Answered step by step

Verified Expert Solution

Question

1 Approved Answer

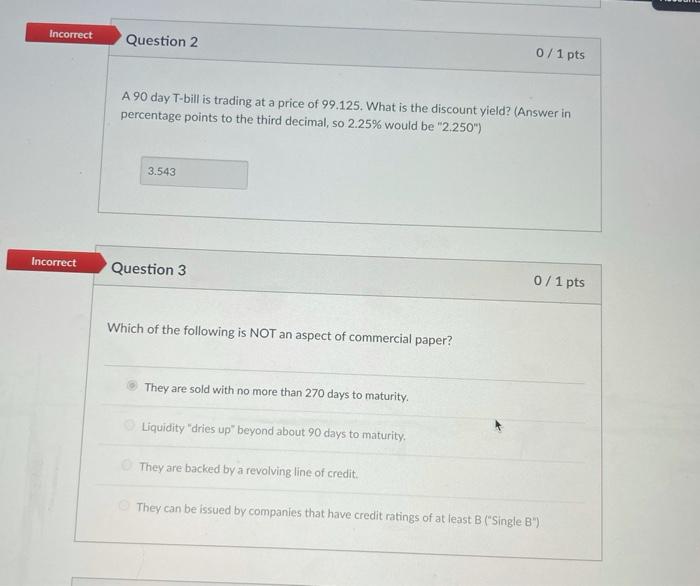

can you provide work/formulas you used as well, thank you! Incorrect Question 2 0/1 pts A 90 day T-bill is trading at a price of

can you provide work/formulas you used as well, thank you!

Incorrect Question 2 0/1 pts A 90 day T-bill is trading at a price of 99.125. What is the discount yield? (Answer in percentage points to the third decimal, so 2.25% would be "2.250") 3.543 Incorrect Question 3 0/1 pts Which of the following is NOT an aspect of commercial paper? They are sold with no more than 270 days to maturity. Liquidity "dries up" beyond about 90 days to maturity, They are backed by a revolving line of credit, They can be issued by companies that have credit ratings of at least B("Single B)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started