Answered step by step

Verified Expert Solution

Question

1 Approved Answer

can you show how to solve this without excel? been asked to complete the capital budget for this project. So far, you have compiled the

can you show how to solve this without excel?

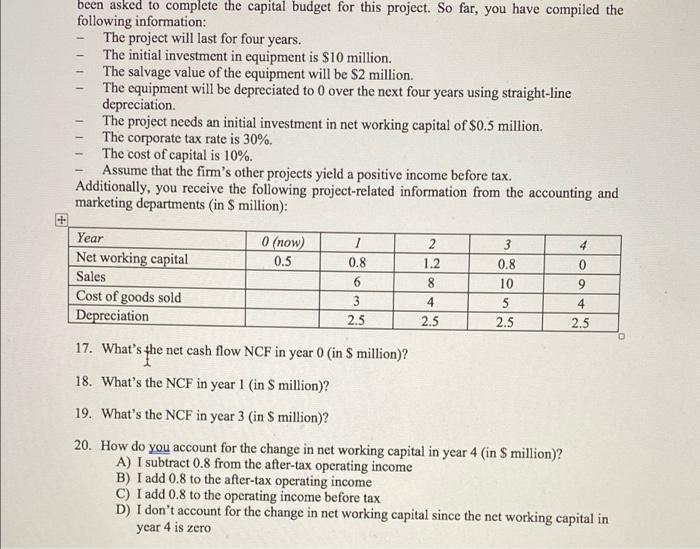

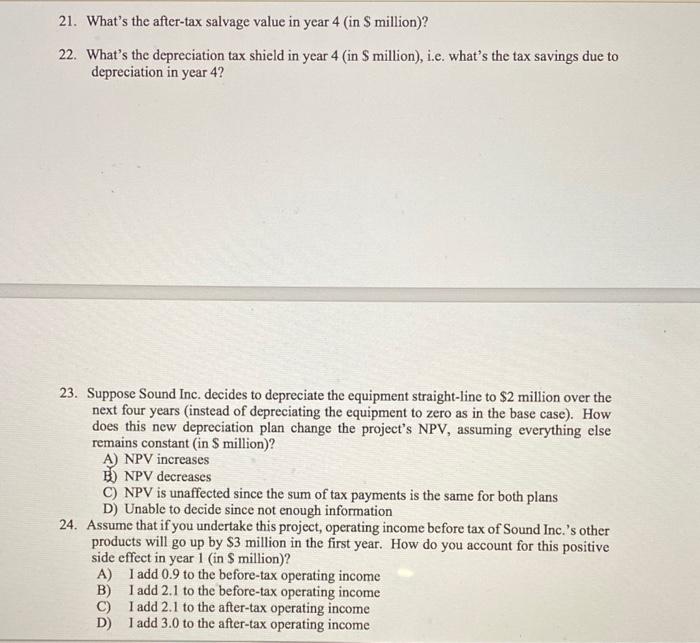

been asked to complete the capital budget for this project. So far, you have compiled the following information: The project will last for four years. The initial investment in equipment is $10 million. The salvage value of the equipment will be $2 million. The equipment will be depreciated to 0 over the next four years using straight-line depreciation. The project needs an initial investment in net working capital of $0.5 million. The corporate tax rate is 30%. The cost of capital is 10%. Assume that the firm's other projects yield a positive income before tax. Additionally, you receive the following project-related information from the accounting and marketing departments in $ million): 1 0 (now) 0.5 4 0.8 0 Year Net working capital Sales Cost of goods sold Depreciation 6 3 2.5 2 1.2 8 4 2.5 3 0.8 10 5 2.5 9 4 2.5 17. What's the net cash flow NCF in year 0 in 9 million)? 18. What's the NCF in year 1 in S million)? 19. What's the NCF in year 3 (in million)? 20. How do you account for the change in net working capital in year 4 in 9 million)? A) I subtract 0.8 from the after-tax operating income B) I add 0.8 to the after-tax operating income C) I add 0.8 to the operating income before tax D) I don't account for the change in net working capital since the networking capital in year 4 is zero 21. What's the after-tax salvage value in year 4 (in S million)? 22. What's the depreciation tax shield in year 4 (in million), i.e. what's the tax savings due to depreciation in year 4? 23. Suppose Sound Inc. decides to depreciate the equipment straight-line to $2 million over the next four years instead of depreciating the equipment to zero as in the base case). How does this new depreciation plan change the project's NPV, assuming everything else remains constant (in 9 million)? A) NPV increases B) NPV decreases C) NPV is unaffected since the sum of tax payments is the same for both plans D) Unable to decide since not enough information 24. Assume that if you undertake this project, operating income before tax of Sound Inc.'s other products will go up by S3 million in the first year. How do you account for this positive side effect in year 1 (in S million)? A) I add 0.9 to the before-tax operating income B) I add 2.1 to the before-tax operating income C) I add 2.1 to the after-tax operating income D) I add 3.0 to the after-tax operating income

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started