Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Can you solve any of the questions without the expected market price on expiry? This question should refer to a put with the same strike/maturity

Can you solve any of the questions without the expected market price on expiry?

This question should refer to a put with the same strike/maturity as the call.

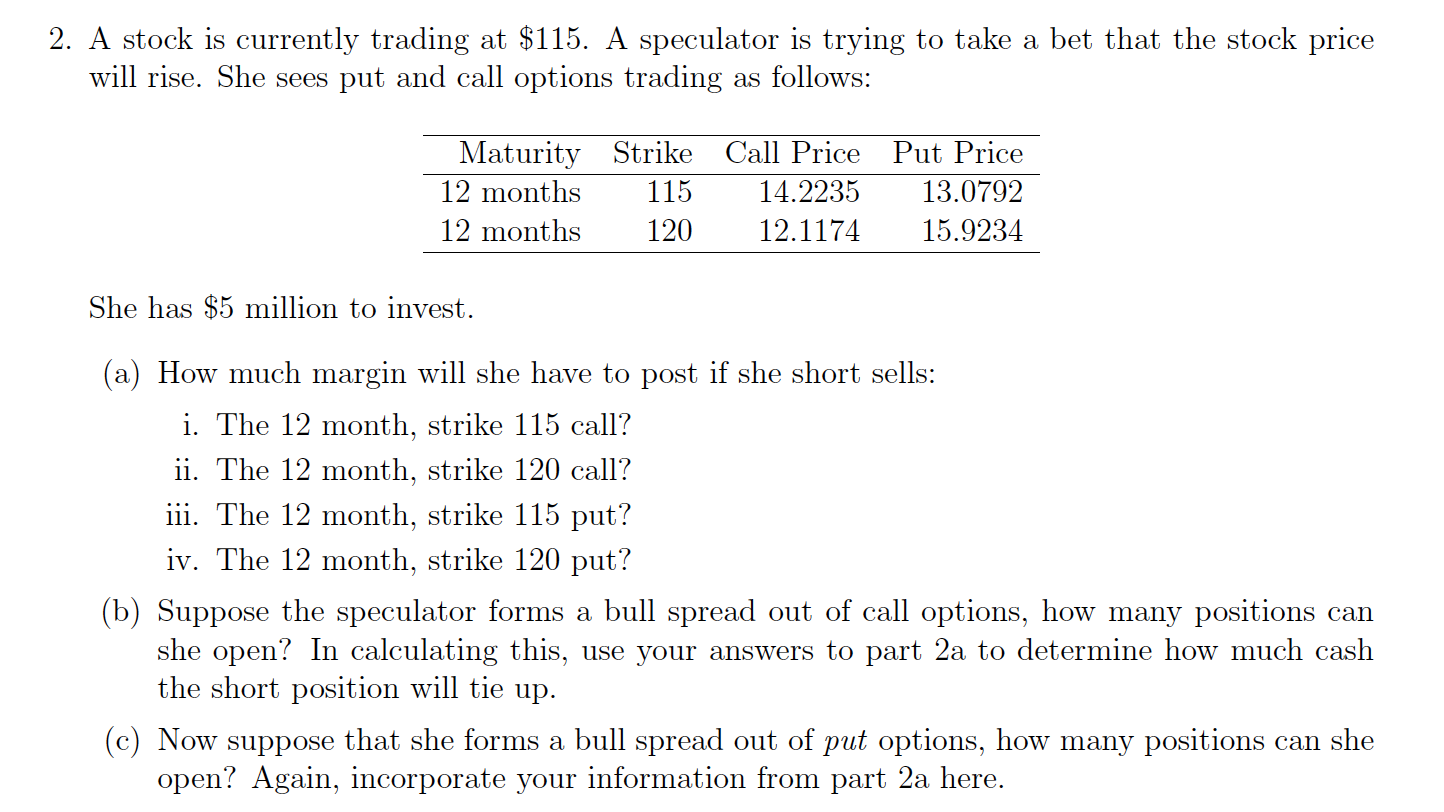

2. A stock is currently trading at $115. A speculator is trying to take a bet that the stock price will rise. She sees put and call options trading as follows: Maturity Strike Call Price Put Price 12 months 115 14.2235 13.0792 12 months 120 12.1174 15.9234 She has $5 million to invest. (a) How much margin will she have to post if she short sells: i. The 12 month, strike 115 call? ii. The 12 month, strike 120 call? iii. The 12 month, strike 115 put? iv. The 12 month, strike 120 put? (b) Suppose the speculator forms a bull spread out of call options, how many positions can she open? In calculating this, use your answers to part 2a to determine how much cash the short position will tie up. (c) Now suppose that she forms a bull spread out of put options, how many positions can she open? Again, incorporate your information from part 2a here. 2. A stock is currently trading at $115. A speculator is trying to take a bet that the stock price will rise. She sees put and call options trading as follows: Maturity Strike Call Price Put Price 12 months 115 14.2235 13.0792 12 months 120 12.1174 15.9234 She has $5 million to invest. (a) How much margin will she have to post if she short sells: i. The 12 month, strike 115 call? ii. The 12 month, strike 120 call? iii. The 12 month, strike 115 put? iv. The 12 month, strike 120 put? (b) Suppose the speculator forms a bull spread out of call options, how many positions can she open? In calculating this, use your answers to part 2a to determine how much cash the short position will tie up. (c) Now suppose that she forms a bull spread out of put options, how many positions can she open? Again, incorporate your information from part 2a hereStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started