Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Can you please tell me if I am doing my discounted and free cash flows properly 2017 2018 2019 2020 2021 2022 2023 2024 2025

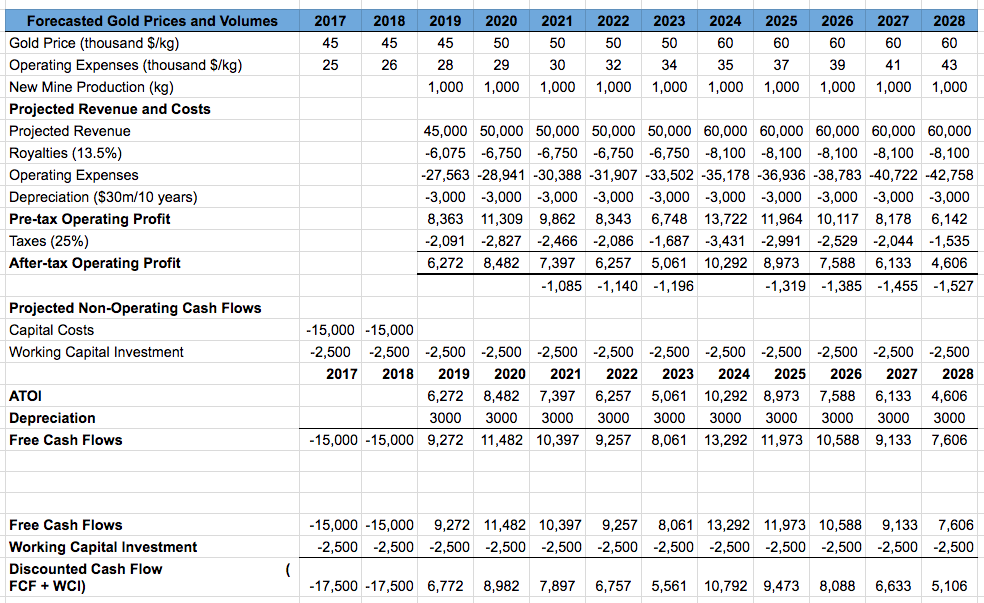

Can you please tell me if I am doing my discounted and free cash flows properly

2017 2018 2019 2020 2021 2022 2023 2024 2025 2026 2027 2028 Forecasted Gold Prices and Volumes Gold Price (thousand $/kg) 45 45 45 50 50 50 50 60 60 60 60 60 25 26 28 29 30 32 34 35 37 39 41 43 Operating Expenses (thousand $/k New Mine Production (kg) 1,000 1,000 1 000 1.000 1.000 1.000 1,000 1,000 1,000 1,000 Projected Revenue and Costs Projected Revenue 45,000 50,000 50,000 50,000 50,000 60,000 60,000 60,000 60,000 60, 000 -6,075 -6,750 -6,750 -6,750 -6,750 -8,100 -8,100 -8,100 -8,100 -8,100 Royalties (13.5%) Operating Expenses -27,563 -28,941 -30,388 -31,907 -33,502 -35,178 -36,936 -38,783 -40,722 -42,758 Depreciation (s30m/10 years) -3,000 -3,000 -3,000 -3,000 -3,000 -3,000 -3,000 -3,000 -3,000 -3,000 8,363 11,309 91862 8,343 6748 13,722 11,964 10,117 8,178 6,142 Pre-tax operating Profit Taxes (25%) -2,091 -2,827 -2,466 -2,086 -1,687 -3,431 -2,991 -2,529 -2,044 -1,535 6,272 8.482 7,397 6,257 5,061 10,292 8,973 7,588 6, 133 4,606 After-tax operating Profit -1,085 -1,140 -1,196 -1,319 -1,385 -1,455 -1,527 Projected Non-Operating Cash Flows -15,000 -15,000 Capital Costs Working Capital Investment -2,500 -2,500 -2,500 -2,500 -2,500 -2,500 -2,500 -2,500 -2,500 -2,500 -2,500 -2,500 2017 2018 2019 2020 2021 2022 2023 2024 2025 2026 2027 2028 ATOl 6,272 8,482 7,397 6,257 5,061 10, 292 8,973 7,588 6, 33 4,606 3000 3000 3000 3000 3000 3000 3000 3000 3000 3000 Depreciation -15,000 -15,000 9,272 11,482 10,397 9,257 8 061 13,292 11,973 10,588 9,133 7606 Free Cash Flows -15,000-15.000 9,272 11,482 10,397 9 257 8,061 13,29 1 1 973 10,588 9,133 7,606 Free Cash Flows Working Capital Investment -2,500 -2,500 -2,500 -2,500 -2,500 -2,500 -2,500 -2,500 -2,500 -2,500 -2,500 -2,500 Discounted Cash Flow FCF WCI) 17,500 17,500 6,772 8,982 7,897 6,757 5,561 10,792 9,473 8,088 6,633 5,106Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started