can you show me how to do this im new to excel and dont know what goes where in the cells. can you show md in excel

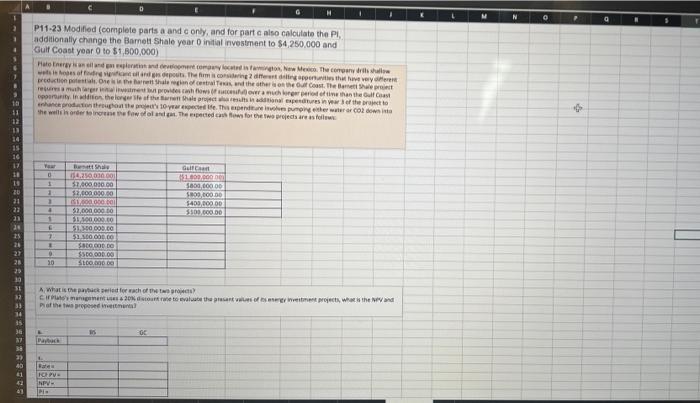

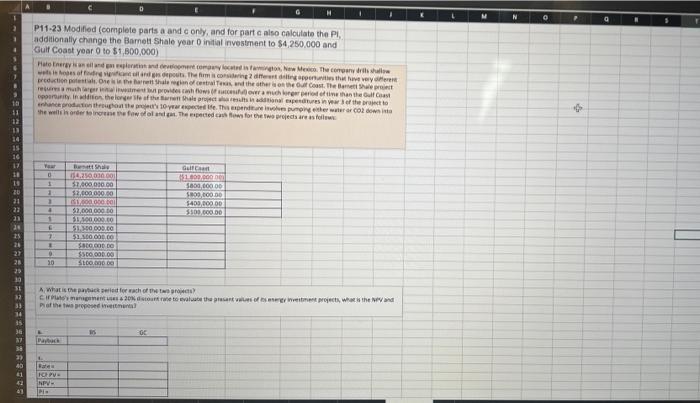

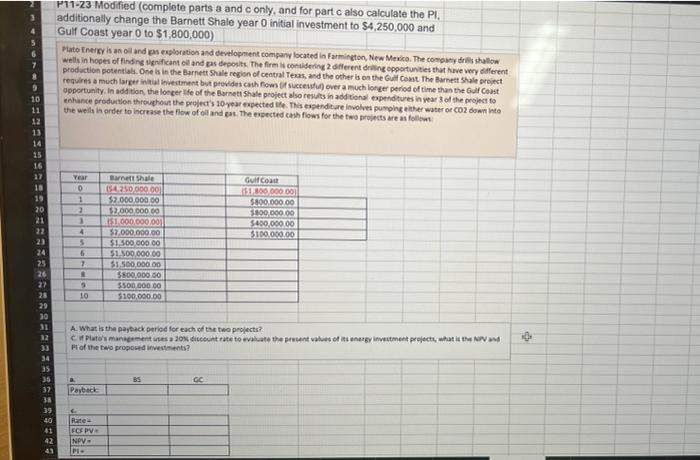

P11-23 Modified (complete parts a and conly, and for parte also calculate the PL additionally change the Bamott Shale year initial investment to $4,250,000 and Gulf Coast year 0 to $1,800,000) Halo nerando comer como coding Me The corres les offered and rout. The conservez des dels contin the very feet in pol. One Barrett She control in the throne cu Coast. The met er much we provides tash flow for a much error of time in the Gulf Com nhandong's 10 yece. This entre un punor etter Water coz con .. pourity In Won theory of the whole proces national expenditur now of the to he will order to refowl. The cows for the two projects are as follow 0 1 3 10 11 12 13 14 15 16 17 11 10 20 21 22 21 20 25 21 27 28 29 30 S1 12 33 14 BS 11001000 51.000.000.00 $2,000 000.00 1.000.000.00 52.000.000.00 98,00.000.00 51.80.000.00 $1.000 SOOD DO SSCO,000.00 $100.000.00 Gu 151.000.000 800,000 5890 000.00 5403,000.00 5903.00.00 1 . 1 7 10 A What is the period for each of the cream 20 ore to walthen en projects, whether and of the presenta GE 3 17 34 Pay 40 51 HOPPE NPV- Pis P11-23 Modified (complete parts a and conly, and for partc also calculate the PI. additionally change the Barnett Shale year O initial investment to $4,250,000 and 4 Gulf Coast year 0 to $1,800,000) 5 Pato Energy is an oil and ps exploration and development company located in Farmington, New Mexico. The company is shallow 6 wells in hopes of finding verificantll and gas deposits. The firm is considering offerent ring opportunities that have very different 7 production potential. One is in the Barnett Shale region of Central Texas, and the other is on the Gulf Coast. The Barnett Shale project 8 requires a much larger in investment but provides cash flow of success over a much longer period of time than the Gulf Coast 9 opportunity. In addition, the longer be of the Barnett Shale project also results in additional expenditures in year of the project to 10 enhance production throughout the project's 10 year expected. This expenditure involves pumping either water or CO2 down into 11 the wells in order to increase the flow of oil and gat. The expected cash flows for the two projets are as follows 12 13 14 15 16 17 Year ne Shale Gulf Coa 10 0 (54.250.000.00 1 800 000 000 19 1 $2.000.000.00 $800,000.00 20 2 $2.000.000.00 5000.000.00 21 3 151.000.000,00 5400.000.00 22 4 57.000.000.00 $100.000,00 23 5 31.500 000.00 24 6 $1.500.000.00 25 7 51.500.000.00 26 $800,000.00 27 9 SSD 000 00 28 10 $100,000.00 29 30 31 A. What is the payback period for each of the two projects? 12 Plato's managements 20discount rate to waste the procent values of its nagy investment projects, what is the NPV and 33 Pl of the two proposed investments? 34 35 30 BS GC 37 Payback 38 39 40 Rate- 41 FCFPV NPV PE 41