Can you prepare a report, which clearly explains JLR plcs investing and financing activities and profits performance? The most recent annual report that we have been able to obtain is for the year ending 31 March 2022, so you should certainly use that. Could your report also explain anything that they have been investing in and how the company is being financed? Youll need to present the ratios in your report, but you wont need to explain the meaning of the ratios themselves. Could you conclude your report by stating whether or not, based on your analysis of the numbers along with other research, you think that JLR plc would make a good long-term investment?

THANK YOU

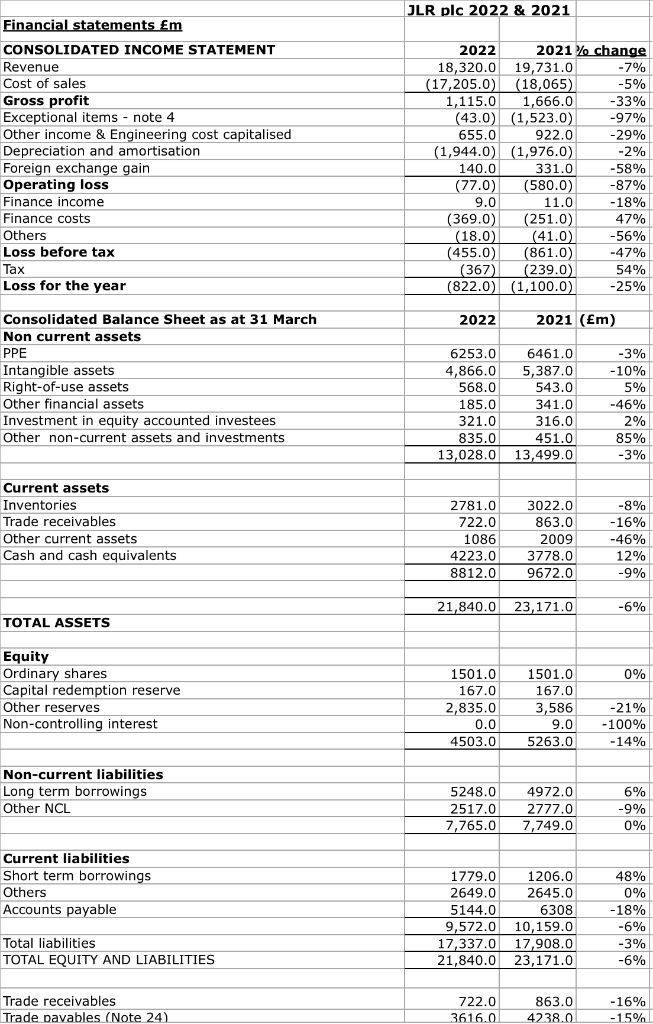

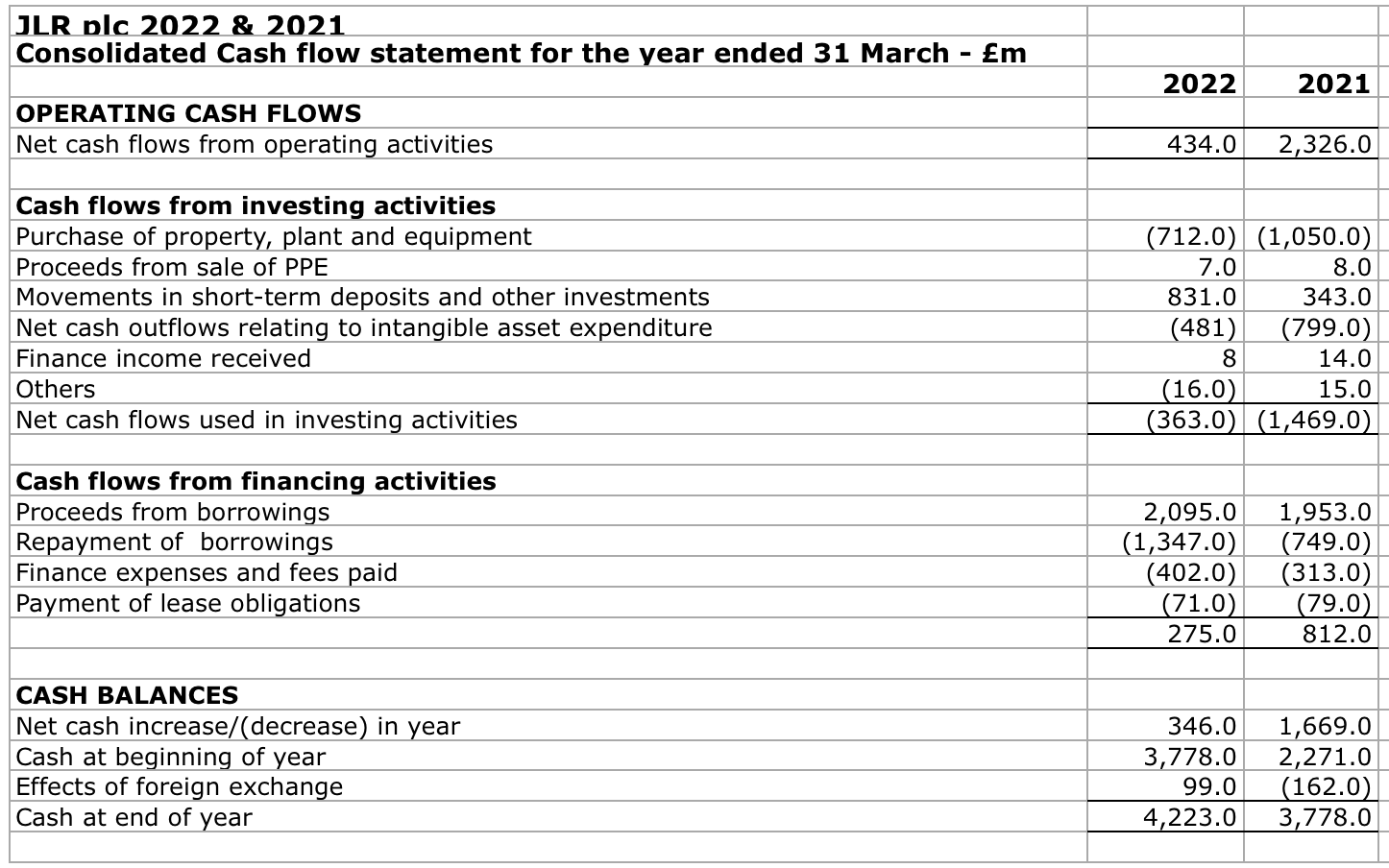

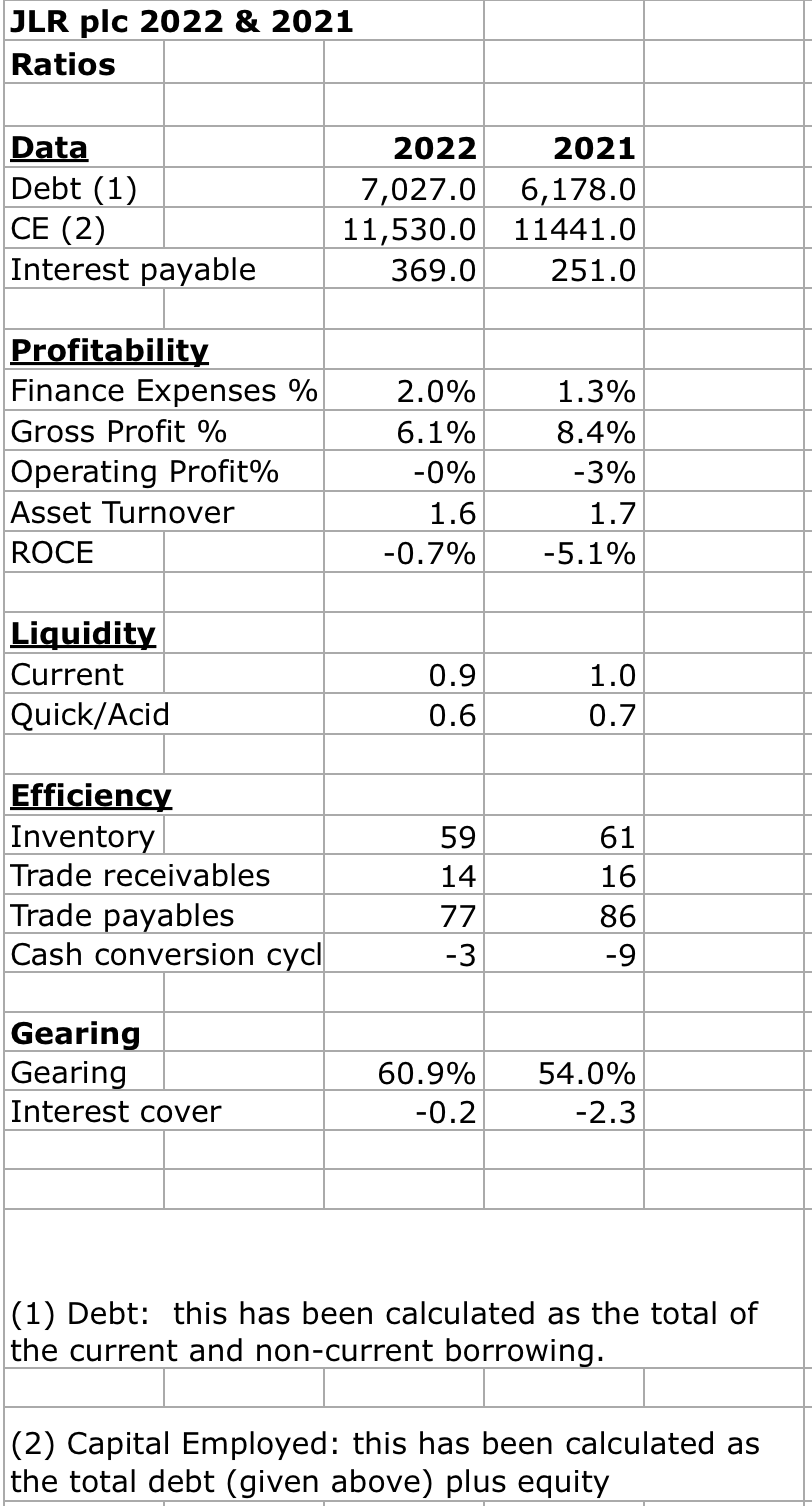

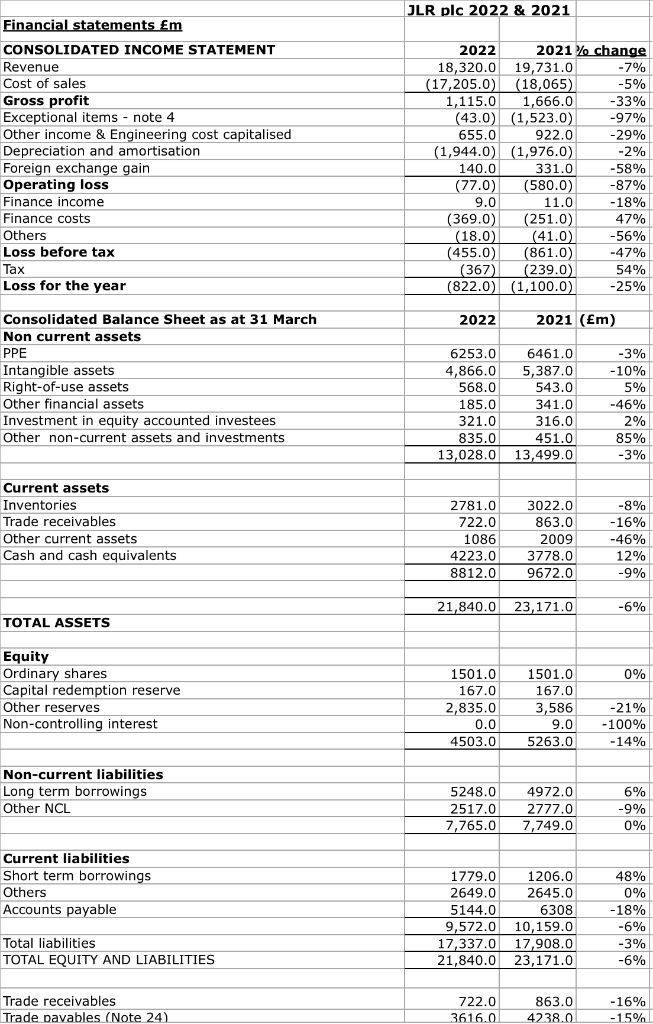

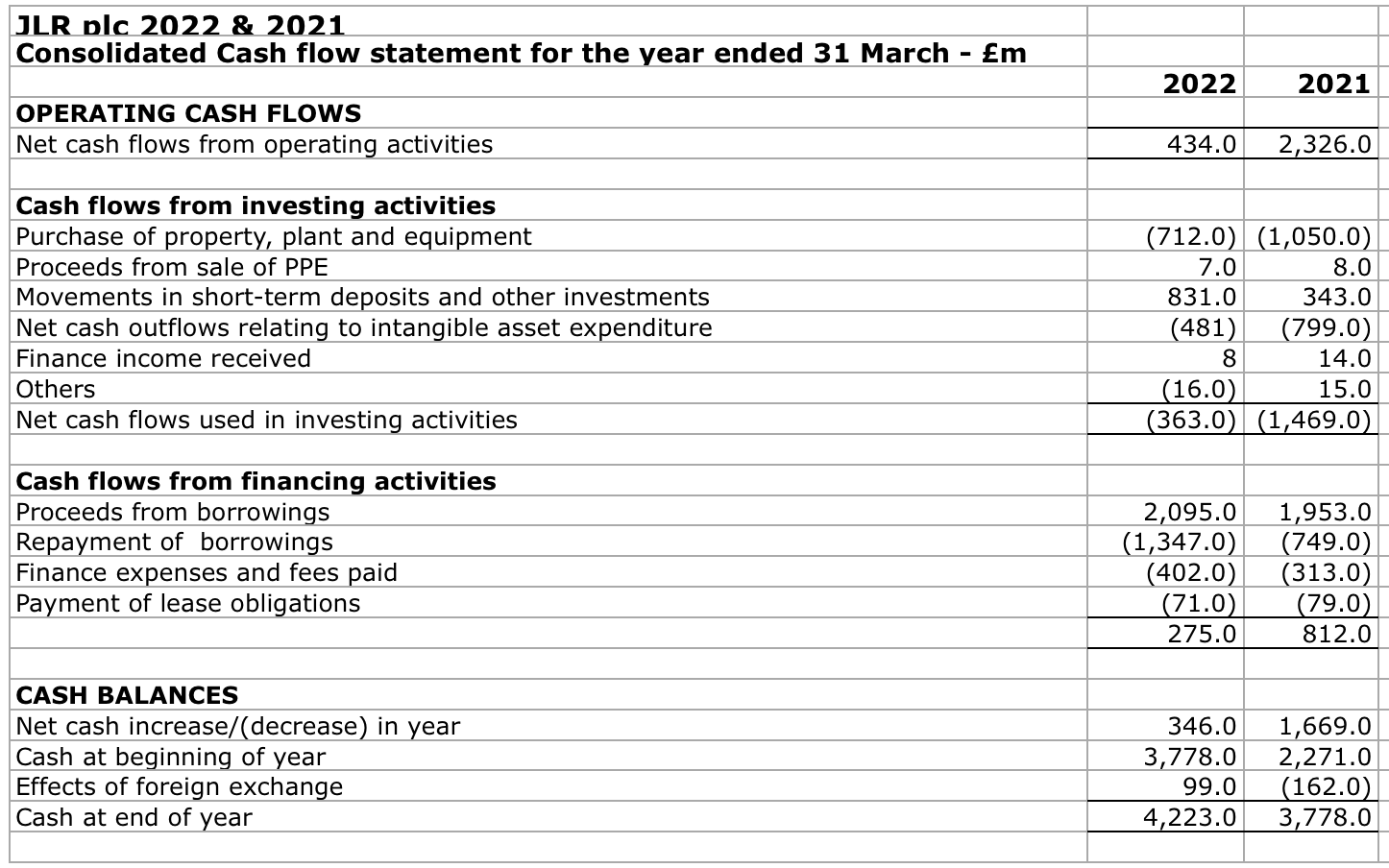

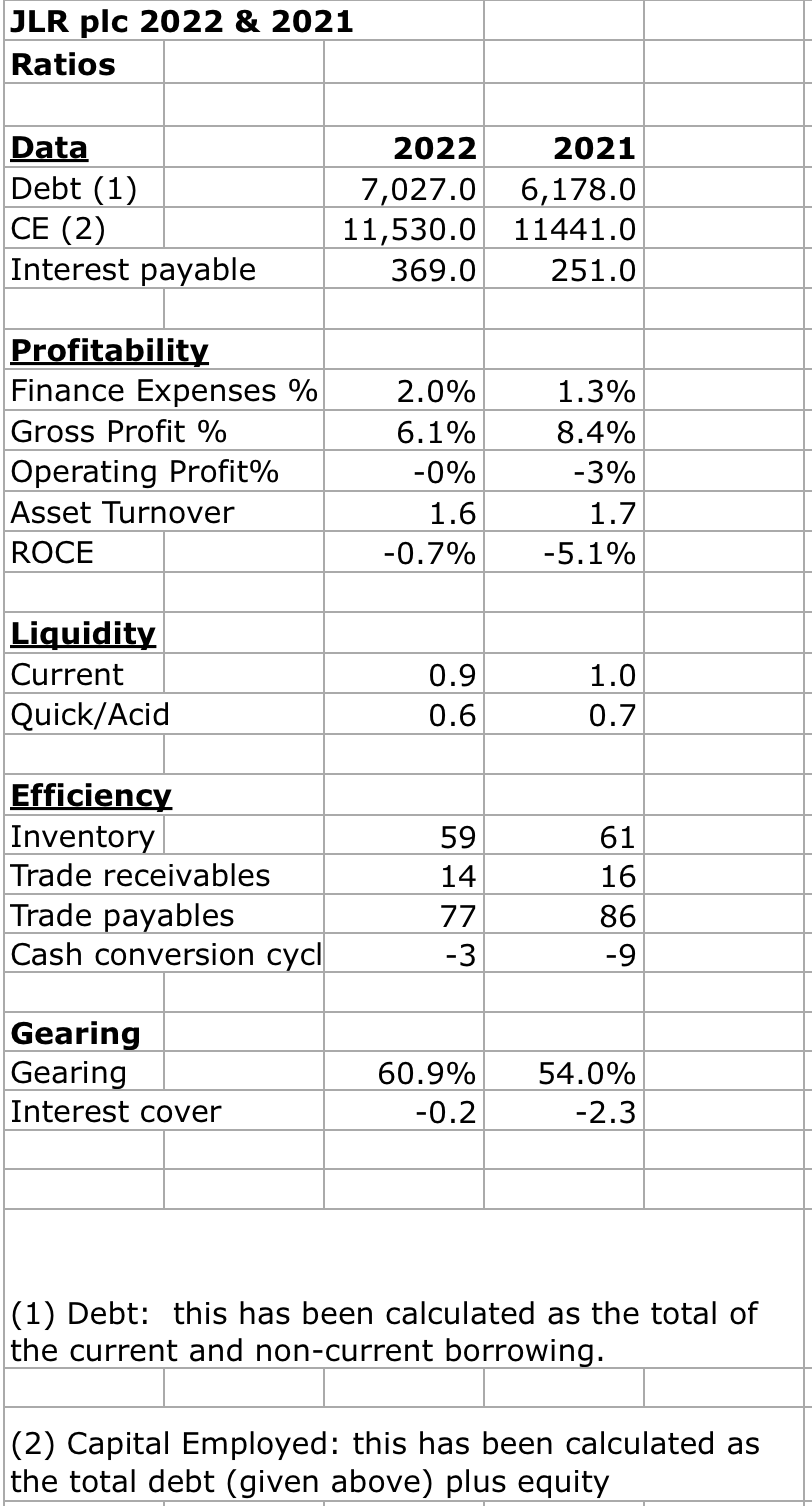

JLR plc 2022&2021 Financial statements m CONSOLIDATED INCOME STATEMENT Revenue Cost of sales Gross profit Exceptional items - note 4 Other income \& Engineering cost capitalised Depreciation and amortisation Foreign exchange gain Operating loss Finance income \begin{tabular}{|r|r|r|} \hline 2022 & 2021% change \\ \hline 18,320.0 & 19,731.0 & 7% \\ \hline(17,205.0) & (18,065) & 5% \\ \hline 1,115.0 & 1,666.0 & 33% \\ \hline(43.0) & (1,523.0) & 97% \\ \hline 655.0 & 922.0 & 29% \\ \hline(1,944.0) & (1,976.0) & 2% \\ \hline 140.0 & 331.0 & 58% \\ \hline(77.0) & (580.0) & 87% \\ \hline 9.0 & 11.0 & 18% \\ \hline(369.0) & (251.0) & 47% \\ \hline(18.0) & (41.0) & 56% \\ \hline(455.0) & (861.0) & 47% \\ \hline(367) & (239.0) & 54% \\ \hline(822.0) & (1,100.0) & 25% \\ \hline & & \end{tabular} Finance costs Others Loss before tax Tax Loss for the year Consolidated Balance Sheet as at 31 March 20222021 (Em) Non current assets PPE Intangible assets Right-of-use assets Other financial assets Investment in equity accounted investees Other non-current assets and investments TOTAL ASSETS Equity Ordinary shares Capital redemption reserve Other reserves Non-controlling interest Non-current liabilities Long term borrowings Other NCL Current liabilities Short term borrowings Others Accounts payable Total liabilities TOTAL EQUITY AND LIABILITIES \begin{tabular}{|r|r|r|} \hline 6253.0 & 6461.0 & 3% \\ \hline 4,866.0 & 5,387.0 & 10% \\ \hline 568.0 & 543.0 & 5% \\ \hline 185.0 & 341.0 & 46% \\ \hline 321.0 & 316.0 & 2% \\ \hline 835.0 & 451.0 & 85% \\ \hline 13,028.0 & 13,499.0 & 3% \\ \hline \end{tabular} JLR olc 2022&2021 Consolidated Cash flow statement for the year ended 31 March - Em OPERATING CASH FLOWS Net cash flows from operating activities 20222021 Cash flows from investing activities Purchase of property, plant and equipment Proceeds from sale of PPE Movements in short-term deposits and other investments \begin{tabular}{l|l} \hline 434.0 & 2,326.0 \\ \hline \end{tabular} Net cash outflows relating to intangible asset expenditure Finance income received Others Net cash flows used in investing activities \begin{tabular}{|r|r|} \hline(712.0) & (1,050.0) \\ \hline 7.0 & 8.0 \\ \hline 831.0 & 343.0 \\ \hline(481) & (799.0) \\ \hline 8 & 14.0 \\ \hline(16.0) & 15.0 \\ \hline(363.0) & (1,469.0) \\ \hline \end{tabular} Cash flows from financing activities Proceeds from borrowings Repayment of borrowings \begin{tabular}{r|r} 2,095.0 & 1,953.0 \\ \hline(1,347.0) & (749.0) \\ \hline(402.0) & (313.0) \\ \hline(71.0) & (79.0) \\ \hline 275.0 & 812.0 \\ \hline \end{tabular} CASH BALANCES Net cash increase/(decrease) in year Cash at beginning of year Effects of foreign exchange Cash at end of year Cash at end of year (1) Debt: this has been calculated as the total of the current and non-current borrowing. (2) Capital Employed: this has been calculated as the total debt (given above) plus equity JLR plc 2022&2021 Financial statements m CONSOLIDATED INCOME STATEMENT Revenue Cost of sales Gross profit Exceptional items - note 4 Other income \& Engineering cost capitalised Depreciation and amortisation Foreign exchange gain Operating loss Finance income \begin{tabular}{|r|r|r|} \hline 2022 & 2021% change \\ \hline 18,320.0 & 19,731.0 & 7% \\ \hline(17,205.0) & (18,065) & 5% \\ \hline 1,115.0 & 1,666.0 & 33% \\ \hline(43.0) & (1,523.0) & 97% \\ \hline 655.0 & 922.0 & 29% \\ \hline(1,944.0) & (1,976.0) & 2% \\ \hline 140.0 & 331.0 & 58% \\ \hline(77.0) & (580.0) & 87% \\ \hline 9.0 & 11.0 & 18% \\ \hline(369.0) & (251.0) & 47% \\ \hline(18.0) & (41.0) & 56% \\ \hline(455.0) & (861.0) & 47% \\ \hline(367) & (239.0) & 54% \\ \hline(822.0) & (1,100.0) & 25% \\ \hline & & \end{tabular} Finance costs Others Loss before tax Tax Loss for the year Consolidated Balance Sheet as at 31 March 20222021 (Em) Non current assets PPE Intangible assets Right-of-use assets Other financial assets Investment in equity accounted investees Other non-current assets and investments TOTAL ASSETS Equity Ordinary shares Capital redemption reserve Other reserves Non-controlling interest Non-current liabilities Long term borrowings Other NCL Current liabilities Short term borrowings Others Accounts payable Total liabilities TOTAL EQUITY AND LIABILITIES \begin{tabular}{|r|r|r|} \hline 6253.0 & 6461.0 & 3% \\ \hline 4,866.0 & 5,387.0 & 10% \\ \hline 568.0 & 543.0 & 5% \\ \hline 185.0 & 341.0 & 46% \\ \hline 321.0 & 316.0 & 2% \\ \hline 835.0 & 451.0 & 85% \\ \hline 13,028.0 & 13,499.0 & 3% \\ \hline \end{tabular} JLR olc 2022&2021 Consolidated Cash flow statement for the year ended 31 March - Em OPERATING CASH FLOWS Net cash flows from operating activities 20222021 Cash flows from investing activities Purchase of property, plant and equipment Proceeds from sale of PPE Movements in short-term deposits and other investments \begin{tabular}{l|l} \hline 434.0 & 2,326.0 \\ \hline \end{tabular} Net cash outflows relating to intangible asset expenditure Finance income received Others Net cash flows used in investing activities \begin{tabular}{|r|r|} \hline(712.0) & (1,050.0) \\ \hline 7.0 & 8.0 \\ \hline 831.0 & 343.0 \\ \hline(481) & (799.0) \\ \hline 8 & 14.0 \\ \hline(16.0) & 15.0 \\ \hline(363.0) & (1,469.0) \\ \hline \end{tabular} Cash flows from financing activities Proceeds from borrowings Repayment of borrowings \begin{tabular}{r|r} 2,095.0 & 1,953.0 \\ \hline(1,347.0) & (749.0) \\ \hline(402.0) & (313.0) \\ \hline(71.0) & (79.0) \\ \hline 275.0 & 812.0 \\ \hline \end{tabular} CASH BALANCES Net cash increase/(decrease) in year Cash at beginning of year Effects of foreign exchange Cash at end of year Cash at end of year (1) Debt: this has been calculated as the total of the current and non-current borrowing. (2) Capital Employed: this has been calculated as the total debt (given above) plus equity