Answered step by step

Verified Expert Solution

Question

1 Approved Answer

can you see it now? 2 arena Based on the above Trial Balance fill in the Following Financial Statements: INCOME STATEMENT for the year ended

can you see it now?

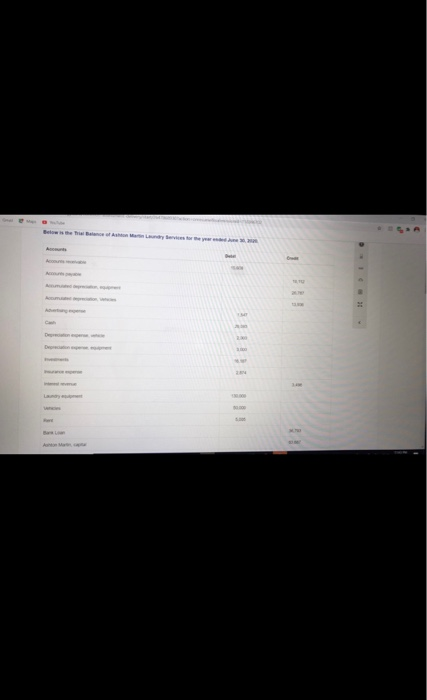

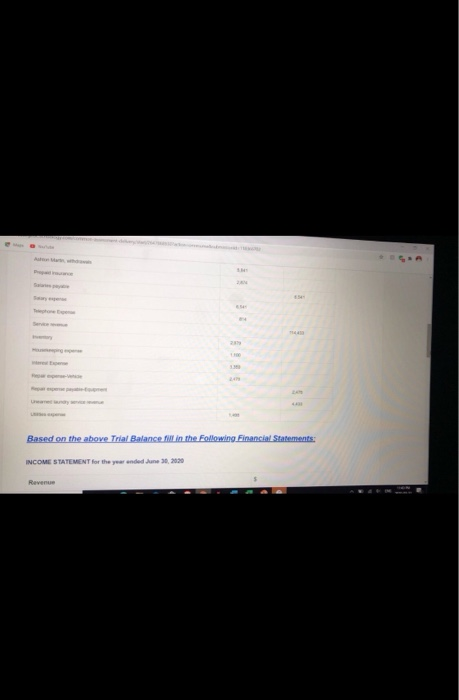

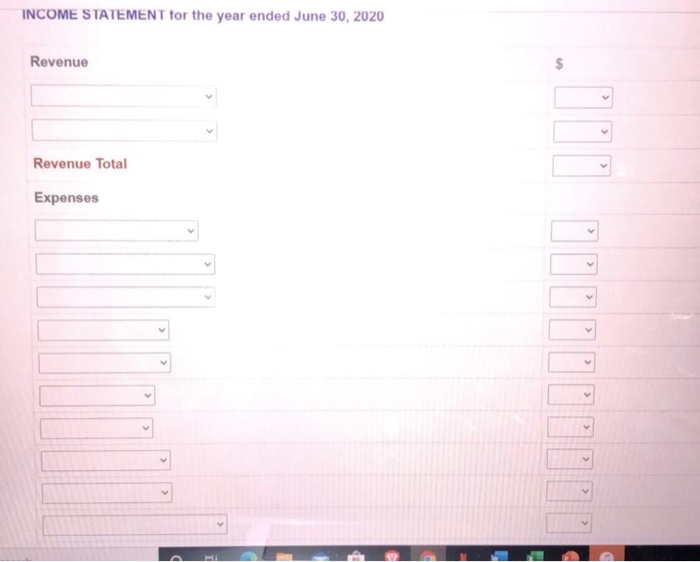

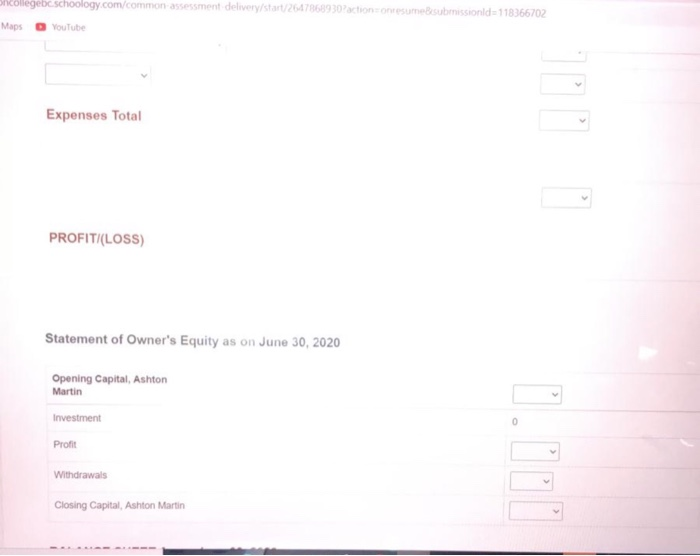

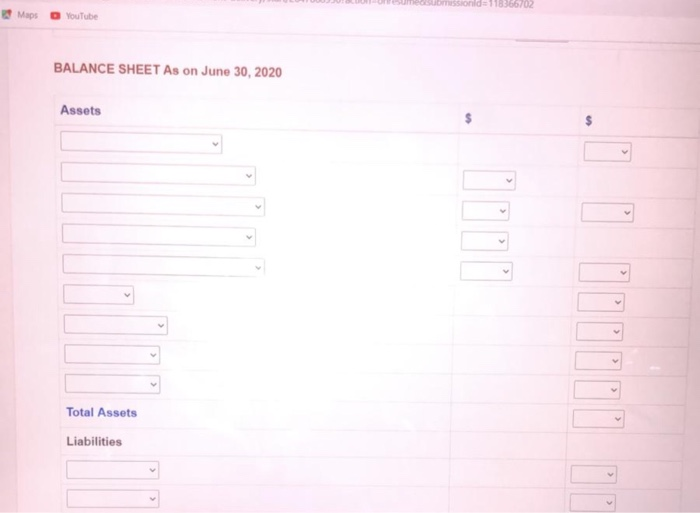

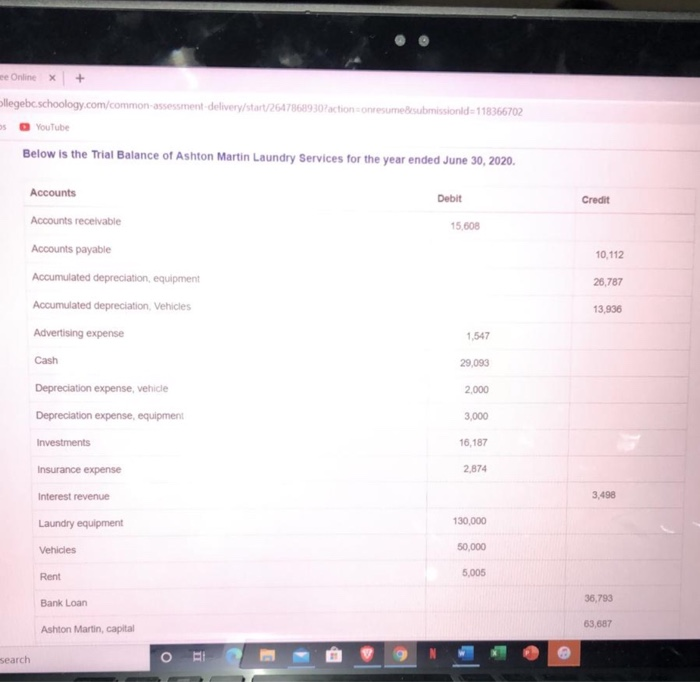

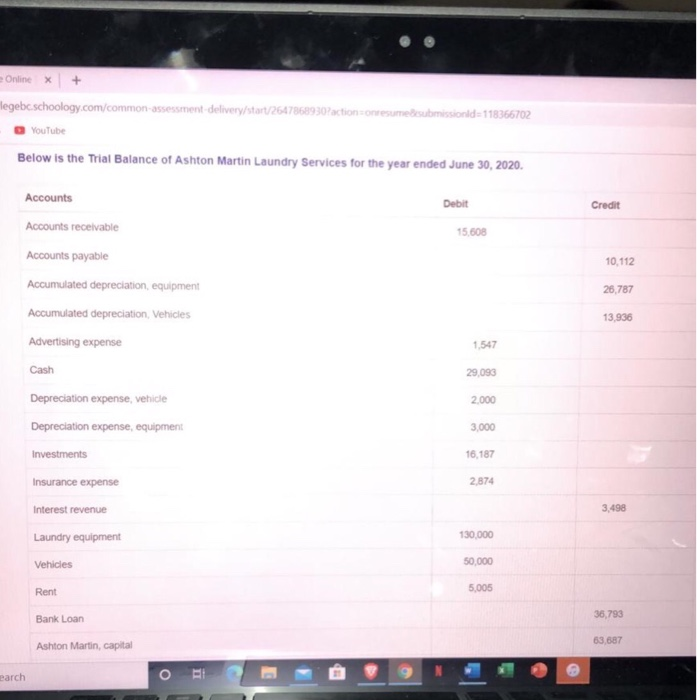

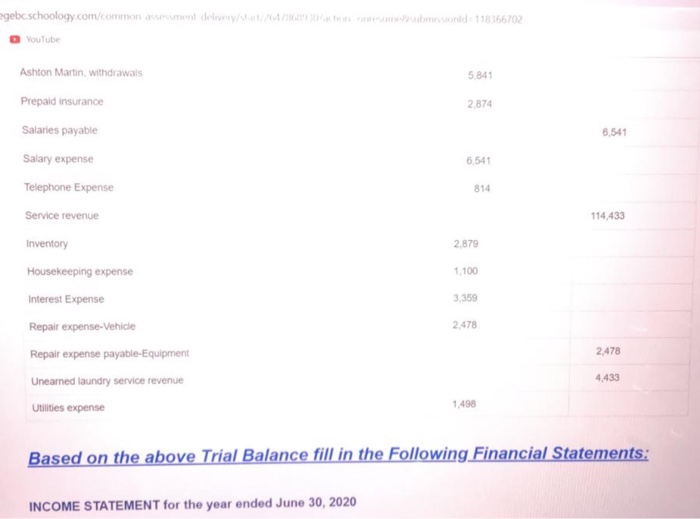

2 arena Based on the above Trial Balance fill in the Following Financial Statements: INCOME STATEMENT for the year ended June 30, 2030 Revenue INCOME STATEMENT for the year ended June 30, 2020 Revenue $ II. Revenue Total > Expenses > collegebc.schoology.com/common assessment delivery/start/2647868930?action onresumesubmissionid=118366702 Maps YouTube Expenses Total PROFIT LOSS) Statement of Owner's Equity as on June 30, 2020 Opening Capital, Ashton Martin Investment Profit 0 Withdrawals Closing Capital, Ashton Martin Submissionid=116366702 e Maps YouTube BALANCE SHEET As on June 30, 2020 Assets $ Total Assets Liabilities e Online x + bllegebc.schoology.com/common-assessment-delivery/start/2647868930?action onresume&submissionId=118366702 YouTube Below is the Trial Balance of Ashton Martin Laundry Services for the year ended June 30, 2020. Debit Credit 15,608 10,112 Accounts Accounts receivable Accounts payable Accumulated depreciation, equipment Accumulated depreciation Vehicles Advertising expense Cash 26,787 13,936 1,547 29,093 2.000 Depreciation expense, vehicle Depreciation expense, equipment Investments 3,000 16,187 2,874 Insurance expense Interest revenue Laundry equipment 3,498 130,000 Vehicles 50,000 Rent 5,005 36,793 Bank Loan Ashton Martin, capital 63,687 search o Online legebc.schoology.com/common assessment delivery/start/2647868930?action=onresume submissionid=118366702 YouTube Below is the Trial Balance of Ashton Martin Laundry Services for the year ended June 30, 2020. Debit Credit 15,608 10.112 26,787 13,936 Accounts Accounts receivable Accounts payable Accumulated depreciation equipment Accumulated depreciation, Vehicles Advertising expense Cash Depreciation expense, vehicle Depreciation expense, equipment Investments Insurance expense 1,547 29,093 2.000 3,000 16.187 2.874 3.498 Interest revenue Laundry equipment 130,000 Vehicles 50,000 Rent 5,005 Bank Loan 36,793 Ashton Martin, capital 63,687 earch egebc.schoology.com/common amont delivenewbessionid=118366702 YouTube 5.841 2.874 6,541 6,541 814 114,433 Ashton Martin, withdrawals Prepaid insurance Salaries payable Salary expense Telephone Expense Service revenue Inventory Housekeeping expense Interest Expense Repair expense-Vehicle Repair expense payable-Equipment Unearned laundry service revenue Utilities expense 2.879 1.100 3.359 2.478 2.478 4,433 1.498 Based on the above Trial Balance fill in the Following Financial Statements: INCOME STATEMENT for the year ended June 30, 2020 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started