Answered step by step

Verified Expert Solution

Question

1 Approved Answer

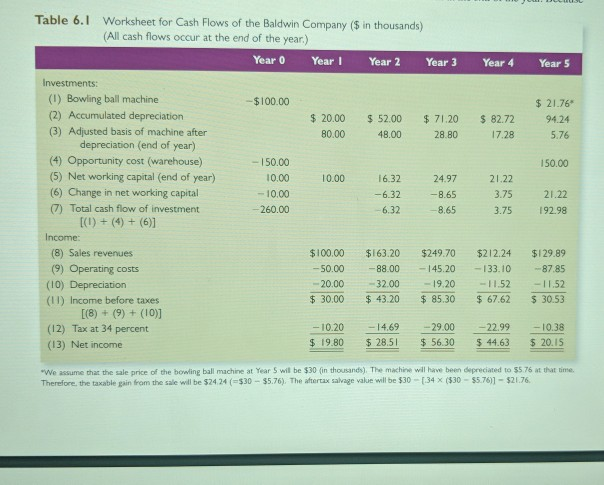

can you please solve this question using a schedule smiliar to to the one in the picture below 3. Assume that you have the following

can you please solve this question using a schedule smiliar to to the one in the picture below

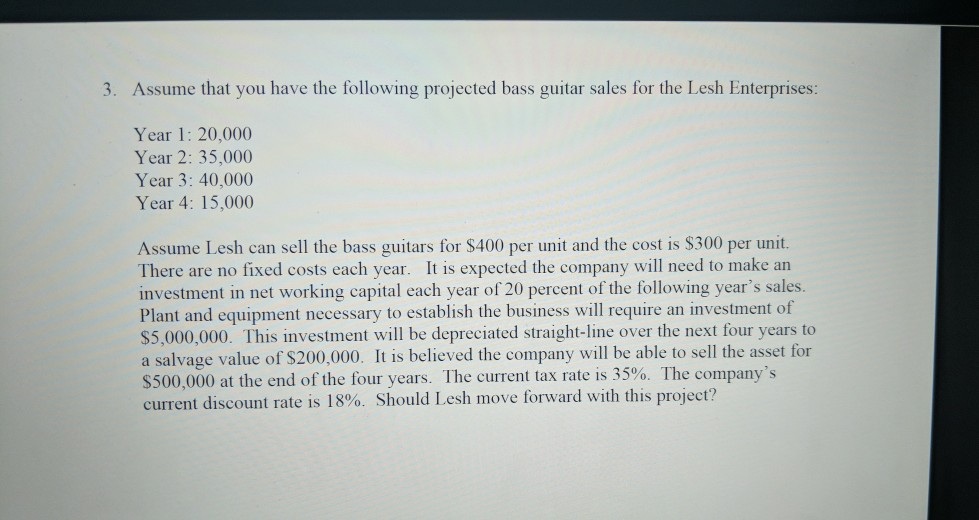

3. Assume that you have the following projected bass guitar sales for the Lesh Enterprises: Year 1: 20,000 Year 2: 35,000 Year 3: 40,000 Year 4: 15,000 Assume Lesh can sell the bass guitars for $400 per unit and the cost is $300 per unit There are no fixed costs each year. It is expected the company will need to make an investment in net working capital each year of 20 percent of the following year's sales. Plant and equipment necessary to establish the business will require an investment of $5,000,000. This investment will be depreciated straight-line over the next four years to a salvage value of $200,000. It is believed the company will be able to sell the asset for $500,000 at the end of the four years. The current tax rate is 35%. The company's current discount rate is 18%. Should Lesh move forward with this project? Table 6.I Worksheet for Cash Flows of the Baldwin Company ($ in thousands) (All cash flows occur at the end of the year.) Year 0 Year Year 2 Year 3 Year 4 Year 5 Investments (I) Bowling ball machine (2) Accumulated depreciation (3) Adjusted basis of machine after -$100.00 $ 20.00 80.00 $21.76 52.00 71.20 $ 82.72 94.24 5.76 48.00 28.80 7.28 depreciation (end of year) (4) Opportunity cost (warehouse) (5) Net working capital (end of year) (6) Change in net working capital 7) Total cash flow of investment 150.00 0.00 -10.00 260.00 150.00 6.32 -6.32 6.32 10.00 24.97 21.22 3.75 3.75 21.22 192.98 8.65 Income (8) Sales revenues (9) Operating costs (10) Depreciation (11) Income before taxes $100.00 163.20 $249.70 $212.24 $129.89 50.00 88.00145.20133.1087.85 -11.52 30.00 43.20 $85.30 67.62 $30.53 20.00 32.00 19.20 1.52 (12) Tax at 34 percent (13) Net income 020 1469 29.00 2.99 28.51 56.30 $44.63 -10.38 20.1S $ 19.80 "We assume that the sale price of the bowling ball machine at Year 5 wil be $30 (in thousands) The machine will have been depreciated to $5.76 at that time Therefore, the taxable gain from the sale will be $24.24 (-$30-$5.76). The aftertax salvage value will be S30-t34 x (S30-S576)-S21.76

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started