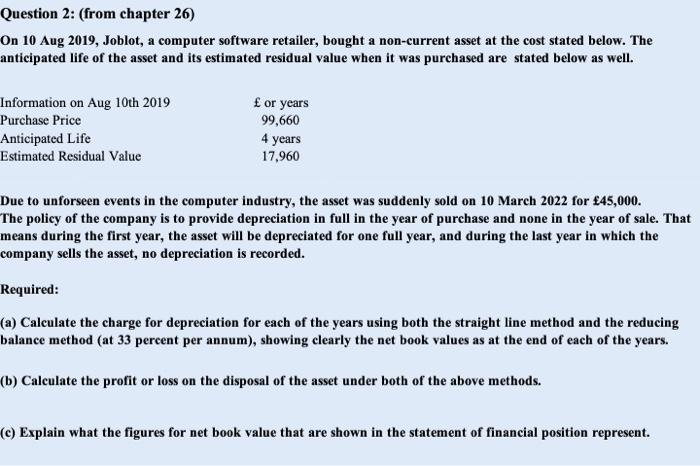

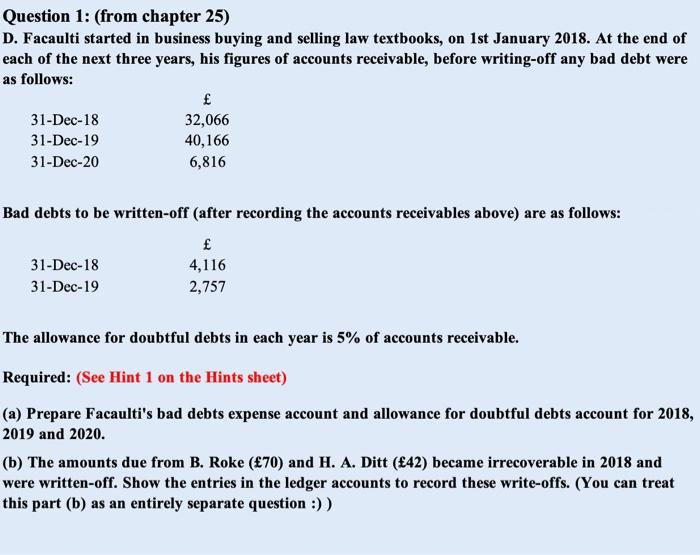

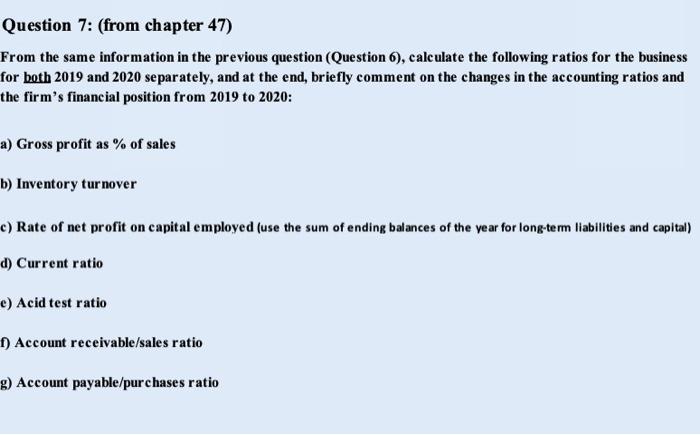

Question 5: (from chapter 29) From the following figures calculate the closing inventory that would be shown using 1) FIFO, ii) LIFO, iii) AVCO methods separately. Month January April October Bought No. of items bought Price bought at () 123 19 83 21 22 Month July December Sold No. of items sold 128 213 Price sold at () 26.5 29.5 153 Question 6: (from chapter 39) The following information were extracted from the financial reports of P.Howell, a sole-trader. From the details below (Income Statement in 2020, and Balance Sheets in 2019 and 2020) you are to draft a statement of cash flow for P. Howell for the year ending 31 December 2020. 2020 140,800 24,300 95,000 28.500) 190.800 50,000 500 2.000 P. Howell Income Statement for the year ending 31 December 2019 E Sales 116,900 Less Cost of goods sold Opening inventory 28,400 Add Purchases 75,000 Less Closing inventory 124,300) (79,100) Gross Profit 37,800 Add Discounts received 400 Profit on sale of furniture 400 38,200 Less Expenses Electricity 1.100 Telephone 2.400 Salary 10.500 General Expenses 1.600 Bad debt 500 Increase in allowance for doubtful debt 100 Depredation Furniture 1,000 (17.2003 21,000 Statement of Financial Position as at 31 December 2019 2.500 52.500 1,500 3,200 15,600 2.100 700 200 1,000 24.300) 28.200 2020 Non-current assets Furniture at cost less depreciation to date 28.000 18.000) 20,000 21.000 15.000) 16,000 Current assets Inventory Accounts receivable less allowance Bank 24,300 5.100 4.000 28.500 4,100 9,000 Total Assets 33,400 53,400 41.600 57,600 Current Labilities Accounts payable 2,700 3.200 7,000 4,000 Non-current liabilities Loan from ). Abastor Total liabilities Net assets 19.700) 43,700 7.2003 50,400 Capital Opening balance b/d Add Net profit Add Capital introduced Less Drawings Total Capital 15,800 21,000 6,900 43,700 28,200 121.500 50,400 43,700 Accounts receivable 2019 15,700 - allowance 600. Accounts receivable 2020 4,900 -allowance 800, Note: Some furniture were sold for 5,000 during 2020. No new furniture was purchased during the year. The following trial balance has been extracted from the ledger of Mr. Yousef, a sole trader: Trial Balance as at 31st May 2020 Dr - Cr- Sales 138,078 Purchases 82,350 Carriage 5,144 Drawings 7,800 Rent 2,800 Rates paid 2,200 Insurance 1,622 Postage and stationary 3,001 Advertising 1,330 Salaries and wages 26,420 Bad debts 877 Allowance for doubtful debts 130 Accounts receivable 12,120 Accounts payable 6,471 Cash in hand 177 Cash at bank 1,002 Inventory as at 1st June 2019 11,927 Equipment at cost 58,000 Accumulated depreciation for equipment 19,000 Capital 53,091 216,770 216,770 The following additional information as at 31st May 2020 is available: 210 880 (a) Rent is accrued by: (b) Rates have been prepaid by: (2) Amount of carriage which represents carriage inwards on the purchases: (d) Equipment is to be depreciated at 15% per annum on it's value at cost. 2211 (@) The allowance for doubtful debts to be increased by: 40 (1) Inventory at the close of business has been valued at: 13551 Required: Prepare an income statement for the year ending 31st May 2020 and a statement of financial position as at that date. Question 3: (from chapter 27) On 1st January 2017 a business purchased a laser printer costing 1,800. The printer has an estimated life of four years after which it will have no residual value. It is expected that the output from the printer will be: Year Sheets printed 2017 34,750 2018 45,050 2019 49,050 2020 56,350 185,200 Required: (a) Calculate the annual depreciation charges for 2017, 2018, 2019 and 2020 on the laser printer on the following bases: (i) the straight line basis; (ii) the reducing balance method at 60 percent per annum; and (iii) the units of output method (where depreciation each year is the ratio of that year's output to overall expected output). (b) Suupose that in 2020 the laser printer were to be sold on 1st July for 200 and that the business had chosen to depreciate it at 60% per annum using the reducing balance method applied on a month for month basis (that means the 6month depreciation for 2020 will be taken into account as half of what would have been the depreciation in 2020 in total). Recustruct the following accounts for 2020 only (no need to show previous years): (i) the Laser Printer account; (ii) the Provision for Depreciation - Laser Printer account; and (iii) the Asset Disposal account. Question 2: (from chapter 26) On 10 Aug 2019, Joblot, a computer software retailer, bought a non-current asset at the cost stated below. The anticipated life of the asset and its estimated residual value when it was purchased are stated below as well. Information on Aug 10th 2019 Purchase Price Anticipated Life Estimated Residual Value or years 99,660 4 years 17,960 Due to unforseen events in the computer industry, the asset was suddenly sold on 10 March 2022 for 45,000. The policy of the company is to provide depreciation in full in the year of purchase and none in the year of sale. That means during the first year, the asset will be depreciated for one full year, and during the last year in which the company sells the asset, no depreciation is recorded. Required: (a) Calculate the charge for depreciation for each of the years using both the straight line method and the reducing balance method (at 33 percent per annum), showing clearly the net book values as at the end of each of the years. (b) Calculate the profit or loss on the disposal of the asset under both of the above methods. (c) Explain what the figures for net book value that are shown in the statement of financial position represent. Question 1: (from chapter 25) D. Facaulti started in business buying and selling law textbooks, on 1st January 2018. At the end of each of the next three years, his figures of accounts receivable, before writing-off any bad debt were as follows: 31-Dec-18 32,066 31-Dec-19 40,166 31-Dec-20 6,816 Bad debts to be written-off (after recording the accounts receivables above) are as follows: 31-Dec-18 4,116 31-Dec-19 2,757 The allowance for doubtful debts in each year is 5% of accounts receivable. Required: (See Hint 1 on the Hints sheet) (a) Prepare Facaulti's bad debts expense account and allowance for doubtful debts account for 2018, 2019 and 2020. (b) The amounts due from B. Roke (70) and H. A. Ditt (42) became irrecoverable in 2018 and were written-off. Show the entries in the ledger accounts to record these write-offs. (You can treat this part (b) as an entirely separate question :)) Question 7: (from chapter 47) From the same information in the previous question (Question 6), calculate the following ratios for the business for both 2019 and 2020 separately, and at the end, briefly comment on the changes in the accounting ratios and the firm's financial position from 2019 to 2020: a) Gross profit as % of sales b) Inventory turnover c) Rate of net profit on capital employed (use the sum of ending balances of the year for long-term liabilities and capital) d) Current ratio e) Acid test ratio 1) Account receivable/sales ratio g) Account payable/purchases ratio thank you

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started