Can you show the formulas you used too! Ty

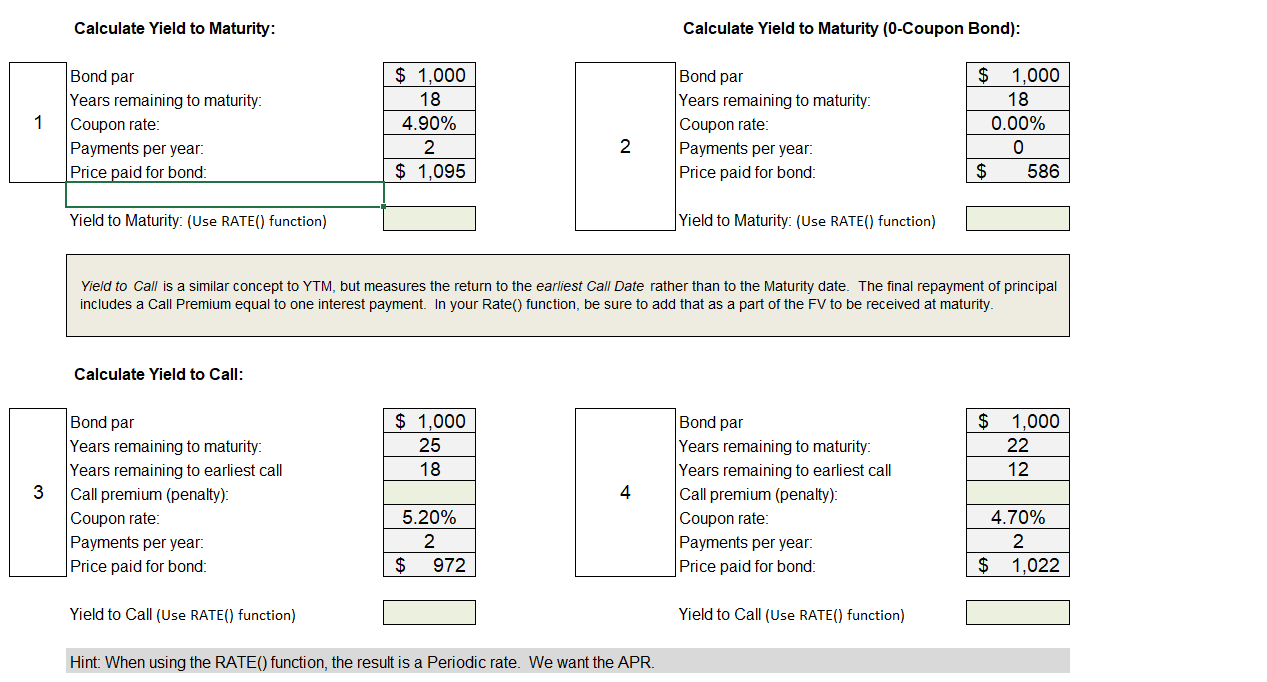

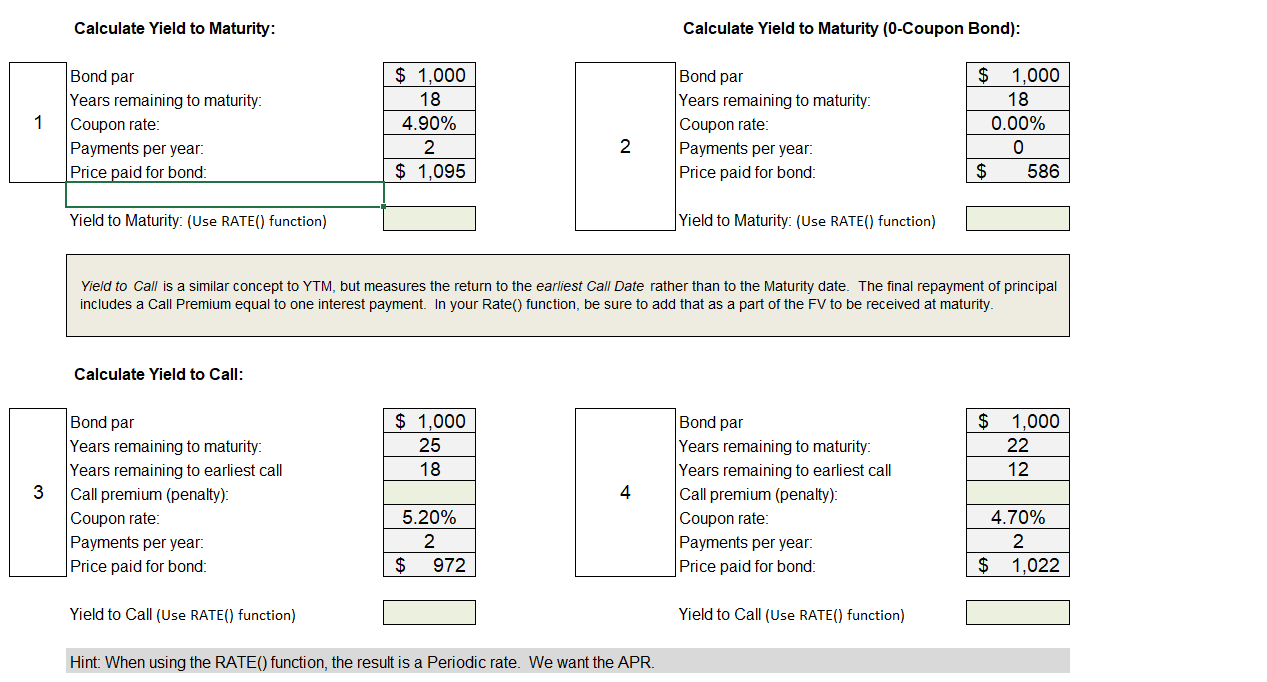

Calculate Yield to Maturity: Calculate Yield to Maturity (0-Coupon Bond): 1 Bond par Years remaining to maturity Coupon rate: Payments per year. Price paid for bond $ 1.000 18 4.90% 2 $ 1,095 Bond par Years remaining to maturity: Coupon rate: Payments per year. Price paid for bond: $ 1,000 18 0.00% 0 $ 586 2 Yield to Maturity: (Use RATE() function) Yield to Maturity: (Use RATE() function) Yield to Call is a similar concept to YTM, but measures the return to the earliest Call Date rather than to the Maturity date. The final repayment of principal includes a Call Premium equal to one interest payment. In your Rate() function, be sure to add that as a part of the FV to be received at maturity. Calculate Yield to Call: Bond par $ 1,000 25 18 $ 1,000 22 12 3 Bond par Years remaining to maturity: Years remaining to earliest call Call premium (penalty): Coupon rate: Payments per year: Price paid for bond: 4 5.20% 2 $ 972 Years remaining to maturity Years remaining to earliest call Call premium (penalty): Coupon rate: Payments per year. Price paid for bond: 4.70% 2 $ 1,022 Yield to Call (Use RATE() function) Yield to Call (Use RATE() function) Hint: When using the RATE() function, the result is a Periodic rate. We want the APR. Calculate Yield to Maturity: Calculate Yield to Maturity (0-Coupon Bond): 1 Bond par Years remaining to maturity Coupon rate: Payments per year. Price paid for bond $ 1.000 18 4.90% 2 $ 1,095 Bond par Years remaining to maturity: Coupon rate: Payments per year. Price paid for bond: $ 1,000 18 0.00% 0 $ 586 2 Yield to Maturity: (Use RATE() function) Yield to Maturity: (Use RATE() function) Yield to Call is a similar concept to YTM, but measures the return to the earliest Call Date rather than to the Maturity date. The final repayment of principal includes a Call Premium equal to one interest payment. In your Rate() function, be sure to add that as a part of the FV to be received at maturity. Calculate Yield to Call: Bond par $ 1,000 25 18 $ 1,000 22 12 3 Bond par Years remaining to maturity: Years remaining to earliest call Call premium (penalty): Coupon rate: Payments per year: Price paid for bond: 4 5.20% 2 $ 972 Years remaining to maturity Years remaining to earliest call Call premium (penalty): Coupon rate: Payments per year. Price paid for bond: 4.70% 2 $ 1,022 Yield to Call (Use RATE() function) Yield to Call (Use RATE() function) Hint: When using the RATE() function, the result is a Periodic rate. We want the APR