Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Can you provide the formulas Scenario 4 A company has developed a novel approach to prevent the spread of viruses and germs in offices and

Can you provide the formulas

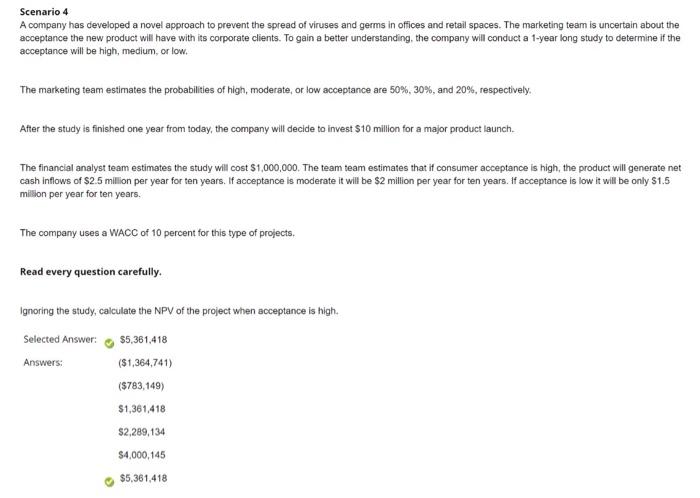

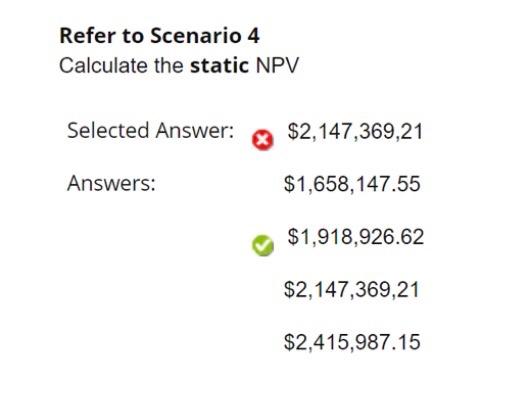

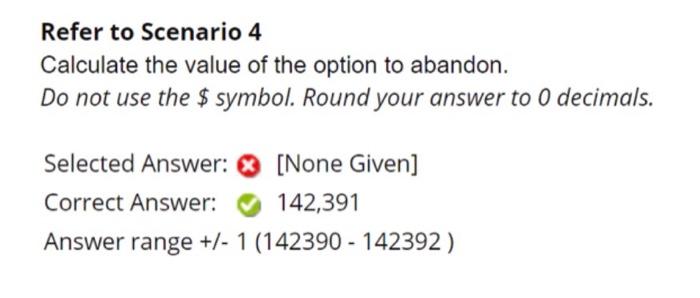

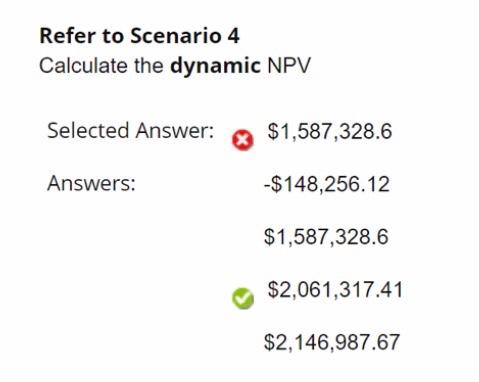

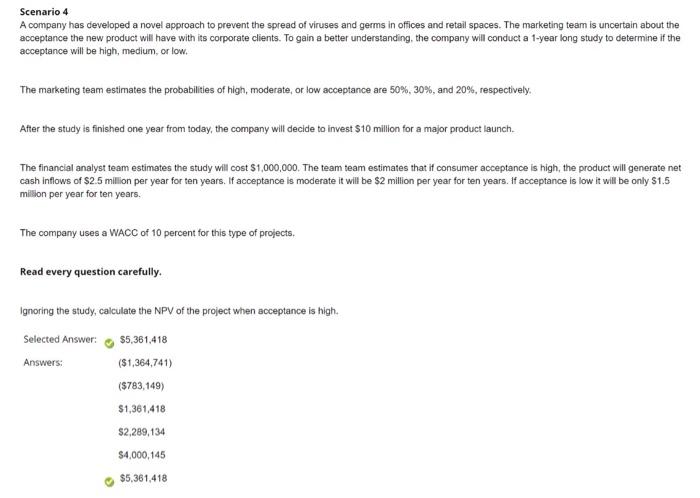

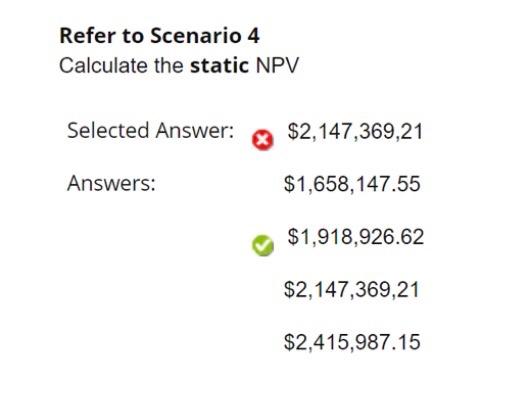

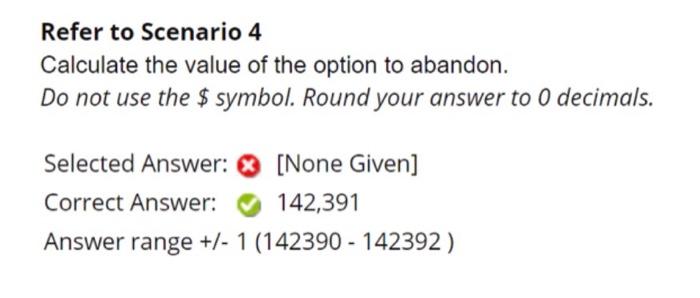

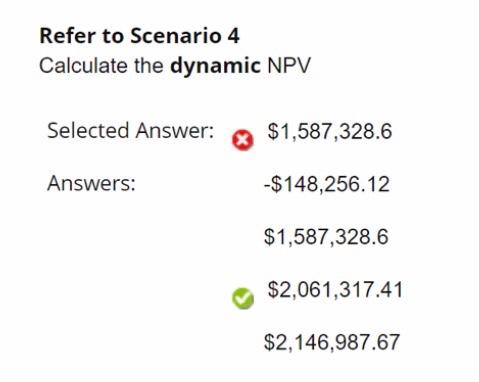

Scenario 4 A company has developed a novel approach to prevent the spread of viruses and germs in offices and retail spaces. The marketing team is uncertain about the acceptance the new product will have with its corporate clients. To gain a better understandingthe company will conduct a 1-year long study to determine if the acceptance will be high, medium, or low. The marketing team estimates the probabilities of high, moderate, or low acceptance are 50%, 30%, and 20%, respectively, After the study is finished one year from today, the company will decide to invest $10 million for a major product launch The financial analyst team estimates the study will cost $1,000,000. The team team estimates that if consumer acceptance is high, the product will generate net cash inflows of $2.5 million per year for ten years. If acceptance is moderate it will be $2 million per year for ten years. If acceptance is low it will be only $1.5 milion per year for ten years. The company uses a WACC of 10 percent for this type of projects. Read every question carefully. Ignoring the study, calculate the NPV of the project when acceptance is high. Selected Answer: $5,361,418 Answers: ($1,364,741) (5783,149) $1,361,418 $2,289,134 $4,000,145 $5,361,418 Refer to Scenario 4 Calculate the static NPV Selected Answer: $2,147,369,21 Answers: $1,658,147.55 $1,918,926.62 $2,147,369,21 $2,415,987.15 Refer to Scenario 4 Calculate the value of the option to abandon. Do not use the $ symbol. Round your answer to 0 decimals. Selected Answer: [None Given] Correct Answer: 142,391 Answer range +/- 1 (142390 - 142392) Refer to Scenario 4 Calculate the dynamic NPV Selected Answer: $1,587,328.6 Answers: -$ 148,256.12 $1,587,328.6 $2,061,317.41 $2,146,987.67

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started