Can you please zoom in to see the images.

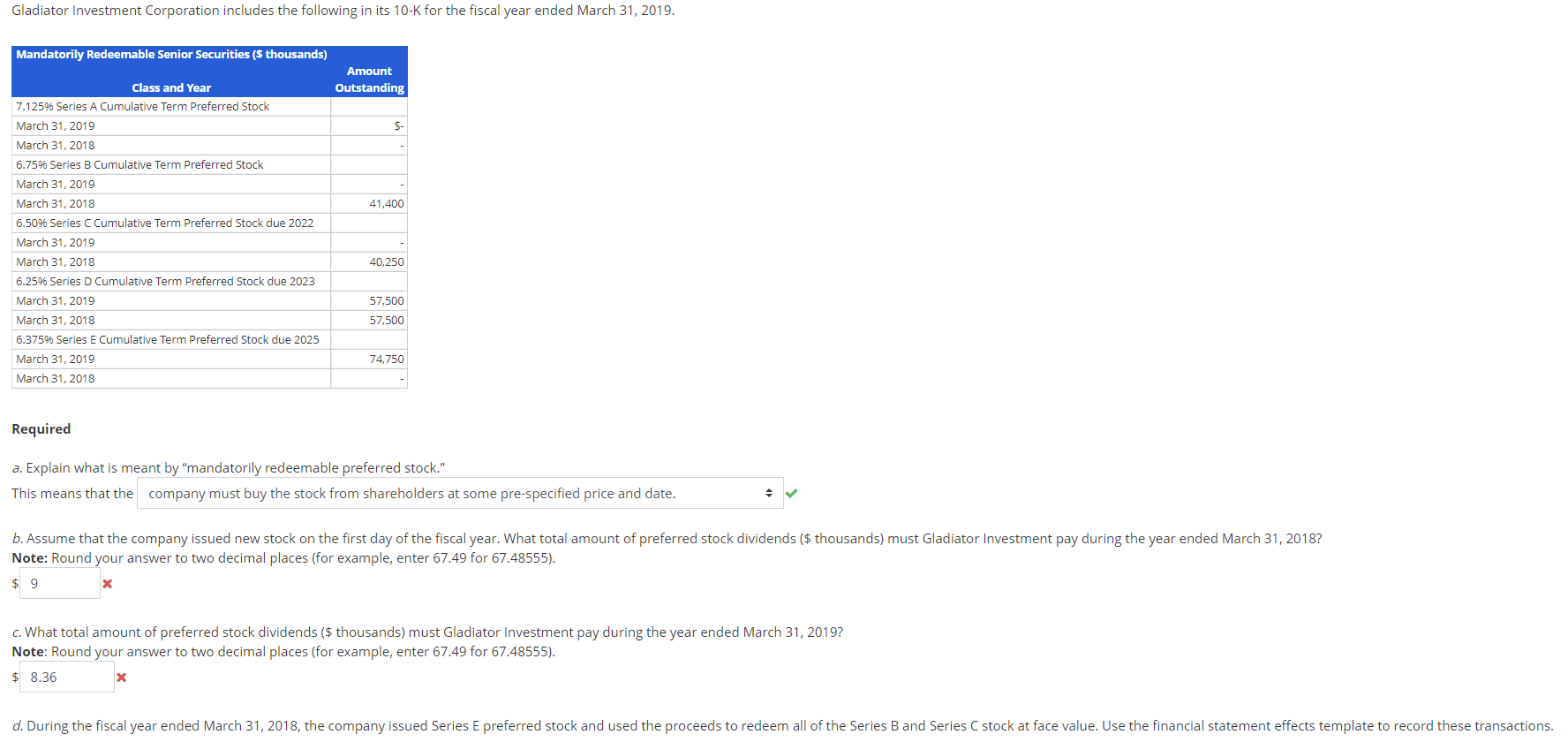

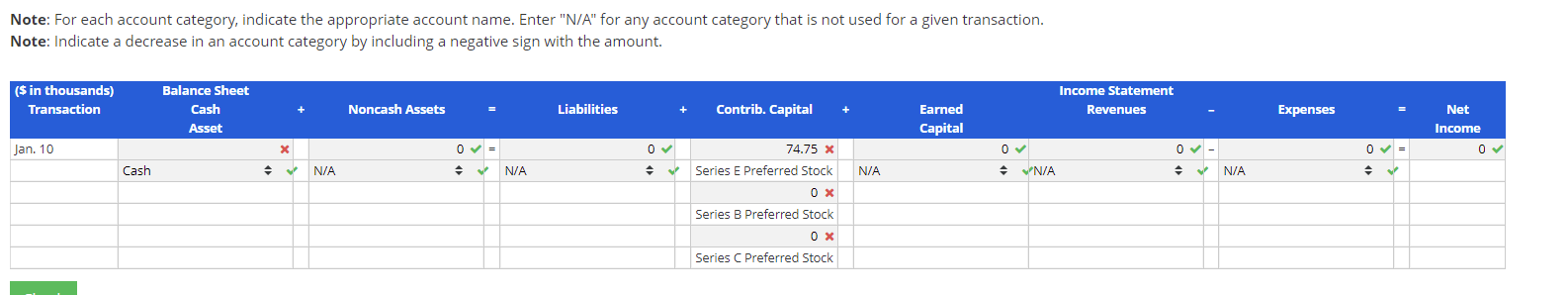

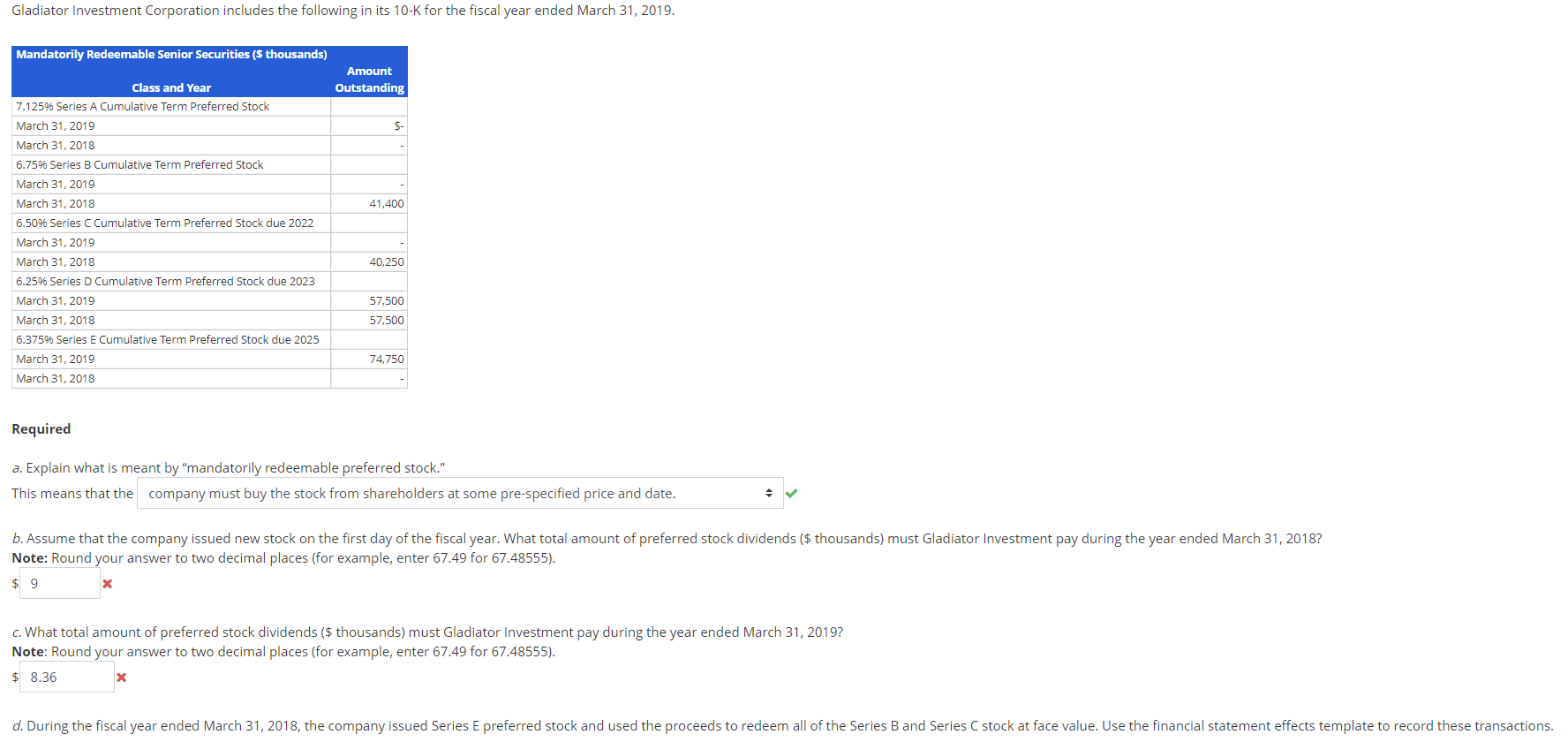

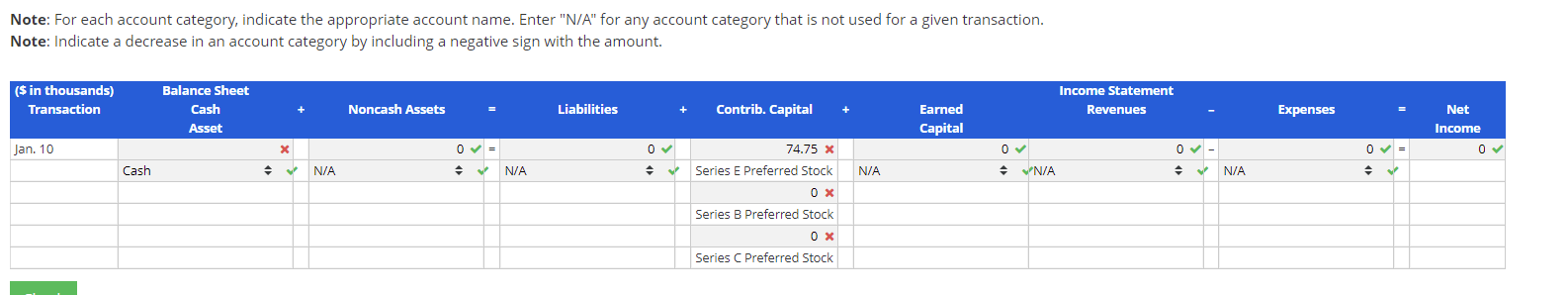

Gladiator Investment Corporation includes the following in its 10-K for the fiscal year ended March 31, 2019. Mandatorily Redeemable Senior Securities ($ thousands) Amount Outstanding $- 41,400 Class and Year 7.12596 Series A Cumulative Term Preferred Stock March 31, 2019 March 31, 2018 6.75% Series B Cumulative Term Preferred Stock March 31, 2019 March 31, 2018 6.50% Series C Cumulative Term Preferred Stock due 2022 March 31, 2019 March 31, 2018 6.2596 Series D Cumulative Term Preferred Stock due 2023 March 31, 2019 March 31, 2018 6.37596 Series E Cumulative Term Preferred Stock due 2025 March 31, 2019 March 31, 2018 40,250 57,500 57,500 74,750 Required a. Explain what is meant by "mandatorily redeemable preferred stock." This means that the company must buy the stock from shareholders at some pre-specified price and date. b. Assume that the company issued new stock on the first day of the fiscal year. What total amount of preferred stock dividends ($ thousands) must Gladiator Investment pay during the year ended March 31, 2018? Note: Round your answer to two decimal places (for example, enter 67.49 for 67.48555). $ 9 x C. What total amount of preferred stock dividends ($ thousands) must Gladiator Investment pay during the year ended March 31, 2019? Note: Round your answer to two decimal places (for example, enter 67.49 for 67.48555). $ 8.36 X d. During the fiscal year ended March 31, 2018, the company issued Series E preferred stock and used the proceeds to redeem all of the Series B and Series C stock at face value. Use the financial statement effects template to record these transactions. Note: For each account category, indicate the appropriate account name. Enter "N/A" for any account category that is not used for a given transaction. Note: Indicate a decrease in an account category by including a negative sign with the amount. ($ in thousands) Transaction Balance Sheet Cash Asset Income Statement Revenues Noncash Assets Liabilities Contrib. Capital Expenses Earned Capital Net Income 0 Jan. 10 x 0 = 0 0 0 - Cash N/A N/A N/A N/A N/A 74.75 X Series E Preferred Stock Series B Preferred Stock Series C Preferred Stock Gladiator Investment Corporation includes the following in its 10-K for the fiscal year ended March 31, 2019. Mandatorily Redeemable Senior Securities ($ thousands) Amount Outstanding $- 41,400 Class and Year 7.12596 Series A Cumulative Term Preferred Stock March 31, 2019 March 31, 2018 6.75% Series B Cumulative Term Preferred Stock March 31, 2019 March 31, 2018 6.50% Series C Cumulative Term Preferred Stock due 2022 March 31, 2019 March 31, 2018 6.2596 Series D Cumulative Term Preferred Stock due 2023 March 31, 2019 March 31, 2018 6.37596 Series E Cumulative Term Preferred Stock due 2025 March 31, 2019 March 31, 2018 40,250 57,500 57,500 74,750 Required a. Explain what is meant by "mandatorily redeemable preferred stock." This means that the company must buy the stock from shareholders at some pre-specified price and date. b. Assume that the company issued new stock on the first day of the fiscal year. What total amount of preferred stock dividends ($ thousands) must Gladiator Investment pay during the year ended March 31, 2018? Note: Round your answer to two decimal places (for example, enter 67.49 for 67.48555). $ 9 x C. What total amount of preferred stock dividends ($ thousands) must Gladiator Investment pay during the year ended March 31, 2019? Note: Round your answer to two decimal places (for example, enter 67.49 for 67.48555). $ 8.36 X d. During the fiscal year ended March 31, 2018, the company issued Series E preferred stock and used the proceeds to redeem all of the Series B and Series C stock at face value. Use the financial statement effects template to record these transactions. Note: For each account category, indicate the appropriate account name. Enter "N/A" for any account category that is not used for a given transaction. Note: Indicate a decrease in an account category by including a negative sign with the amount. ($ in thousands) Transaction Balance Sheet Cash Asset Income Statement Revenues Noncash Assets Liabilities Contrib. Capital Expenses Earned Capital Net Income 0 Jan. 10 x 0 = 0 0 0 - Cash N/A N/A N/A N/A N/A 74.75 X Series E Preferred Stock Series B Preferred Stock Series C Preferred Stock