Can you solve all of them? If the reserve requirement is .5 and the Fed sells $10 million of bonds, what will happen to the money supply?

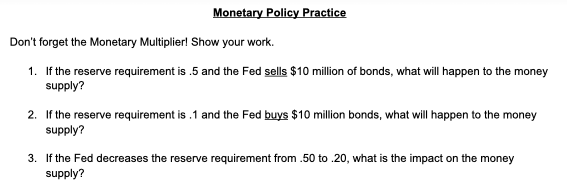

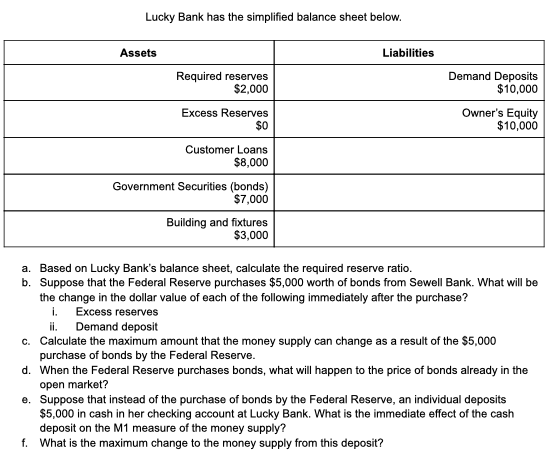

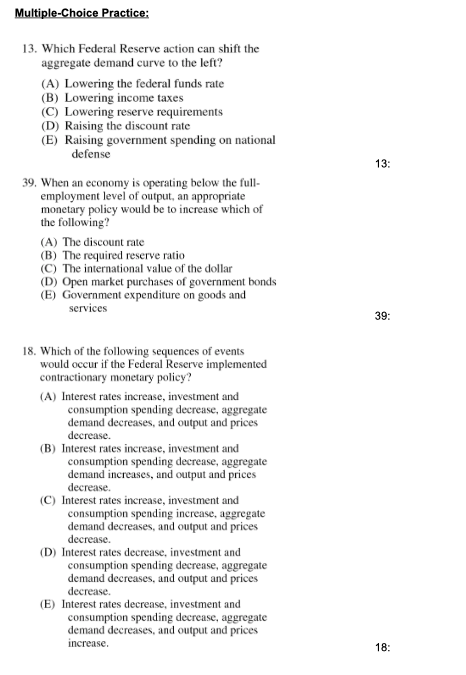

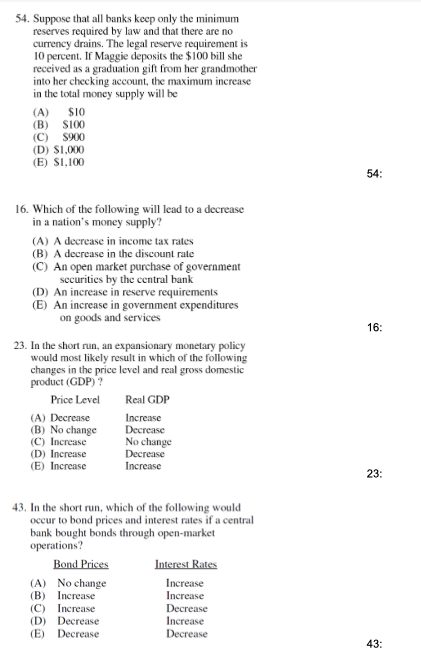

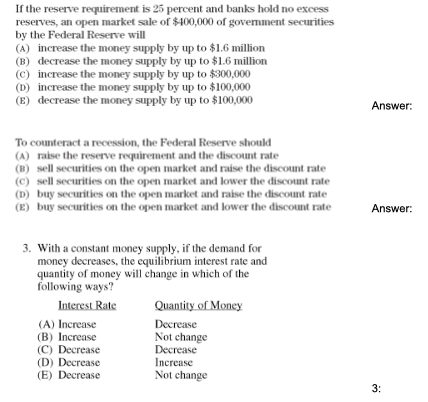

Monetary Policy Practice Don't forget the Monetary Multiplier! Show your work. 1. If the reserve requirement is .5 and the Fed sells $10 million of bonds, what will happen to the money supply? 2. If the reserve requirement is .1 and the Fed buys $10 million bonds, what will happen to the money supply? 3. If the Fed decreases the reserve requirement from .50 to .20, what is the impact on the money supply?Lucky Bank has the simplified balance sheet below. Assets Liabilities Required reserves Demand Deposits $2,000 $10,000 Excess Reserves Owner's Equity $0 $10,000 Customer Loans $8,000 Government Securities (bonds) $7,000 Building and fixtures $3,000 a. Based on Lucky Bank's balance sheet, calculate the required reserve ratio. b. Suppose that the Federal Reserve purchases $5,000 worth of bonds from Sewell Bank. What will be the change in the dollar value of each of the following immediately after the purchase? i. Excess reserves il. Demand deposit c. Calculate the maximum amount that the money supply can change as a result of the $5,000 purchase of bonds by the Federal Reserve. d. When the Federal Reserve purchases bonds, what will happen to the price of bonds already in the open market? e. Suppose that instead of the purchase of bonds by the Federal Reserve, an individual deposits $5,000 in cash in her checking account at Lucky Bank. What is the immediate effect of the cash deposit on the M1 measure of the money supply? f. What is the maximum change to the money supply from this deposit?Multiple-Choice Practice: 13. Which Federal Reserve action can shift the aggregate demand curve to the left? (A) Lowering the federal funds rate (B) Lowering income taxes (C) Lowering reserve requirements (D) Raising the discount rate (E) Raising government spending on national defense 13: 39. When an economy is operating below the full- employment level of output, an appropriate monetary policy would be to increase which of the following (A) The discount rate (B) The required reserve ratio (C) The international value of the dollar (D) Open market purchases of government bonds (E) Government expenditure on goods and services 39: 18. Which of the following sequences of events would occur if the Federal Reserve implemented contractionary monetary policy? (A) Interest rates increase, investment and consumption spending decrease, aggregate demand decreases, and output and prices decrease. (B) Interest rates increase, investment and consumption spending decrease, aggregate demand increases, and output and prices decrease. (C) Interest rates increase, investment and consumption spending increase, aggregate demand decreases, and output and prices decrease. (D) Interest rates decrease, investment and consumption spending decrease, aggregate demand decreases, and output and prices decrease. (E) Interest rates decrease, investment and consumption spending decrease, aggregate demand decreases, and output and prices increase. 18:54. Suppose that all banks keep only the minimum reserves required by law and that there are no currency drains. The legal reserve requirement is 10 percent. If Maggie deposits the $100 bill she received as a graduation gift from her grandmother into her checking account, the maximum increase in the total money supply will be (A) $10 (B) $100 (C) $900 (D) $1,000 (E) $1,100 54: 16. Which of the following will lead to a decrease in a nation's money supply? (A) A decrease in income tax rates (B) A decrease in the discount rate (C) An open market purchase of government securities by the central bank (D) An increase in reserve requirements (E) An increase in government expenditures on goods and services 16: 23. In the short run, an expansionary monetary policy would most likely result in which of the following changes in the price level and real gross domestic product (GDP) ? Price Level Real GDP (A) Decrease Increase (B) No change Decrease (C) Increase No change (D) Increase Decrease (E) Increase Increase 23: 43. In the short run, which of the following would occur to bond prices and interest rates if a central bank bought bonds through open-market operations? Bond Prices Interest Rates (A) No change Increase (B) Increase Increase (C) Increase Decrease (D) Decrease Increase (E) Decrease Decrease 43:If the reserve requirement is 25 percent and banks hold no excess reserves, an open market sale of $400,000 of government securities by the Federal Reserve will (A) increase the money supply by up to $1.6 million (B) decrease the money supply by up to $1.6 million (C) increase the money supply by up to $300,000 (D) increase the money supply by up to $100,000 (E) decrease the money supply by up to $100,000 Answer: To counteract a recession, the Federal Reserve should (A) raise the reserve requirement and the discount rate (B) sell securities on the open market and raise the discount rate (c) sell securities on the open market and lower the discount rate (D) buy securities on the open market and raise the discount rate (E) buy securities on the open market and lower the discount rate Answer: 3. With a constant money supply, if the demand for money decreases, the equilibrium interest rate and quantity of money will change in which of the following ways? Interest Rate Quantity of Money (A) Increase Decrease (B) Increase Not change (C) Decrease Decrease (D) Decrease Increase (E) Decrease Not change 3