can you provide the calculated matrics

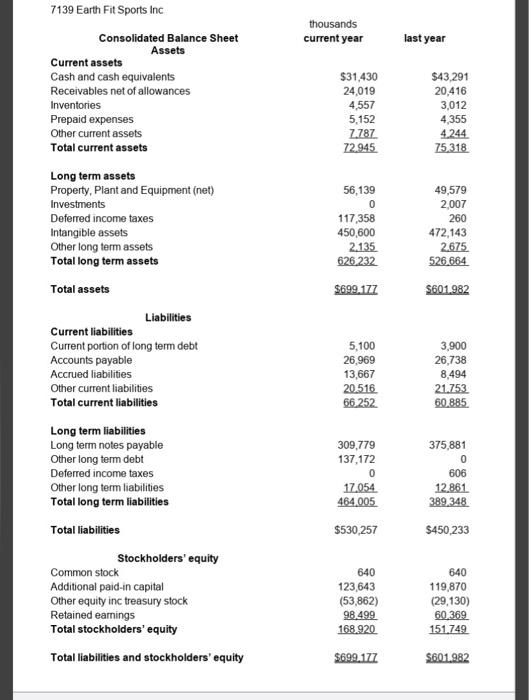

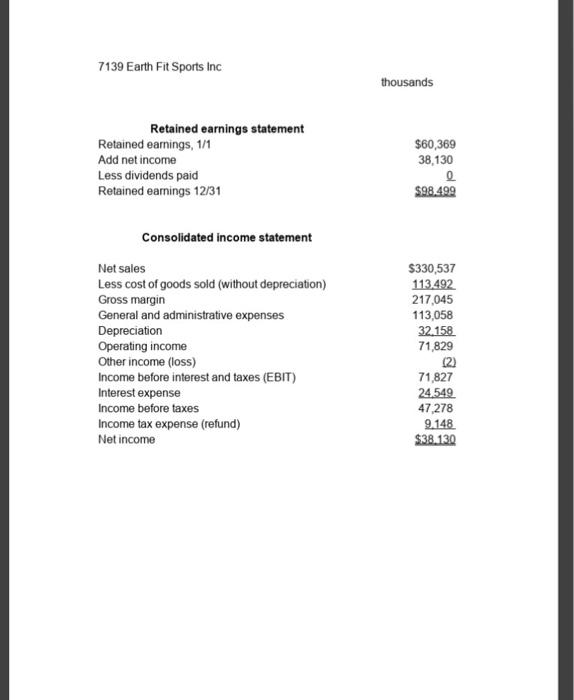

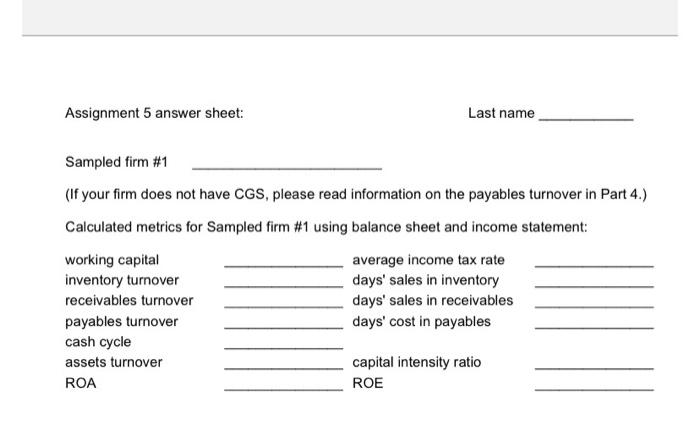

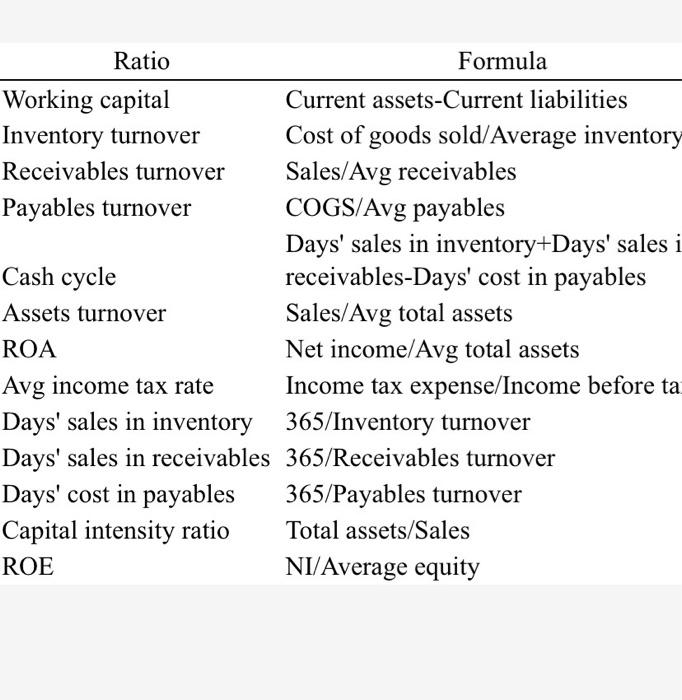

thousands current year last year $31,430 24,019 4,557 5,152 Z787 72.945 $43,291 20,416 3,012 4,355 4244 75318 56,139 0 117,358 450,600 2.135 626.232 49,579 2,007 260 472,143 2.675 526.664 7139 Earth Fit Sports Inc Consolidated Balance Sheet Assets Current assets Cash and cash equivalents Receivables net of allowances Inventories Prepaid expenses Other current assets Total current assets Long term assets Property, Plant and Equipment (net) Investments Deferred income taxes Intangible assets Other long term assets Total long term assets Total assets Liabilities Current liabilities Current portion of long term debt Accounts payable Accrued liabilities Other current liabilities Total current liabilities Long term liabilities Long term notes payable Other long term debt Deferred income taxes Other long term liabilities Total long term liabilities Total liabilities $699.177 5601.982 5,100 26,969 13,667 20.516 66.252 3,900 26,738 8,494 21.753 60.885 309,779 137,172 375,881 0 606 12.861 389.348 17.054 464.005 $530,257 $450,233 Stockholders' equity Common stock Additional paid in capital Other equity inc treasury stock Retained earnings Total stockholders' equity 640 123,643 (53,862) 98.499 168.920 640 119,870 (29,130) 60.369 151.749 Total liabilities and stockholders' equity $699.177 $601982 7139 Earth Fit Sports Inc thousands Retained earnings statement Retained earnings, 1/1 Add net income Less dividends paid Retained earnings 12/31 $60,369 38,130 0 $98.499 Consolidated income statement Net sales Less cost of goods sold (without depreciation) Gross margin General and administrative expenses Depreciation Operating income Other income (loss) Income before interest and taxes (EBIT) Interest expense Income before taxes Income tax expense (refund) Net income $330,537 113.492 217,045 113,058 32.158 71,829 122 71,827 24.549 47 278 9.148 $38.130 Assignment 5 answer sheet: Last name Sampled firm #1 (If your firm does not have CGS, please read information on the payables turnover in Part 4.) Calculated metrics for Sampled firm #1 using balance sheet and income statement: working capital average income tax rate inventory turnover days' sales in inventory receivables turnover days' sales in receivables payables turnover days' cost in payables cash cycle assets turnover capital intensity ratio ROA ROE Ratio Formula Working capital Current assets-Current liabilities Inventory turnover Cost of goods sold/Average inventory Receivables turnover Sales/Avg receivables Payables turnover COGS/Avg payables Days' sales in inventory+Days' sales i Cash cycle receivables-Days' cost in payables Assets turnover Sales/Avg total assets ROA Net income/Avg total assets Avg income tax rate Income tax expense/Income before ta Days' sales in inventory 365/Inventory turnover Days' sales in receivables 365/Receivables turnover Days' cost in payables 365/Payables turnover Capital intensity ratio Total assets/Sales ROE NI/Average equity