Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Can you see if my answers are correct? The Sales Mix percentages for Quacko Mullen's Gourmet Wine Divisions Paris and Vienna arc 70% and 30%.

Can you see if my answers are correct?

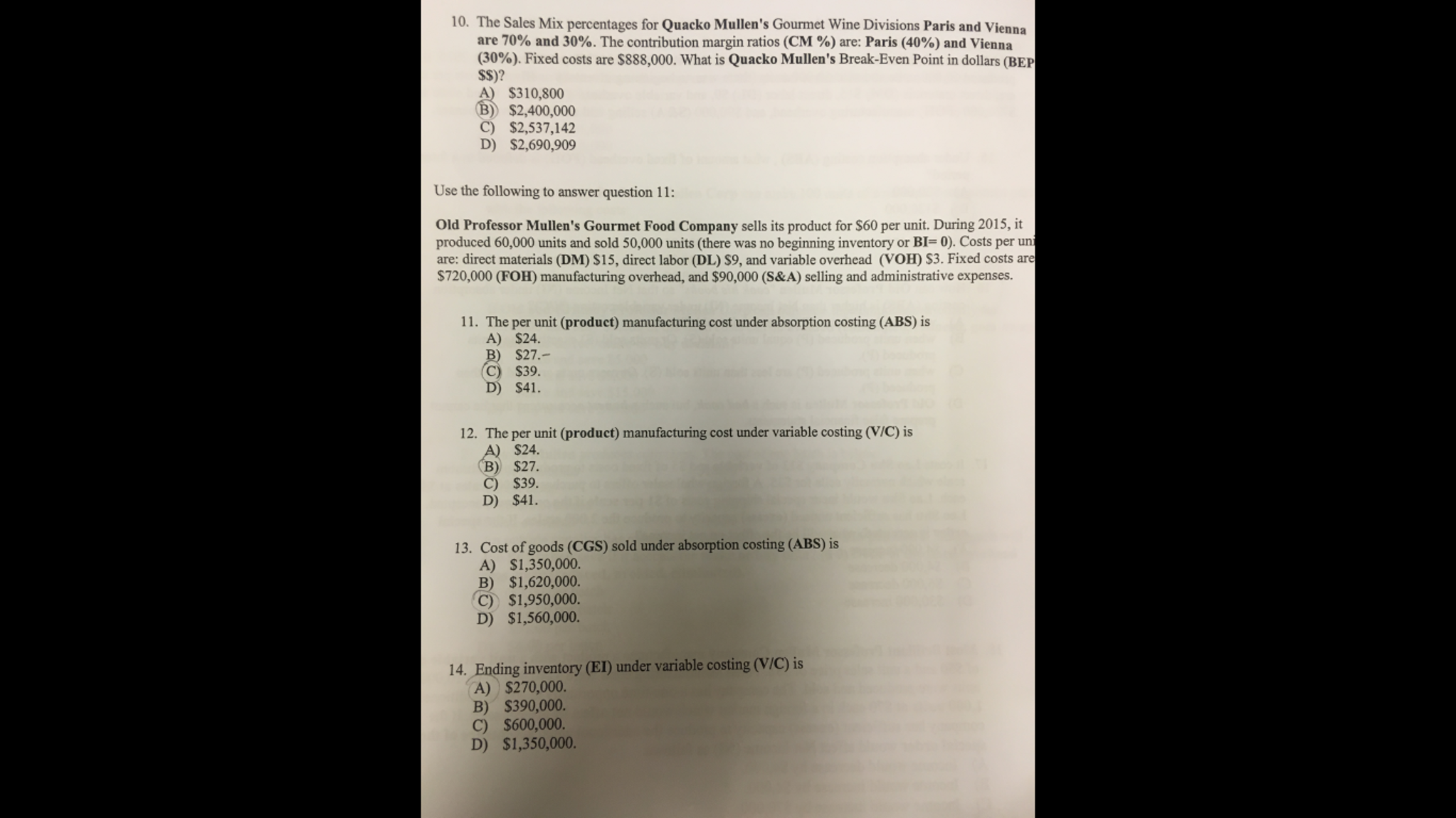

The Sales Mix percentages for Quacko Mullen's Gourmet Wine Divisions Paris and Vienna arc 70% and 30%. The contribution margin ratios (CM %) are: Paris (40%) and Vienna (30%). Fixed costs are $888,000. What is Quacko Mullen's Break-Even Point in dollars (BEP SS)? A) 5310, 800 B) $2, 400,000 C) $2, 537, 142 D) $2, 690, 909 Use the following to answer question 11: Old Professor Mullen's Gourmet Food Company sells its product for $60 per unit. During 2015, it produced 60,000 units and sold 50,000 units (there was no beginning inventory or BI = 0). Costs per unit are: direct materials (DM) $15, direct labor (DL.) S9, and variable overhead (VOH) $3. Fixed costs are $720,000 (FOH) manufacturing overhead, and $90,000 (S&A) selling and administrative expenses. The per unit (product) manufacturing cost under absorption costing (ABS) is A) $24. B) $27. C) $39. D) $41. The per unit (product) manufacturing cost under variable costing (V/C) is $24. B) $27 C) $39. D) $41. Cost of goods (CGS) sold under absorption costing (ABS) is A) $1, 350,000. B) $1, 620,000. $1, 950,000. D) $1, 560,000. Ending inventory (EI) under variable costing (V/C) is A) 5270,000. B) $390,000. C) $600,000. D) $1, 350,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started