Answered step by step

Verified Expert Solution

Question

1 Approved Answer

can you show all work for every calculation please. 10. If Allie purchases a car for $35,000 and pays $4,000 down and the balance in

can you show all work for every calculation please.

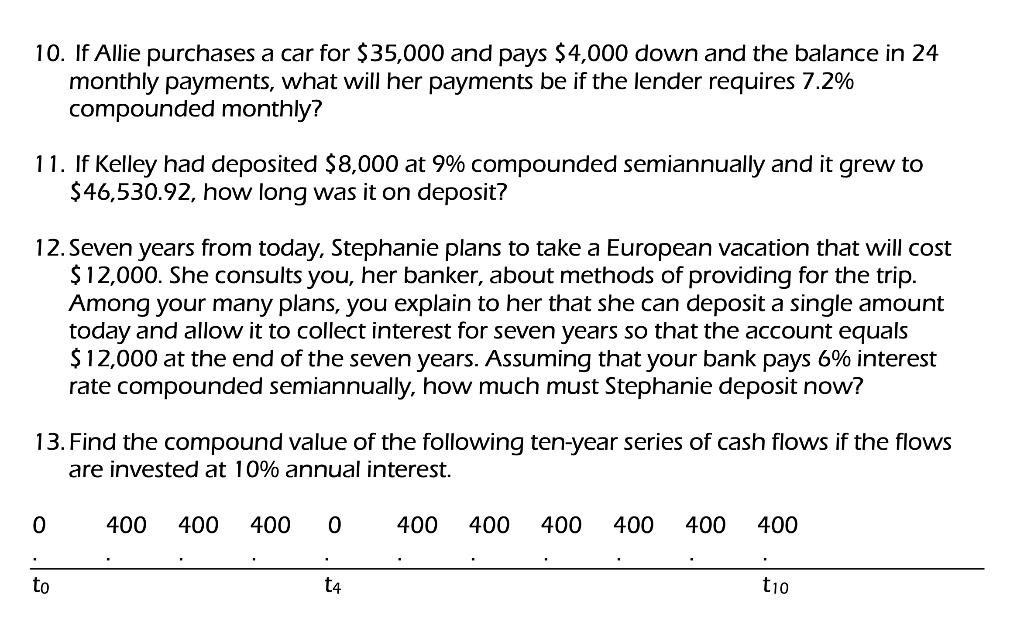

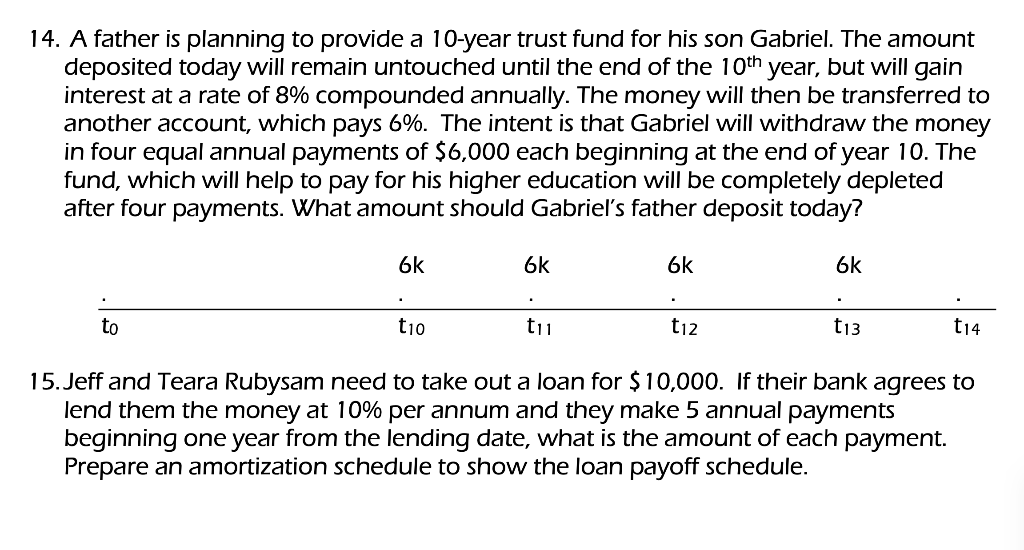

10. If Allie purchases a car for $35,000 and pays $4,000 down and the balance in 24 monthly payments, what will her payments be if the lender requires 7.2% compounded monthly? 11. If Kelley had deposited $8,000 at 9% compounded semiannually and it grew to $46,530.92, how long was it on deposit? 12. Seven years from today, Stephanie plans to take a European vacation that will cost $ 12,000. She consults you, her banker, about methods of providing for the trip. Among your many plans, you explain to her that she can deposit a single amount today and allow it to collect interest for seven years so that the account equals $12,000 at the end of the seven years. Assuming that your bank pays 6% interest rate compounded semiannually, how much must Stephanie deposit now? 13. Find the compound value of the following ten-year series of cash flows if the flows are invested at 10% annual interest. 0 400 400 400 0 400 400 400 400 400 400 to t4 t10 14. A father is planning to provide a 10-year trust fund for his son Gabriel. The amount deposited today will remain untouched until the end of the 10th year, but will gain interest at a rate of 8% compounded annually. The money will then be transferred to another account, which pays 6%. The intent is that Gabriel will withdraw the money in four equal annual payments of $6,000 each beginning at the end of year 10. The fund, which will help to pay for his higher education will be completely depleted after four payments. What amount should Gabriel's father deposit today? 6k 6k 6k 6k to t10 tu t12 t13 t14 15.Jeff and Teara Rubysam need to take out a loan for $10,000. If their bank agrees to lend them the money at 10% per annum and they make 5 annual payments beginning one year from the lending date, what is the amount of each payment. Prepare an amortization schedule to show the loan payoff scheduleStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started