Answered step by step

Verified Expert Solution

Question

1 Approved Answer

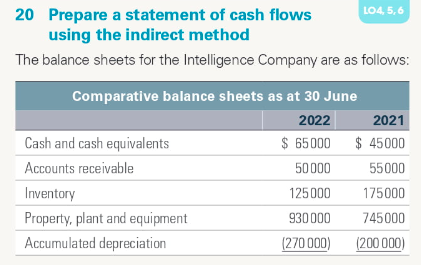

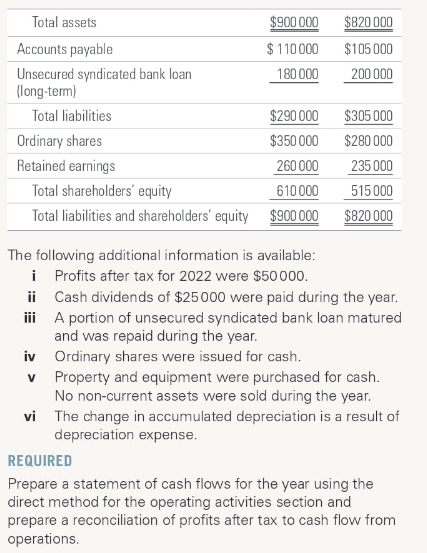

Can you show me the working out with getting the answers please? Thank you! 20 Prepare a statement of cash flows LO4, 5, 6 using

Can you show me the working out with getting the answers please?

Thank you!

20 Prepare a statement of cash flows LO4, 5, 6 using the indirect method The balance sheets for the Intelligence Company are as follows: Comparative balance sheets as at 30 June 2022 2021 Cash and cash equivalents $ 65000 $ 45000 Accounts receivable 50000 55000 Inventory 125000 175000 Property, plant and equipment 930000 745000 Accumulated depreciation (270 000) 200 000) $900 000 $ 110000 180 000 $820 000 $105 000 200 000 Total assets Accounts payable Unsecured syndicated bank loan (long-term) Total liabilities Ordinary shares Retained earnings Total shareholders' equity Total liabilities and shareholders' equity $290 000 $350 000 260 000 610000 $900 000 $305 000 $280 000 235 000 515 000 $820 000 The following additional information is available: i Profits after tax for 2022 were $50 000. ii Cash dividends of $25000 were paid during the year. iii A portion of unsecured syndicated bank loan matured and was repaid during the year. iv Ordinary shares were issued for cash. V Property and equipment were purchased for cash. No non-current assets were sold during the year, vi The change in accumulated depreciation is a result of depreciation expense. REQUIRED Prepare a statement of cash flows for the year using the direct method for the operating activities section and prepare a reconciliation of profits after tax to cash flow from operationsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started