Answered step by step

Verified Expert Solution

Question

1 Approved Answer

can you provide the financial calculator steps as well? You decide to begin saving for a vacation in 3 years. You can deposit $4,000 at

can you provide the financial calculator steps as well?

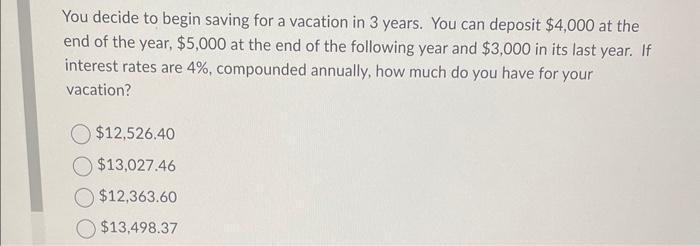

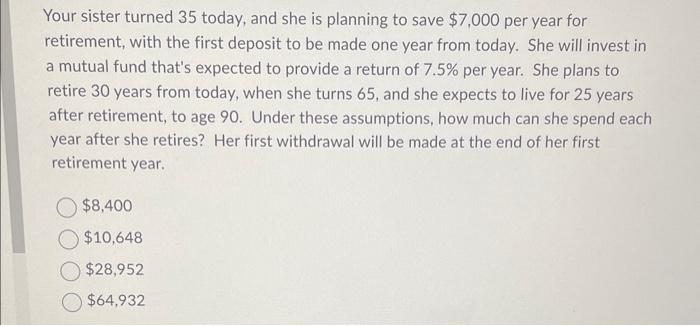

You decide to begin saving for a vacation in 3 years. You can deposit $4,000 at the end of the year, $5,000 at the end of the following year and $3,000 in its last year. If interest rates are 4%, compounded annually, how much do you have for your vacation? $12,526.40$13,027.46$12,363.60$13,498.37 Your sister turned 35 today, and she is planning to save $7,000 per year for retirement, with the first deposit to be made one year from today. She will invest in a mutual fund that's expected to provide a return of 7.5% per year. She plans to retire 30 years from today, when she turns 65 , and she expects to live for 25 years after retirement, to age 90 . Under these assumptions, how much can she spend each year after she retires? Her first withdrawal will be made at the end of her first retirement year. $8,400$10,648$28,952$64,932

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started