can you solve for ( direct labor) please

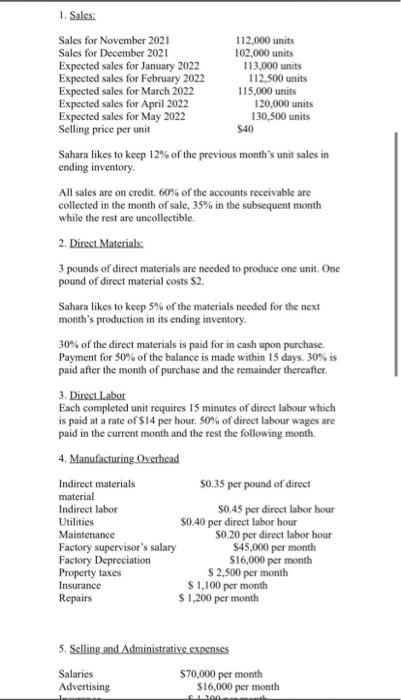

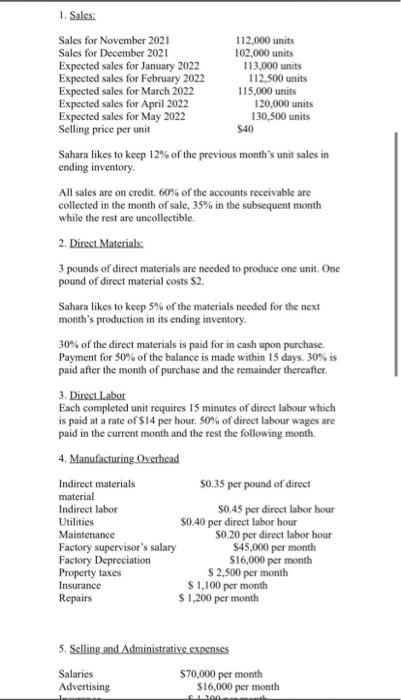

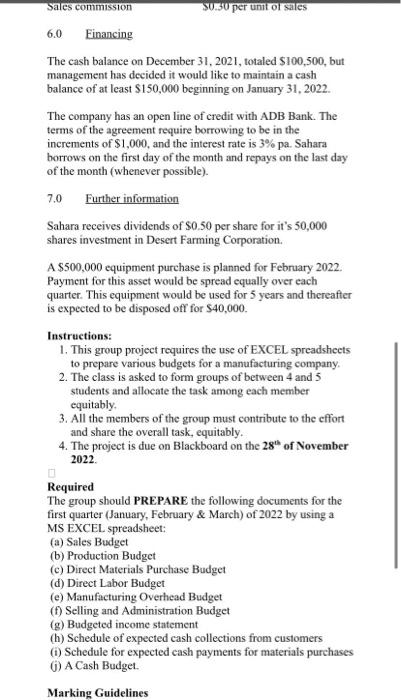

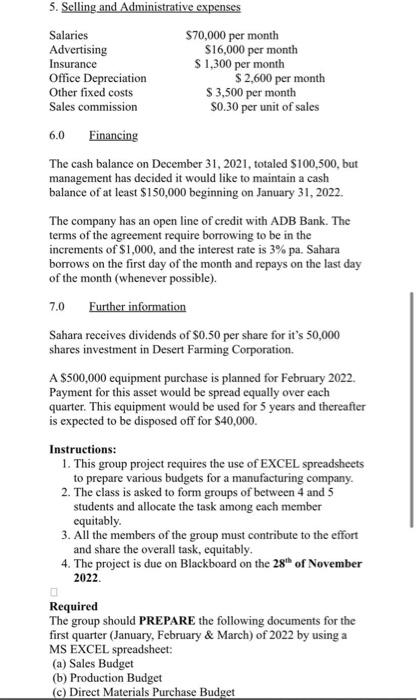

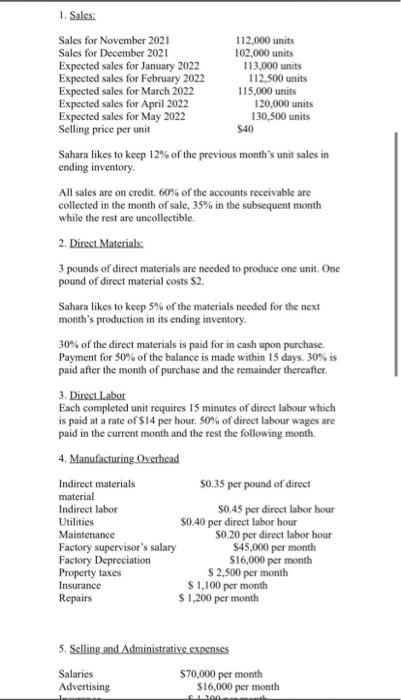

Sahara likes to keep 12% of the previous month's unit sales in ending inventory. All sales are on credit. 60% of the accounts receivable are collected in the month of sale, 35% in the subsequent month while the rest are uncollectible. 2. Direct Materials: 3 pounds of direct materials are needed to produce one unit. One pound of direct material cost \$\$2. Sahara likes to keep 5% of the materials needed for the next month's production in its ending inventory. 30% of the direct materials is paid for in cash upon purchase. Payment for 50% of the balance is made within 15 days. 30% is paid after the month of purchase and the remainder thereafter. 3. Direct Labor Each completed unit requires 15 minutes of direct labour which is paid at a rate of 514 per hour. 50% of direct labour wages are paid in the current month and the rest the following month. 5. Selling and Administrative expenses Sales commission \$0.30 per unit of sales 6.0 Einancing The cash balance on December 31, 2021, totaled $100,500, but management has decided it would like to maintain a cash balance of at least $150,000 beginning on January 31, 2022. The company has an open line of credit with ADB Bank. The terms of the agreement require borrowing to be in the increments of $1,000, and the interest rate is 3% pa. Sahara borrows on the first day of the month and repays on the last day of the month (whenever possible). 7.0 Further information Sahara receives dividends of $0.50 per share for it's 50,000 shares investment in Desert Farming Corporation. A $500,000 equipment purchase is planned for February 2022. Payment for this asset would be spread equally over each quarter. This equipment would be used for 5 years and thereafter is expected to be disposed off for $40,000. Instructions: 1. This group project requires the use of EXCEL spreadsheets to prepare various budgets for a manufacturing company. 2. The class is asked to form groups of between 4 and 5 students and allocate the task among each member equitably. 3. All the members of the group must contribute to the effort and share the overall task, equitably. 4. The project is due on Blackboard on the 28th of November 2022. Required The group should PREPARE the following documents for the first quarter (January, February \& March) of 2022 by using a MS EXCEL spreadsheet: (a) Sales Budget (b) Production Budget (c) Direct Materials Purchase Budget (d) Direct Labor Budget (e) Manufacturing Overhead Budget (f) Selling and Administration Budget (g) Budgeted income statement (h) Schedule of expected cash collections from customers (i) Schedule for expected cash payments for materials purchases (j) A Cash Budget. Marking Guidelines 5. Selling and Administrative expenses 6.0 The cash balance on December 31, 2021, totaled $100, 500, but management has decided it would like to maintain a cash balance of at least $150,000 beginning on January 31, 2022. The company has an open line of credit with ADB Bank. The terms of the agreement require borrowing to be in the increments of $1,000, and the interest rate is 3% pa. Sahara borrows on the first day of the month and repays on the last day of the month (whenever possible). 7.0 Further information Sahara receives dividends of $0.50 per share for it's 50,000 shares investment in Desert Farming Corporation. A $500,000 equipment purchase is planned for February 2022. Payment for this asset would be spread equally over each quarter. This equipment would be used for 5 years and thereafter is expected to be disposed off for $40,000. Instructions: 1. This group project requires the use of EXCEL spreadsheets to prepare various budgets for a manufacturing company. 2. The elass is asked to form groups of between 4 and 5 students and allocate the task among each member equitably. 3. All the members of the group must contribute to the effort and share the overall task, equitably. 4. The project is due on Blackboard on the 28th of November 2022. Required The group should PREPARE the following documents for the first quarter (January, February \& March) of 2022 by using a MS EXCEL spreadsheet: (a) Sales Budget (b) Production Budget (c) Direct Materials Purchase Budget Sahara likes to keep 12% of the previous month's unit sales in ending inventory. All sales are on credit. 60% of the accounts receivable are collected in the month of sale, 35% in the subsequent month while the rest are uncollectible. 2. Direct Materials: 3 pounds of direct materials are needed to produce one unit. One pound of direct material cost \$\$2. Sahara likes to keep 5% of the materials needed for the next month's production in its ending inventory. 30% of the direct materials is paid for in cash upon purchase. Payment for 50% of the balance is made within 15 days. 30% is paid after the month of purchase and the remainder thereafter. 3. Direct Labor Each completed unit requires 15 minutes of direct labour which is paid at a rate of 514 per hour. 50% of direct labour wages are paid in the current month and the rest the following month. 5. Selling and Administrative expenses Sales commission \$0.30 per unit of sales 6.0 Einancing The cash balance on December 31, 2021, totaled $100,500, but management has decided it would like to maintain a cash balance of at least $150,000 beginning on January 31, 2022. The company has an open line of credit with ADB Bank. The terms of the agreement require borrowing to be in the increments of $1,000, and the interest rate is 3% pa. Sahara borrows on the first day of the month and repays on the last day of the month (whenever possible). 7.0 Further information Sahara receives dividends of $0.50 per share for it's 50,000 shares investment in Desert Farming Corporation. A $500,000 equipment purchase is planned for February 2022. Payment for this asset would be spread equally over each quarter. This equipment would be used for 5 years and thereafter is expected to be disposed off for $40,000. Instructions: 1. This group project requires the use of EXCEL spreadsheets to prepare various budgets for a manufacturing company. 2. The class is asked to form groups of between 4 and 5 students and allocate the task among each member equitably. 3. All the members of the group must contribute to the effort and share the overall task, equitably. 4. The project is due on Blackboard on the 28th of November 2022. Required The group should PREPARE the following documents for the first quarter (January, February \& March) of 2022 by using a MS EXCEL spreadsheet: (a) Sales Budget (b) Production Budget (c) Direct Materials Purchase Budget (d) Direct Labor Budget (e) Manufacturing Overhead Budget (f) Selling and Administration Budget (g) Budgeted income statement (h) Schedule of expected cash collections from customers (i) Schedule for expected cash payments for materials purchases (j) A Cash Budget. Marking Guidelines 5. Selling and Administrative expenses 6.0 The cash balance on December 31, 2021, totaled $100, 500, but management has decided it would like to maintain a cash balance of at least $150,000 beginning on January 31, 2022. The company has an open line of credit with ADB Bank. The terms of the agreement require borrowing to be in the increments of $1,000, and the interest rate is 3% pa. Sahara borrows on the first day of the month and repays on the last day of the month (whenever possible). 7.0 Further information Sahara receives dividends of $0.50 per share for it's 50,000 shares investment in Desert Farming Corporation. A $500,000 equipment purchase is planned for February 2022. Payment for this asset would be spread equally over each quarter. This equipment would be used for 5 years and thereafter is expected to be disposed off for $40,000. Instructions: 1. This group project requires the use of EXCEL spreadsheets to prepare various budgets for a manufacturing company. 2. The elass is asked to form groups of between 4 and 5 students and allocate the task among each member equitably. 3. All the members of the group must contribute to the effort and share the overall task, equitably. 4. The project is due on Blackboard on the 28th of November 2022. Required The group should PREPARE the following documents for the first quarter (January, February \& March) of 2022 by using a MS EXCEL spreadsheet: (a) Sales Budget (b) Production Budget (c) Direct Materials Purchase Budget