Answered step by step

Verified Expert Solution

Question

1 Approved Answer

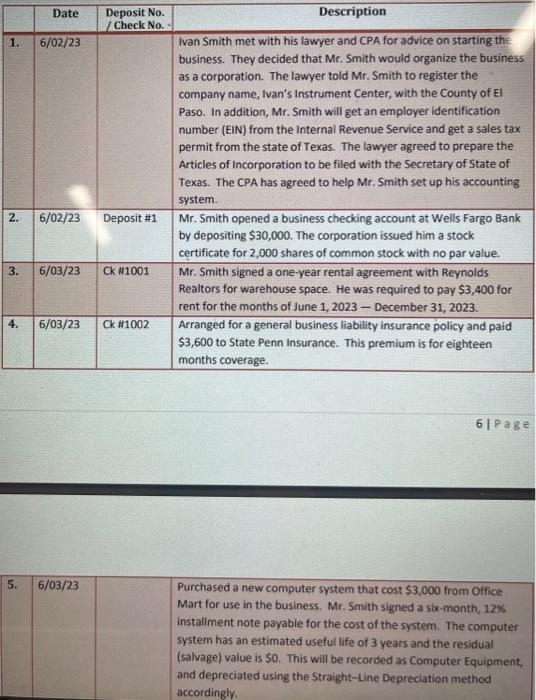

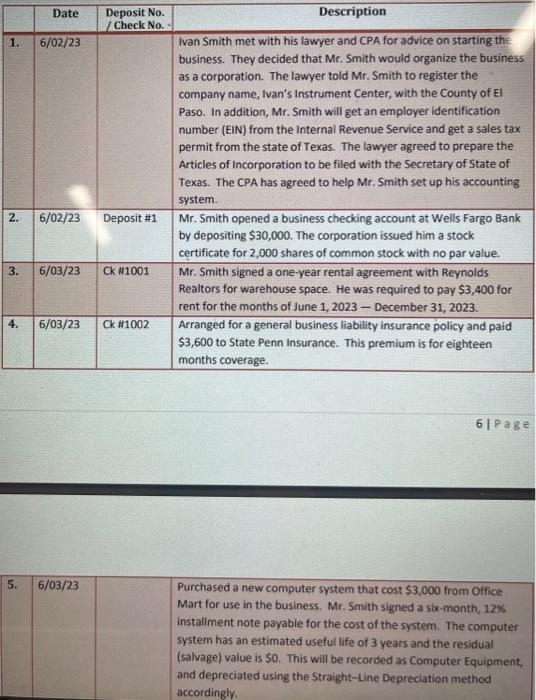

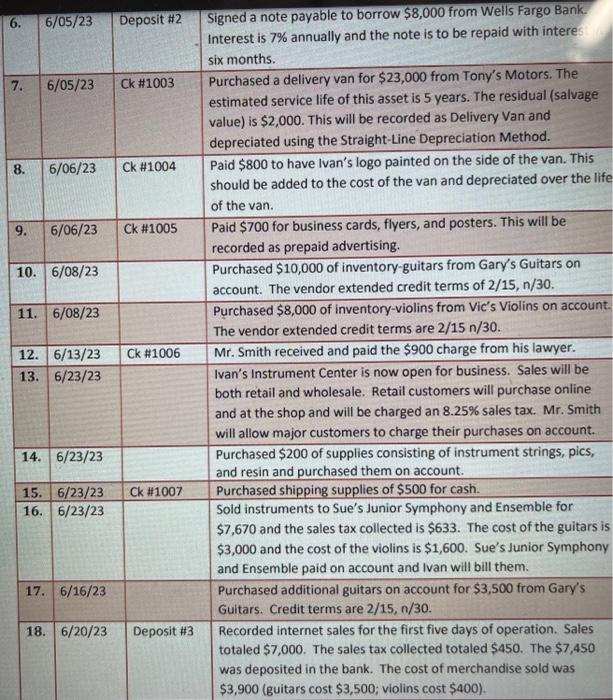

can you please write the journal entries for the following transactions. The account numbers are provided and the templet format. Purchased a new computer system

can you please write the journal entries for the following transactions. The account numbers are provided and the templet format.

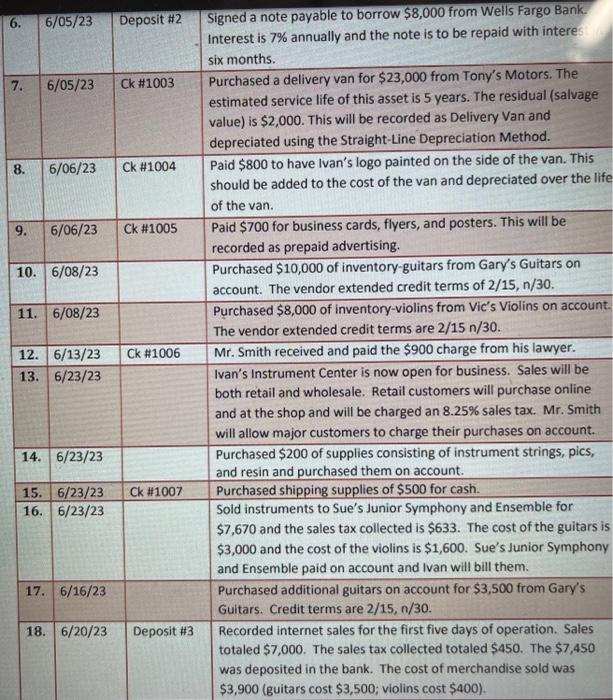

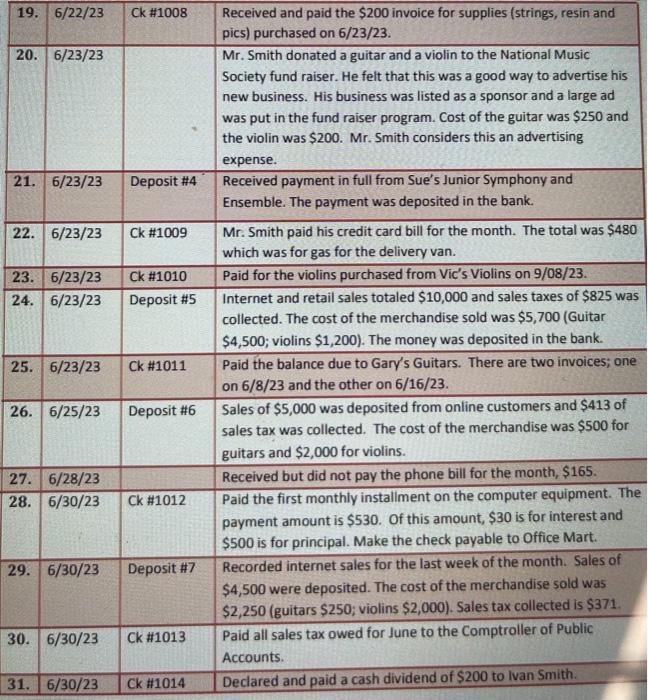

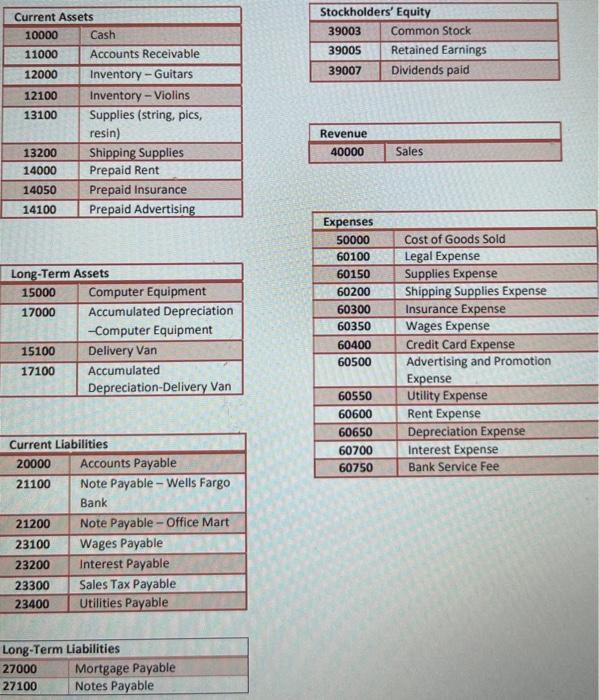

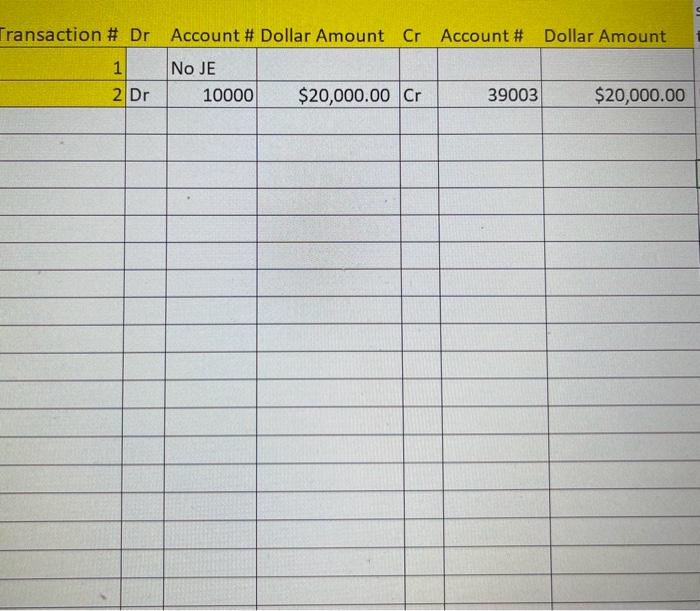

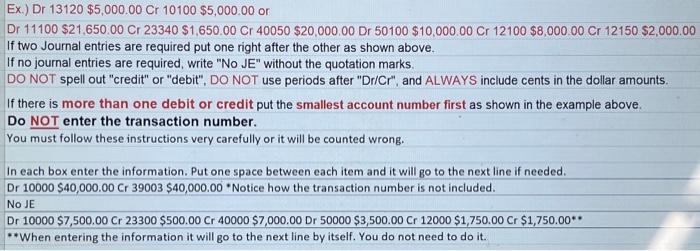

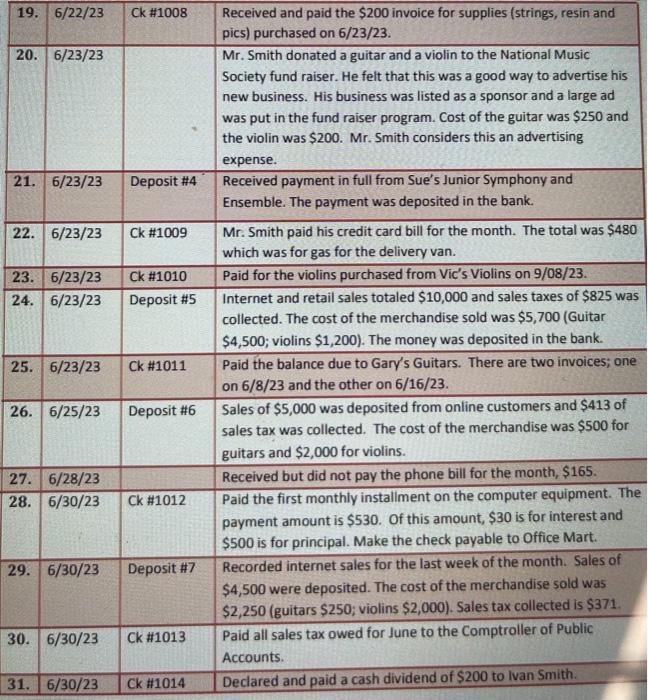

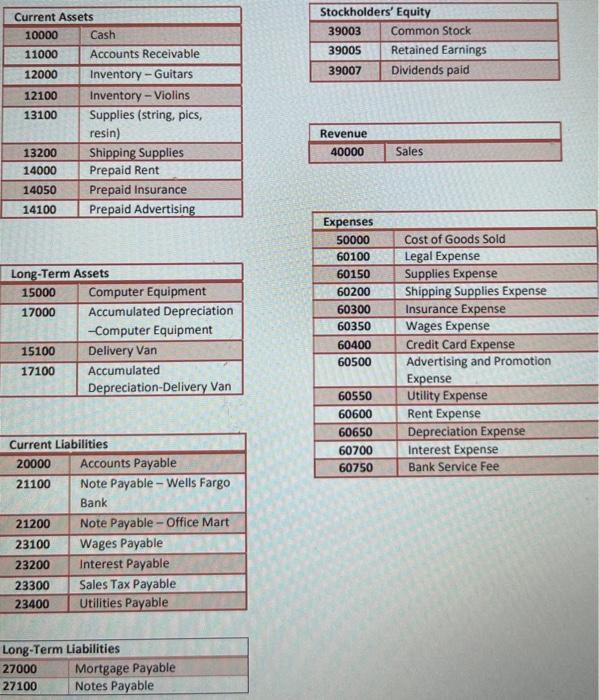

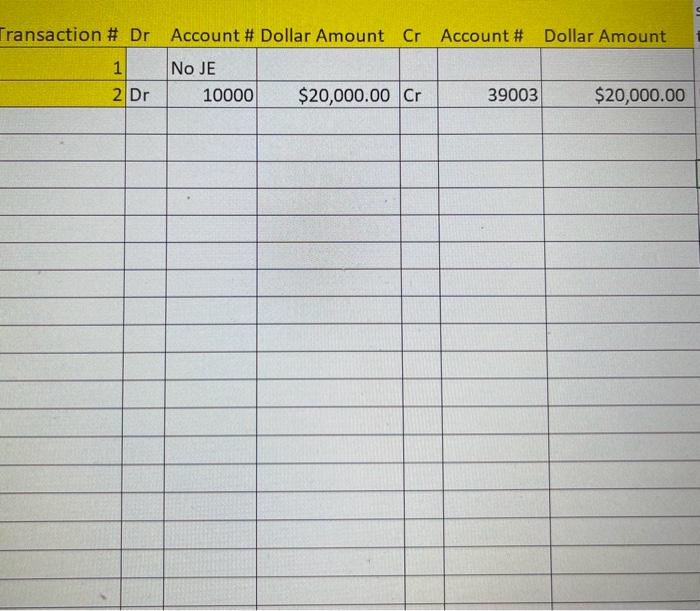

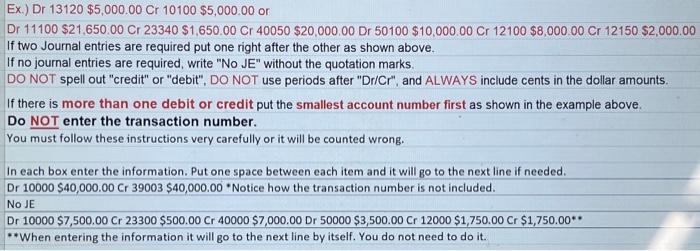

Purchased a new computer system that cost $3,000 from Office Mart for use in the business. Mr. Smith signed a six-month, 12% installment note payabie for the cost of the system. The computer system has an estimated useful life of 3 years and the residual (salvage) value is $0. This will be recorded as Computer Equipment, and depreciated using the Straight-Line Depreciation method accordingly, \begin{tabular}{|l|l|} \hline \multicolumn{2}{|c|}{ Current Assets } \\ \hline 10000 & Cash \\ \hline 11000 & Accounts Receivable \\ \hline 12000 & Inventory - Guitars \\ \hline 12100 & Inventory - Violins \\ \hline 13100 & Supplies(string,pics,resin) \\ \hline 13200 & Shipping Supplies \\ \hline 14000 & Prepaid Rent \\ \hline 14050 & Prepaid Insurance \\ \hline 14100 & Prepaid Advertising \\ \hline \end{tabular} \begin{tabular}{|c|l|} \hline \multicolumn{2}{|c|}{ Stockholders' Equity } \\ \hline 39003 & Common Stock \\ \hline 39005 & Retained Earnings \\ \hline 39007 & Dividends paid \\ \hline \end{tabular} \begin{tabular}{|c|l|} \hline \multicolumn{2}{|l|}{ Long-Term Assets } \\ \hline 15000 & Computer Equipment \\ \hline 17000 & AccumulatedDepreciation-ComputerEquipment \\ \hline 15100 & Delivery Van \\ \hline 17100 & AccumulatedDepreciation-DeliveryVan \\ \hline \end{tabular} \begin{tabular}{|l|l|} \hline \multicolumn{2}{|l|}{ Current Liabilities } \\ \hline 20000 & Accounts Payable \\ \hline 21100 & NotePayable-WellsFargoBank \\ \hline 21200 & Note Payable - Office Mart \\ \hline 23100 & Wages Payable \\ \hline 23200 & Interest Payable \\ \hline 23300 & Sales Tax Payable \\ \hline 23400 & Utilities Payable \\ \hline \end{tabular} \begin{tabular}{|c|l|} \hline Expenses & \\ \hline 50000 & Cost of Goods Sold \\ \hline 60100 & Legal Expense \\ \hline 60150 & Supplies Expense \\ \hline 60200 & Shipping Supplies Expense \\ \hline 60300 & Insurance Expense \\ \hline 60350 & Wages Expense \\ \hline 60400 & Credit Card Expense \\ \hline 60500 & Advertising and Promotion \\ & Expense \\ \hline 60550 & Utility Expense \\ \hline 60600 & Rent Expense \\ \hline 60650 & Depreciation Expense \\ \hline 60700 & Interest Expense \\ \hline 60750 & Bank Service Fee \\ \hline \end{tabular} Long-Term Liabilities \begin{tabular}{l|l|} \hline 27000 & Mortgage Payable \\ \hline 27100 & Notes Payable \\ \hline \end{tabular} Ex.) Dr 13120$5,000.00Cr10100$5,000.00 or Dr 11100$21,650.00Cr23340$1,650.00Cr40050$20,000,00Dr50100$10,000.00Cr12100$8,000.00Cr12150$2,000.00 If two Journal entries are required put one right after the other as shown above. If no journal entries are required, write "No JE" without the quotation marks. DO NOT spell out "credit" or "debit", DO NOT use periods after "Dr/Cr", and ALWAYS include cents in the dollar amounts. If there is more than one debit or credit put the smallest account number first as shown in the example above. Do NOT enter the transaction number. You must follow these instructions very carefully or it will be counted wrong. In each box enter the information. Put one space between each item and it will go to the next line if needed. Dr 10000$40,000.00Cr39003$40,000.00 Notice how the transaction number is not included. No JE Dr 10000$7,500.00Cr23300$500.00Cr40000$7,000.00Dr50000$3,500.00Cr12000$1,750.00Cr$1,750.00 * When entering the information it will go to the next line by itself. You do not need to do it

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started